These three time-tested Vanguard ETFs can supercharge your long-term wealth-building strategy.

Creating long-term wealth doesn’t require complicated investment strategies. Low-cost exchange-traded funds (ETFs) have consistently delivered better results than most professional money managers.

The historical data consistently shows that passive index funds generally outperform their actively managed counterparts after accounting for fees and expenses. Here are three standout Vanguard ETFs that exemplify efficient, simple investing while providing excellent portfolio diversification.

Image source: Getty Images.

Market dominance at rock-bottom costs

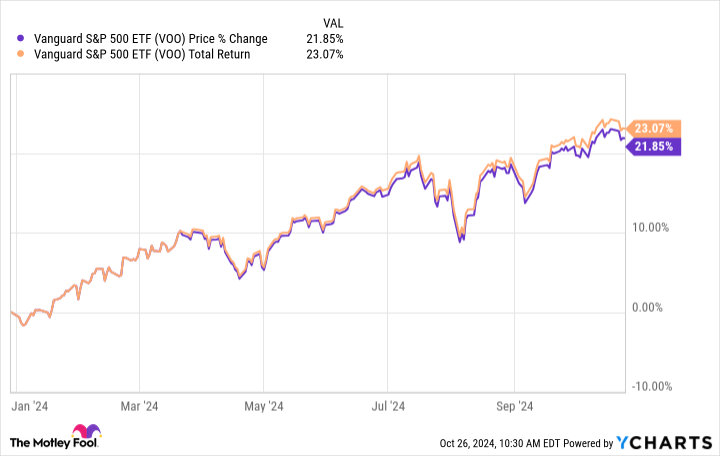

The Vanguard S&P 500 ETF tracks 500 (VOO -0.04%) of the largest U.S. companies, providing instant diversification across America’s most established businesses. The fund has generated approximately 13.3% average annual returns over the prior 10 years. Its ultra-low 0.03% expense ratio means more money stays in your pocket, compared to the industry average of 0.78% for similar S&P 500-tracking vehicles.

Since its 2010 launch, this ETF has delivered consistent market-matching performance through various economic cycles. The fund maintains a healthy 1.23% yield while providing exposure to innovation leaders and stable blue chip companies. Its broad diversification helps reduce individual stock risk. Lastly, the Vanguard S&P 500 ETF’s median market capitalization of $262.2 billion reflects its focus on well-established companies with proven track records.

Premium growth at a bargain price

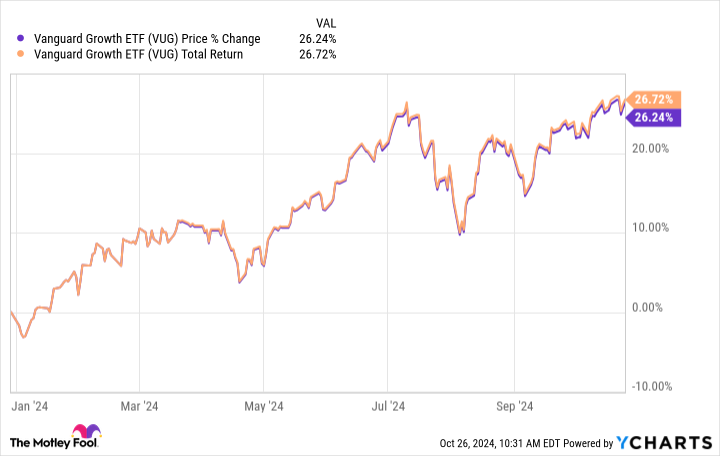

The Vanguard Growth ETF (VUG 0.46%) targets premier U.S. companies with above-average growth potential by tracking the CRSP U.S. Large Cap Growth Index. With a minimal expense ratio of 0.04%, this ETF provides cost-effective access to America’s fastest-growing companies. The fund features 183 holdings focused on innovative market leaders across multiple sectors, with a median market capitalization of $1.4 trillion.

Performance speaks volumes with this growth-oriented fund, delivering an average annual return of 15.54% over the prior 10-year period. Technology comprises nearly 57.7% of the portfolio, followed by consumer discretionary at 18.4%.

This sector mix positions the fund to capitalize on the global economy’s digital transformation and emerging consumer spending trends. The Vanguard Growth ETF’s holdings demonstrate exceptionally strong earnings growth of 23.5% over the past five years, resulting in an impressive return on investment of 134% over this same timeframe.

Technology’s rising tide

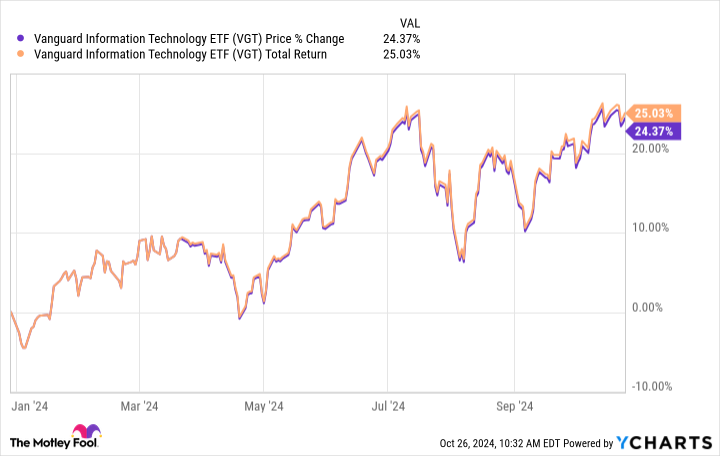

The Vanguard Information Technology ETF (VGT 0.47%) zeroes in on the tech sector’s tremendous growth potential. This focused approach has rewarded investors with stellar 20.68% average annual returns over the prior 10 years. Despite its specialized nature, the fund maintains broad diversification with 316 holdings across various tech subsectors, creating a balanced approach to tech sector investing.

According to Vanguard, the Vanguard Information Technology ETF’s 0.10% expense ratio remains notably lower than similar sector-focused funds, which average 0.95%.

Software, semiconductors, and hardware companies dominate the fund’s portfolio, providing exposure to critical technological advancement areas. The fund’s holdings demonstrate robust earnings growth of 25.5% and an outstanding return on investment of 176% over the prior five years.

The ETF combines established tech giants with innovative emerging players. Its holdings span application software (14.9%), systems software (20.2%), and semiconductors (28.8%), offering a comprehensive tech sector investment vehicle. The median market capitalization of $472.2 billion underscores its focus on established technology leaders while maintaining exposure to emerging tech companies.

Key takeaways

Both time-tested performance and future growth potential make these three Vanguard ETFs compelling options for long-term wealth building. Their combination of broad market exposure, targeted growth focus, and rock-bottom costs creates a powerful foundation for investment success. Together, these funds provide a well-rounded approach to capturing U.S. market growth across different investment styles and sectors.

George Budwell has positions in Vanguard S&P 500 ETF and Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.