As inflation moves back toward the Federal Reserve’s 2% target, investors and firm managers will be looking at market-based measures of inflation expectations to make their decisions.

The TIPS data, along with real-time data, should provide the confidence for the Fed to pivot to lower interest rates.

Treasury Inflation-Protected Securities, or TIPS, are one of those measures used to make such decisions.

Launched in 1997, TIPS bonds are relatively new security. The value of the bond and its dividends are adjusted by the rate of inflation, with the value of the bond never dropping below its original price.

For households and commercial investors, the TIPS market provides a guaranteed return no matter the effect of inflation.

In terms of the investment-decision process, the implied breakeven inflation rate of TIPS yields has been a reliable indicator of inflation expectations, with the TIPS yield providing a market-driven estimate of real interest rates, which are adjusted for inflation.

The current low level of the real yield suggests that businesses and the government will continue to invest in infrastructure and productivity, which helps reduce inflation.

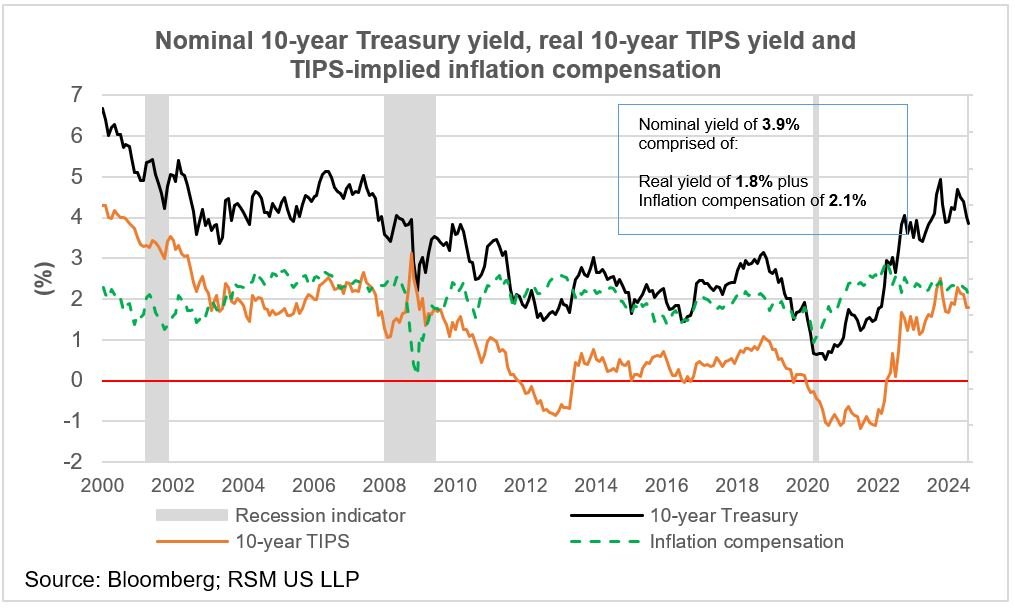

The 10-year TIPS market is anticipating a drop in inflation to reasonable levels, to an average of just under 2.1% over the life of the 10-year bond. That would be just above the Federal Reserve’s 2.0% inflation target.

The forward-looking TIPS data, along with real-time data, should provide the confidence for the Federal Reserve to make its long-awaited policy pivot to lower rates at its September meeting, where we expect the Fed to reduce its policy rate by 25 basis points.

This decline in inflation expectations comes as the headline personal consumption expenditures index, the Fed’s preferred measure of inflation, stood at 2.5% in July and the better-known consumer price index fell to 2.9% that month, below its 3.3% average of the past 12 months.

The 10-year Treasury bond is now yielding 3.9%, which is a full percentage-point lower than its recent peak of 4.9%, which came 10 months ago.

The TIPS 10-year note, which is a proxy estimate of the real yield, is yielding 1.8% and is 0.7 percentage points lower than its recent peak of 2.5%.

For businesses with a five-year investment horizon, the TIPS yield is 1.8% with an anticipated inflation rate of just under 2%.

The 3.9% Treasury bond yield can be decomposed into the 1.8% real yield in the TIPS market plus the anticipated inflation rate of 2.1%.

Read more of RSM’s insights on inflation, the economy and the middle market.

The recent drop in both Treasury yields and TIPS yields are adding credence to the success of the Federal Reserve’s campaign to squeeze inflation out of the economy.

In general, we would expect the bond market to front-run the Fed’s decisions on lowering its policy rate, pressuring interest rates lower across all but the shortest maturity Treasury bills and bonds, which are tied directly to the overnight federal funds rate.

We think that the Fed over the next year will reduce its policy rate to the new post-pandemic neutral rate of 3% to 3.5%. If this happens, one should anticipate a resetting of the entire Treasury curve lower, with rates in the belly of the curve between two and five years falling more than the longer end, which would result a normalization of the Treasury curve.

As of Aug. 19, market prices imply that at the end of next year, the two-year rate will stand near 3.54% and the 10-year near 3.89%.