Key Takeaways

- Spot bitcoin ETF volumes doubled during the market crash.

- Morgan Stanley to start recommending bitcoin ETFs to qualifying clients.

Share this article

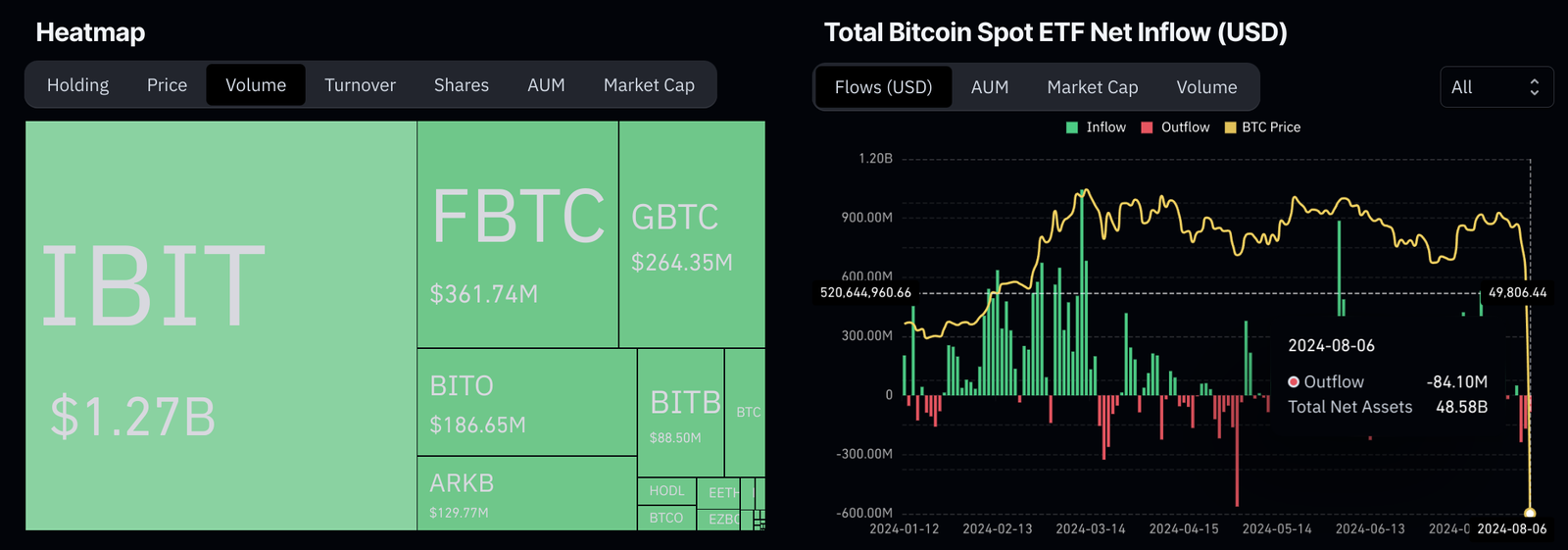

Trading volume for Bitcoin exchange-traded funds surged to $5.7 billion on August 6, surging from the prior 48 hours as crypto markets experienced heightened volatility. Outflows have since calmed down at $84.1 million, according to data from Coinglass, with net assets remaining at the $48 billion threshold.

