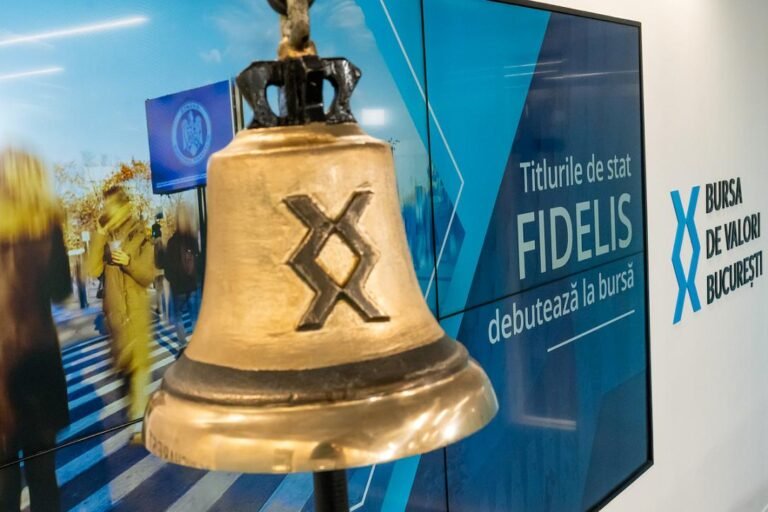

The Fidelis government bonds issued in October by the Romanian Ministry of Finance, worth almost RON 2.2 billion, can be traded on the Bucharest Stock Exchange starting Thursday, October 23.

The Romanian government attracted RON 946.8 million and EUR 246.1 million through seven issues of government securities for the population in October, as part of the ninth public offering carried out this year on the capital market.

The primary selling offer for Fidelis government bonds was carried out, between October 10 and 17, through the Bucharest Stock Exchange’s system. The offer was intermediated by the syndicate formed by BT Capital Partners (Lead Manager), Banca Comerciala Romana, BRD – Groupe Societe Generale, TradeVille, and UniCredit Bank (Intermediaries), and Banca Transilvania, Libra Internet Bank (Distribution Group).

During this offer, Romanians placed over 21,000 subscription orders for both RON-denominated and EUR-denominated government bonds with a return of up to 8.2%.

The income obtained through government bonds, both from interest and from capital gains, is non-taxable.

The next offering of Fidelis government securities is estimated to begin in the first part of November.

Through the 29 offerings carried out since August 2020, the Ministry of Finance has attracted RON 59.2 billion (EUR 11.9 billion) from the population, of which over 30% were carried out only this year. The sums cover a large public deficit, limited to 8.4% this year, according to a governmental decision.

(Photo source: Bursa de Valori Bucuresti on Facebook)