Eurobond holders’ debt restructuring proposal to Ukraine’s government fails to consider the country’s current wartime situation and is “excessively harsh,” Ukraine’s RRR4U economics think tank consortium report concludes.

Though both parties confirmed they are in favor of finding a solution during debt restructuring negotiations, RRR4U found that the creditor’s stance could result in Ukraine defaulting if an agreement is not reached in August 2024.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

The report was made by the Resilience, Reconstruction and Relief for Ukraine Consortium which includes representatives from leading Ukrainian economic think tanks: the Center for Economic Strategy, the Institute for Economic Research and Policy Consulting, the Institute of Analytics and Advocacy, and the DiXi Group.

Apart from a tight deadline and inability to reach debt sustainability deadlines the International Monetary Fund (IMF) set for Ukraine, another risk is that creditors consider only an upside scenario during negotiations.

This may not align with “the reality of worsening economic situation in Ukraine,” RRR4U warns.

“In the case of the downside scenario, Ukraine may not receive the additional debt relief it requires,” the analysts write.

Tight Limitations

Ukraine informed its creditors that it would be unable to pay following Russia’s full-scale invasion in February 2022.

Other Topics of Interest

Dutch Good Growth Fund Becomes a Shareholder of Bank Lviv

In the first deal for Ukraine’s banking sector after the invasion, the Dutch invested €4.5 million in capital to purchase shares of a Ukrainian Swiss and Iceland-owned bank operating in Ukraine.

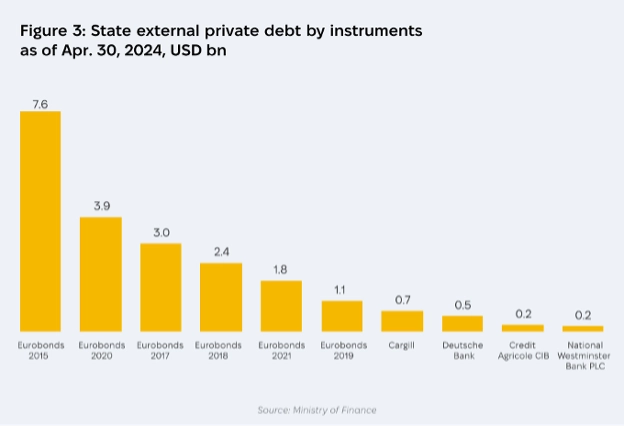

The country also requested new conditions of payment and has presented two options for a $20 billion Eurobond debt restructuring for creditors, which include Amundi, BlackRock, and Amia Capital, according to Bloomberg.

The first option includes a vanilla bond with 40 cents per dollar and a value recovery instrument (VRI) called the “Ukraine Recovery Instrument.” The VRI’s value is dependent upon Ukraine’s performance on tax revenues and real GDP levels.

Interest rates for Vanilla Bonds are estimated at 1 percent in the second quarter of 2024 and throughout 2025, 3 percent during 2026-2027, and 6 percent from 2028 to maturity.

The securities would mature in 2034, 2035, 2036, 2038, and 2040. Currently such bonds are set to mature in 2024-2032, 2034 and 2035.

The second option would include a vanilla bond at the same conditions, but at a higher price – 47.5 cents to the dollar.

Bondholders have proposed different conditions. They also include vanilla bonds and VRIs but with a higher interest rate of 7.25 percent. They also proposed a 20 percent haircut instead of a 25-60 percent haircut per one of Eurobond’s nominal price.

Also, investors proposed only two maturities in 2034 and 2035. “The shorter maturity of the new bonds is an unfavorable aspect for Ukraine,” the RRR4U report says.

The IMF has opposed the creditor’s proposal while other official creditors insist cashflows during the IMF program period – that is until 2027 – should remain minimal.

Debt Restructuring Alternatives for Ukraine

As alternative options, the RRR4U report suggests donor-backed long-term bonds and mirroring the proposal to the terms of the EU Ukraine Facility Program.

Ukraine can replace the existing debt with long-term bonds backed by Ukraine’s partner’s guarantees, for instance, US Treasury bonds.

These bonds may offer extended maturities of up to 30 years or lower yields.

New conditioning of the Eurobonds can also mirror conditions of the EU Facility Program. The interest in this scenario is still paid to the bondholders but would be low or equal to the interest rate on the EU Facility Debt.

RRR4U analysts also suggest a bond buy-back, but it will be hard to find resources now because of liquidity constraints. Russian frozen assets could have been used for these purposes.