(Bloomberg) — Treasuries traders wrapped up a tumultuous week in which a gauge of bond-market volatility soared to a new high for the year, suggesting more upheaval to come.

Most Read from Bloomberg

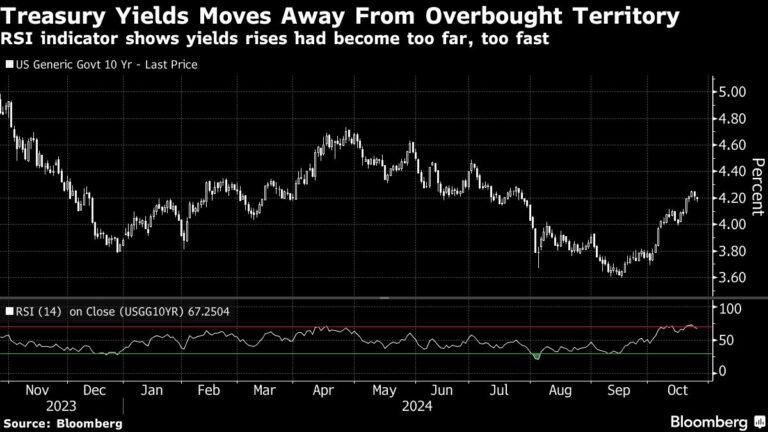

In a furious five days of trading, yields first jumped, sending the 10-year yield above 4.2% for the first time since July. The moves came despite few new catalysts, as investors continued to reassess their outlook for interest-rate cuts from the Federal Reserve and for the US election.

The severity of this week’s back and forth suggests even greater volatility in coming days, when the US bond market must weather a myriad of events — from key jobs data, to the US election, to a meeting by the Fed. The ICE BofA Move Index, which tracks expected swings in Treasuries in the coming month, climbed to the highest level this year on Tuesday.

“We are in a new regime of elevated volatility; for the past decade, it’s not like that,” said Tracy Chen, portfolio manager at Brandywine Global Investment Management. “We are going to see more volatility as we get closer to the election.”

Yields on 10-year notes rose 2 basis points to about 4.24% on Friday, extending the weekly to 15 basis points. Two-year yields touched 4.11% Friday, the highest since mid-August, as oil prices climbed.

Where Next?

Prior to this month, the bond market had been on its best run in 14 years. But losses in October have eroded those gains and Treasuries are now up just 1.7% this year, trailing the 4.4% return in T-bills, the equivalent of cash.

Arif Husain, chief investment officer of fixed-income at T. Rowe Price., said 10-year yields will test 5% in next six months on rising inflation expectations and concerns over US fiscal spending. Billionaire investor Paul Tudor Jones said he’s avoiding fixed-income because “all roads lead to inflation,” echoing the view of Stanley Druckenmiller, who has said he shorted bonds.

Still, some technical indicators suggest this week’s selloff in Treasuries was — at its peak — overdone. And 10-year yields have already risen more than 50 basis points since the Fed’s half-point reduction in September, defying expectations that the start of an easing cycle would provide a tailwind to bond investors.

Trades on Friday instead showed appetite in the options market to hedge a move lower in yields, with a large position looking for the benchmark rate to slip to roughly 4.12% by the end of Monday’s session.