In September alone, companies such as US Foods and Royal Caribbean Cruises borrowed a combined $109.7 billion in junk-rated bonds and loans, according to PitchBook LCD data. That is the third-largest monthly total in records going back to 2005.

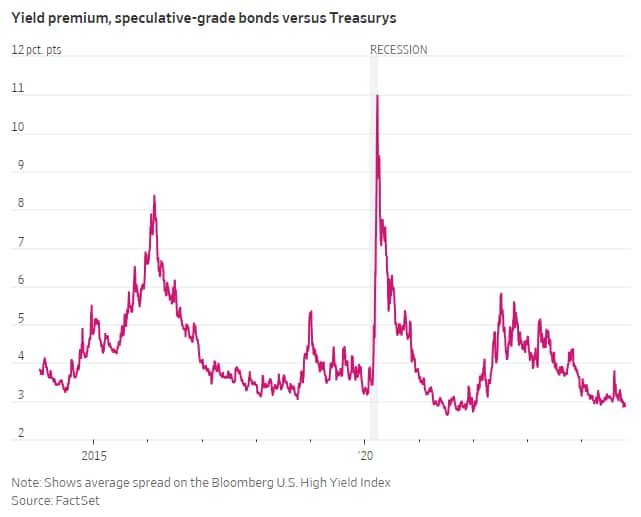

The extra yield that investors demand to hold speculative-grade corporate bonds over U.S. Treasurys fell to 2.85 percentage points last week, just a touch higher than the 14-year lows reached in 2021, according to Bloomberg data. It is a sign investors have few concerns that the economy is on the verge of a slowdown that would spark bankruptcies and defaults among lower-rated companies.

The chief cause of that optimism: two months of encouraging labor-market data, which have largely swept aside summer concerns about a possible recession. With stock indexes hitting record after record, the surge in corporate borrowing has added to the good mood on Wall Street, showing that even riskier businesses can access funding when they need it.

“Credit is a confidence game, and right now investors are exhibiting a lot of confidence,” said Michael Anderson, head of U.S. credit strategy at Citigroup.

Businesses have accomplished a lot with their recent borrowing. Back in 2022, when the Fed was aggressively raising interest rates, many worried that lower-rated companies would have trouble raising new money to pay back older debt as it came due.

View Full Image

Now, however, just $65 billion of junk-rated bonds and loans in the Morningstar U.S. High-Yield Bond Index and Morningstar LSTA Leveraged Loan Index are still due to mature in 2025, according to PitchBook LCD. That is down from $181 billion at the end of last year and $347 billion at the end of 2022. The so-called maturity wall has largely been pushed back to 2028 and beyond.

The latest surge in issuance has gone beyond just refinancings. Some $22.1 billion of junk-rated loans issued in September were used by businesses to pay dividends to their owners, the largest monthly total in records going back to 2000 by a comfortable margin, according to PitchBook LCD.

The trend, investors and analysts say, is partly the result of higher rates. Those have made it harder for private-equity firms to sell their portfolio businesses, driving them to deliver cash to their investors by other means.

But it is also a classic sign of a frothy market. Investors are so eager to buy loans that they are willing to add debt to businesses that is used to reward equity holders rather than fund investments that could make the companies more profitable.

“When there’s money available in the market, some pretty attractive terms, and there’s not enough new debt creation, you invariably get to the point that you start to see more aggressive action,” said Randy Parrish, head of public credit at the asset manager Voya Investment Management.

View Full Image

Belron International, a U.K.-based vehicle-glass repair and replacement company, this month executed the largest dividend-funding junk-debt sale of all time, according to PitchBook LCD data. The company raised the equivalent of $9 billion in a loan-and-bond deal to refinance about 4.3 billion euros, or about $4.7 billion, of outstanding term loans and fund a roughly €4.4 billion shareholder dividend. Rating agency S&P Global downgraded the company’s credit rating as a result of the deal, which significantly increased an important debt-to-earnings ratio.

Still, demand for Belron’s debt—which included both dollar and euro components—was so strong that investors were willing to accept lower yields and weaker lender protections than they were initially offered.

Chobani last week issued $650 million of bonds in a rare deal that allows the yogurt company to either pay interest in cash or defer payments by issuing additional debt. Chobani said it intends to use proceeds to fund a dividend to its indirect parent and use the rest for general corporate purposes. It was able to increase the size of the offering from $500 million after demand for the deal exceeded its expectations.

View Full Image

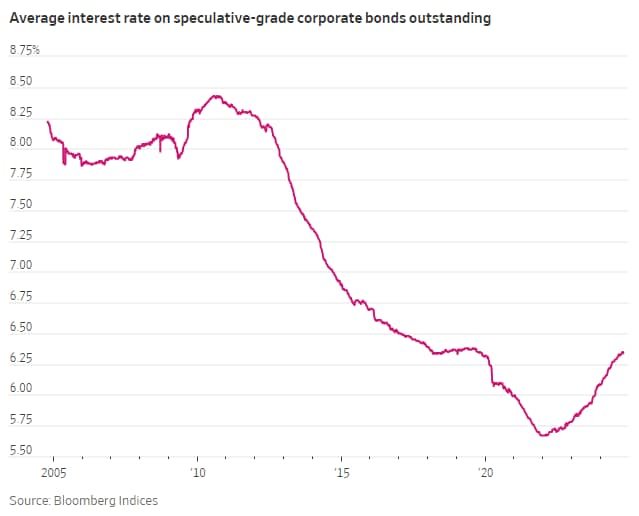

Because interest rates are higher now than they were when many companies last borrowed in the debt market, the average interest rate on their outstanding bonds has been creeping upward. That is likely to continue for some time, even now that the Fed has started to cut short-term interest rates.

The average coupon of bonds in the Bloomberg U.S. High Yield Index was recently 6.34%, up from around 5.7% in early 2022.

That, however, remains well below the average level that prevailed for much of the 2010s, and some analysts say they aren’t too worried about the recent incremental increase.

“They are refinancing paper that was ridiculously cheap just because the Fed had rates at zero,” said Citigroup’s Anderson. “They are paying more, but it’s not life-changing money. It’s not balance-sheet-changing money.”

Write to Sam Goldfarb at sam.goldfarb@wsj.com and Vicky Ge Huang at vicky.huang@wsj.com