Looking for a simple way to invest $1,000 for the long term? You can buy these four ETFs now and hold them forever.

You don’t have to build a fancy stock portfolio. Many investors simply settle for a market-tracking index fund, and keep adding funds to that boring but effective long-term investment. There is absolutely nothing wrong with that approach. Matching the returns of the S&P 500 (^GSPC 1.00%) index can build serious wealth in the long run.

There’s always the middle ground, though. Have you ever thought about setting up a portfolio with a promising mix of exchange-traded funds (ETFs)? This method can give you the natural stability and diversity of index funds with some hope of a market-beating performance. Read on to see four ETFs that would add up to a robust long-term investment strategy.

I’ll show you index-tracking safety and income-generating bonds. You’ll see high-tech growth stocks and potentially undervalued small-caps. There’ll be laughter. There may be tears. There could even be a ticker-tape parade at the end.

Image source: Getty Images.

Mix and match: Four simple ETFs to buy today

Today, I’ll build a long-term fund portfolio with four ingredients:

- The SPDR S&P 500 ETF Trust (SPY 1.00%) is a simple S&P 500 index fund. It comes with about 500 component stocks and minimal annual fees. This is a great starting point for any portfolio, providing a strong foundation and plenty of stability.

- Next, I’ll spice things up with the Invesco QQQ Trust (QQQ 1.69%). This ETF mirrors the returns of the NASDAQ 100 market index, which is a fairly volatile stock list with a heavy weighting of names from the tech sector.

- Next comes the Vanguard Small-Cap ETF (VB 0.42%). The fund has 1,379 stocks under management today, with a median market cap of $8.5 billion. No single stock represents more than 0.7% of the fund’s total value. It’s the epitome of diversification, and a good choice if you think small-caps are trading at a discount nowadays.

- The iShares 20+ Year Treasury Bond ETF (TLT 0.17%) rounds off my fund selection this time. Reflecting the investment results of nearly 50 long-dated U.S. Treasury Bonds, this ETF provides a hedge against stock market downturns and monthly cash distributions adding up to a yearly yield of 4.3%. And after a 50% price drop in less than 5 years, this fund looks deeply undervalued right now.

How these ETFs weathered economic downturns

These funds have been around the block once or twice, providing enough market history for a useful historical example or two.

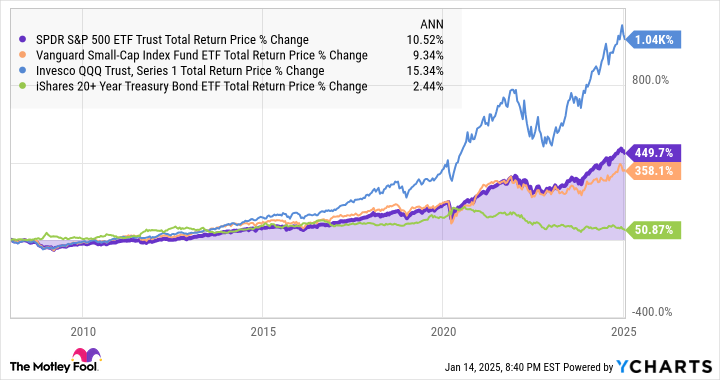

Let’s imagine buying these four ETFs just before a deep market downturn, like at the end of 2007. The subprime mortgage meltdown started the next summer, followed by a slow stock market recovery. The S&P 500 still traded 8% lower three years later, even if you reinvested dividends in more shares along the way. The other three ETFs on my list delivered modest but positive total returns over the same period:

SPY Total Return Price data by YCharts

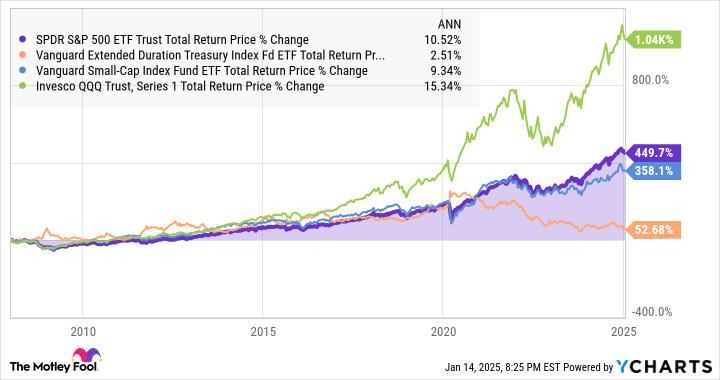

Changing the analysis period shows similar trends over other periods such as two, five, and seven years. Across all of these periods, the worst performer in my basket of ETFs was the bog-standard S&P 500 ETF. The broad market index eventually caught up with the small-cap and bond funds, but keeps falling further behind the Nasdaq ETF’s tech stocks:

SPY Total Return Price data by YCharts

In these charts, I see a diversified ETF collection providing better shareholder value in economic downturns, and the bullish effect remains several years into the recovery.

Splitting your ETF portfolio into a few distinct categories will also let you manage your holdings with more precision over time. You can always add more funds to undervalued ETFs, lock in some profits by selling a small portion of your best performers, and so on. And if you prefer, you can just let the whole collection ride for decades without micromanaging the balance.

Adapting your ETF strategy to market swings

As a whole, my four ETFs have underperformed a pure S&P 500 tracker slightly over the last decade. The Nasdaq 100 fund took a hard hit in the recent inflation crisis, and so did the bond fund.

On the upside, the tech stocks have a long history of S&P 500-beating returns, and the Treasury fund looks poised for a strong recovery. Any of these ETFs (or the whole bundle) should be a helpful addition to any investor’s long-term strategy right now. If I were really building this hypothetical portfolio with $1,000 of real money in this economy, I might hold limit the skyrocketing Nasdaq ETF to a $150 share and give the bond fund $350 instead. The S&P 500 and small-cap funds can stay at the average four-way split with $250 each.

Your strategy and results may vary, though. Remember, there’s no one-size-fits-all answer.

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.