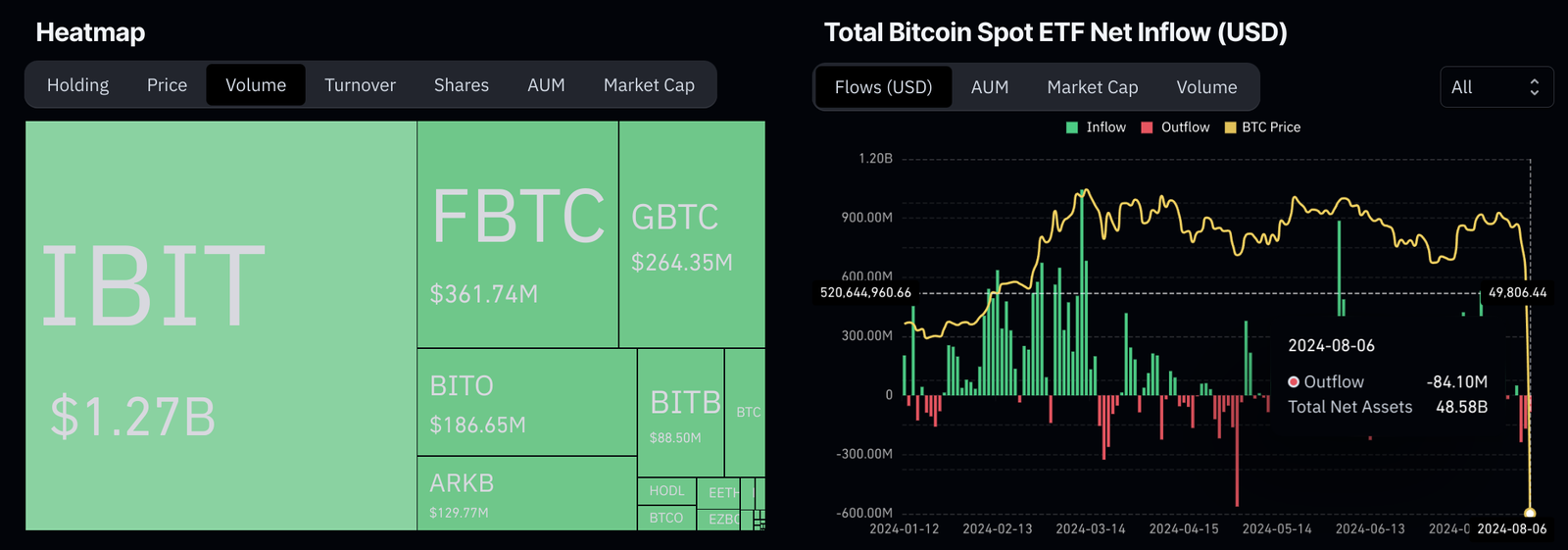

The spike in ETF trading coincided with an 8% drop in Bitcoin’s price since August 4. Ethereum saw an even steeper 21% decline after major funds like Jump Trading and Paradigm reportedly sold hundreds of millions of dollars worth of ETH. Alex Thorn, head of research at Galaxy Digital, reported that Bitcoin ETF trading volume exceeded $1.3 billion within just 20 minutes of market open. The iShares Bitcoin Trust led activity with over $1.27 billion in volume.

Rebound after six-month low

Bitcoin and Ethereum prices are rebounding after hitting six-month lows on Monday, with Bitcoin dipping below $50,000 and Ethereum experiencing its largest single-day drop in three years. The sell-off coincided with a broader market downturn affecting global stocks.

Despite the market turbulence, net flow data from CoinGlass indicates that most ETF holders maintained their positions. Analysts believe the sell-off was exacerbated by broader macroeconomic concerns, including weak US employment data and volatility across asset classes. For context, the S&P 500 index has fallen over 5% since August 1.

JPMorgan Chase analysts report that spot Bitcoin ETF trading volumes more than doubled on Monday to over $5.2 billion, surpassing the January debut. Spot Ethereum ETFs saw inflows exceeding $49 million across all funds.

Increased asset allocation anticipated

Bernstein analysts highlight that unlike previous cycles, Bitcoin ETFs now provide a highly liquid investment avenue, trading around $2 billion daily. They anticipate increased asset allocation to Bitcoin as more wirehouses approve these products in the coming months.

The surge in Bitcoin ETF volume suggests some investors viewed the price dip as a buying opportunity. However, market structure remains fragile according to Markus Thielen of 10x Research, who expects new crypto investment to slow until conditions stabilize.

“It’s unlikely that significant players will invest amid high volatility and unpredictable prices,” Thielen said. “Many still need to exit positions and deleverage their portfolios,” explaining their assessment.

The doubling of Bitcoin ETF volume highlights how quickly institutional capital can flow in and out of crypto markets during periods of volatility. It also demonstrates the growing importance of ETFs as a vehicle for Bitcoin exposure among traditional investors.

Share this article