Generating passive income is a cornerstone of financial independence. It creates steady cash flows without requiring active involvement, allowing investors to focus on other aspects of their lives or pursue additional opportunities. For many, the ultimate goal is to build a portfolio that generates enough passive income to cover living expenses indefinitely.

Enter Vanguard exchange-traded funds (ETFs), the brainchild of investing legend John Bogle. These ETFs offer a powerful combination of broad diversification and rock-bottom fees, making them ideal vehicles for long-term wealth-building and income generation. Vanguard’s approach to investing, pioneered by Bogle, emphasizes low-cost, passive strategies that have revolutionized the investment landscape.

Image source: Getty Images.

Vanguard ETFs distinguish themselves in the investment landscape through a unique blend of features. These funds typically boast lower turnover rates compared to actively managed alternatives, a characteristic that substantially reduces investors’ tax liabilities. This tax efficiency, combined with the impressive dividend growth rates many Vanguard ETFs have demonstrated since their inception, underscores the premium quality of their underlying holdings.

Moreover, Vanguard’s approach to passive management ensures that these ETFs closely track their underlying indexes. This methodology maximizes efficiency while maintaining the simplicity that individual investors appreciate. The result is a powerful investment vehicle that combines the benefits of broad market exposure with the cost-effectiveness of passive investing.

Another critical advantage of Vanguard’s low-cost ETFs is their reliability. Thanks to their highly diversified portfolios and high-quality holdings, these ETFs are unlikely to suspend their cash distributions, even during economic downturns. This reliability is a significant benefit over individual stocks, which may cut or eliminate dividends during challenging times.

Let’s explore three Vanguard ETFs that have the potential to provide lifetime passive income, each offering a unique approach to dividend investing.

A low-cost core holding

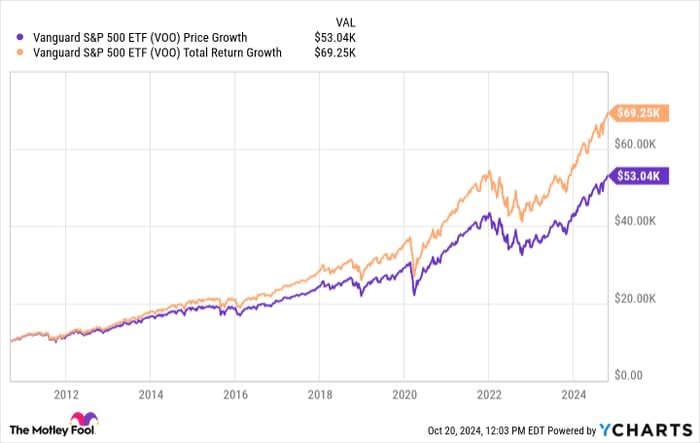

The Vanguard S&P 500 ETF (NYSEMKT: VOO) mirrors the performance of the benchmark S&P 500 index, encompassing 500 of the largest U.S. companies. With an ultra-low expense ratio of 0.03%, this ETF allows investors to retain more of their returns. While its 30-day SEC yield of 1.23% might appear modest initially, the fund’s true strength lies in its growth potential.

Since its inception in 2010, the fund has achieved an impressive 13.4% compound annual growth rate (CAGR) of distributions. This remarkable figure illustrates the power of investing in high-quality, dividend-growing companies over time. To put this into perspective, a $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have burgeoned to $69,250 today.

Comprehensive U.S. market exposure

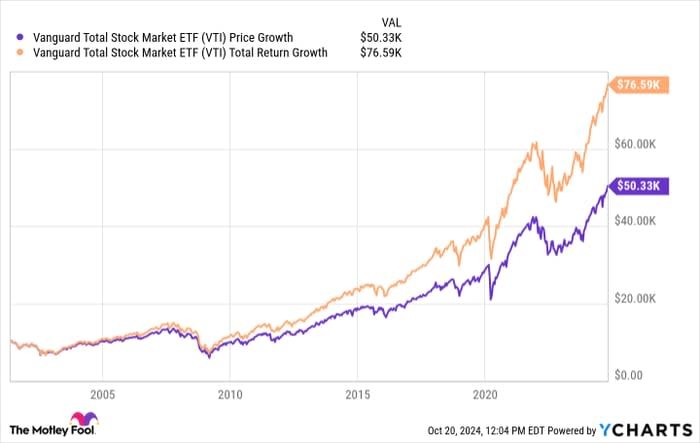

The Vanguard Total Stock Market Index Fund ETF Shares (NYSEMKT: VTI) offers investors broad exposure to the entire U.S. stock market, encompassing small-, mid-, and large-cap stocks. Matching its S&P 500 counterpart, it sports a minimal expense ratio of 0.03%, maximizing investor returns.

While its 30-day SEC yield of 1.22% closely mirrors the S&P 500 ETF, this fund’s true value lies in its long-term performance and diversification across the entire U.S. market. Since its inception in 2001, the fund’s distributions have grown at an annual rate of 5.05%.

This steady growth translates to significant returns over time. A $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have blossomed to $76,590 today.

The fund’s performance has outpaced the aforementioned S&P 500 ETF due to its longer track record. Its comprehensive coverage provides investors with a simple way to capture the performance of the entire U.S. stock market in a single fund.

Focus on high-yield stocks

For investors prioritizing current income, the Vanguard High Dividend Yield Index Fund ETF Shares (NYSEMKT: VYM) presents a compelling option. This ETF targets stocks with above-average dividend yields, resulting in a higher 30-day SEC yield of 2.65%.

While its expense ratio is slightly higher at 0.06%, it remains remarkably low compared to actively managed funds. The fund’s strength lies in its income generation and growth potential.

Since its 2006 inception, the ETF’s distributions have grown at an annual rate of 9.18%. Although its earnings growth rate of 10.6% is lower than the broader market ETFs, it compensates with a higher current yield.

To illustrate its performance, a $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have grown to $45,750 today. This growth showcases the fund’s potential for both income and capital appreciation over time.

The power of passive management

All three ETFs benefit from Vanguard’s passive management approach, which closely tracks their respective indexes. This hands-off approach simplifies investing for individuals seeking passive income. The low turnover rates of these ETFs (2.2% for the Vanguard S&P 500 ETF and Vanguard Total Stock Market ETF, 5.7% for the Vanguard High Dividend Yield ETF) further enhance their tax efficiency.

These Vanguard ETFs showcase the potential for growing passive income over time. Their broad diversification, ultra-low fees, and passive management approach set them apart in the ETF landscape.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF, Vanguard Total Stock Market ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool has a disclosure policy.