Crypto markets may see another wave of exchange-traded fund debuts this week, with Solana, Litecoin and HBAR funds appearing in US exchange listings ahead of a potential launch on Tuesday.

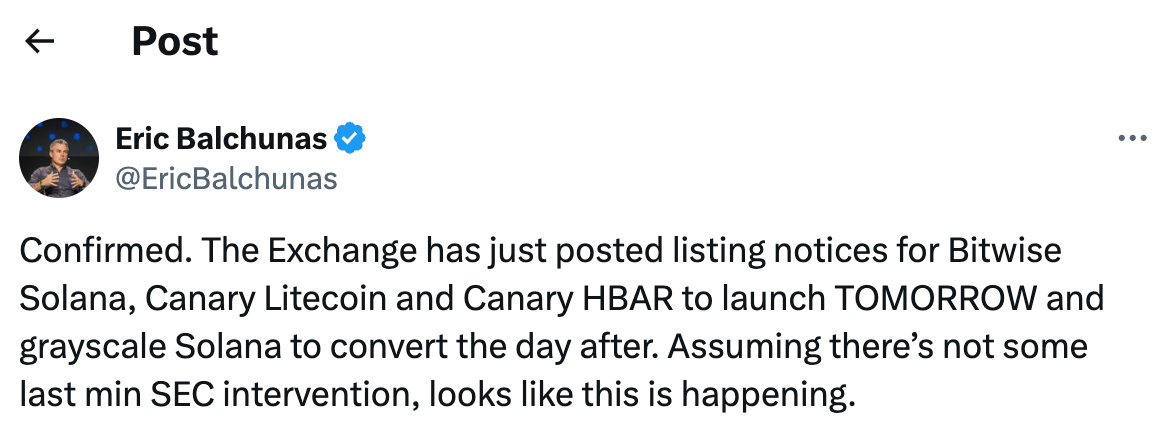

According to Bloomberg analyst Eric Balchunas, US exchange listing notices have appeared for Bitwise’s Solana (SOL) ETF and Canary’s Litecoin (LTC) and Hedera (HBAR) ETFs, with the funds slated to go live on Tuesday.

In an X post on Monday, Balchunas said Grayscale’s Solana Trust is expected to convert to an ETF the following day.

A crypto ETF is a fund traded on a stock exchange that allows investors to gain exposure to digital assets such as Bitcoin (BTC) or SOL without owning or managing the coins.

The approval process for crypto ETFs in US markets has stalled since the federal government shut down on Oct. 1. However, the Securities and Exchange Commission (SEC) is still operating, albeit at a limited capacity.

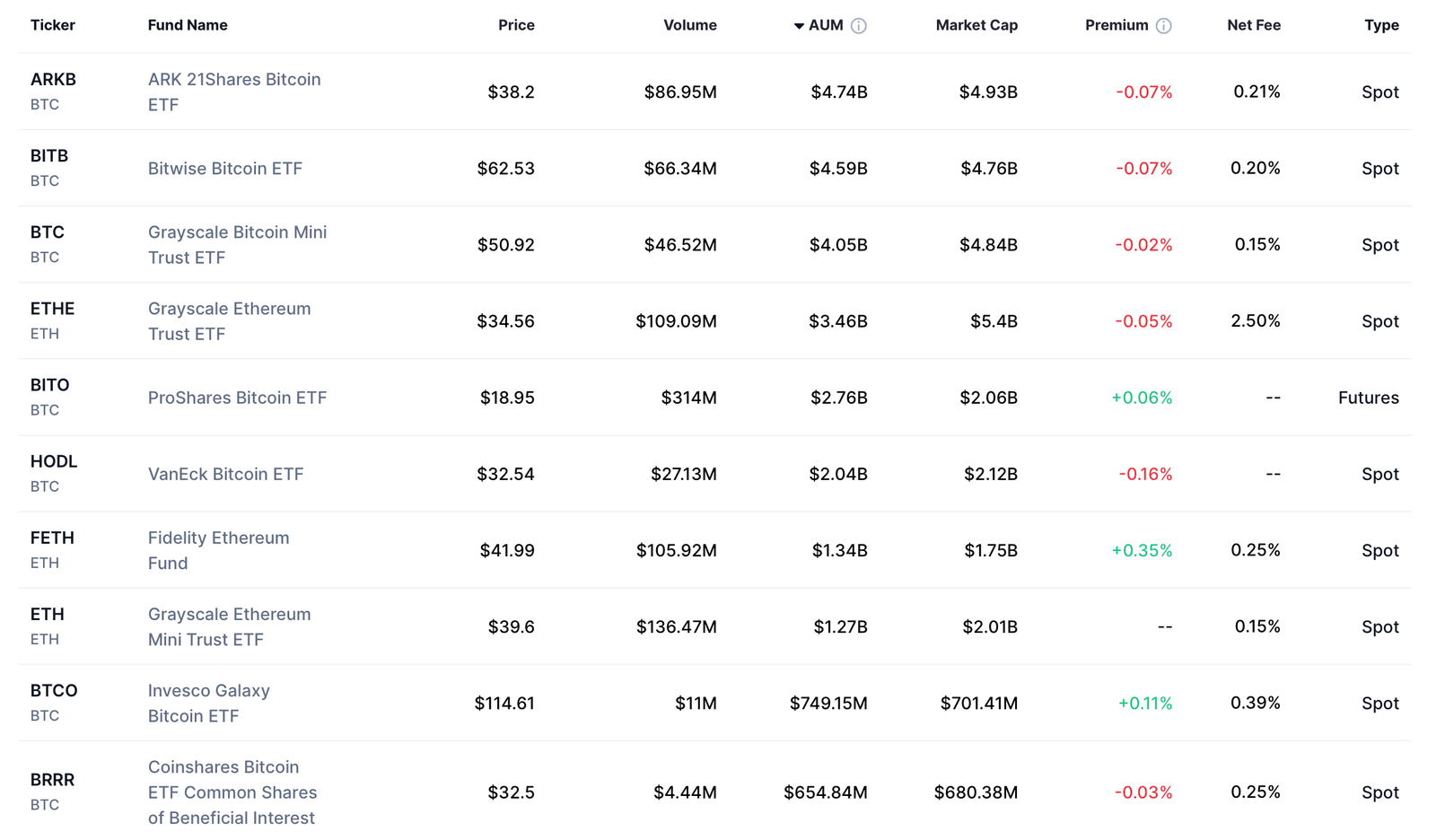

The SEC approved the first US spot Bitcoin ETFs on Jan. 10, 2024, opening the door for ETFs to be listed and traded by BlackRock, Grayscale, Bitwise, ARK 21Shares, WisdomTree, Fidelity, Valkyrie, VanEck, Hashdex, Franklin Templeton and Invesco Galaxy.

As Cointelegraph reported in September, as many as 16 ETFs were queued up for SEC approval in October, connected to various altcoins, including SOL, LTC, and Dogecoin (DOGE).

Related: Spot Ether ETFs see outflows for second consecutive week amid ‘cooling demand’

Solana Staking ETFS

Staking, which involves locking up cryptocurrency to help secure a proof-of-stake blockchain like Solana and earning rewards paid out in the same token, has become one of the main narratives in crypto this year.

In July, the REX-Osprey Solana Staking ETF debuted on the Cboe BZX Exchange, becoming the first crypto staking ETF approved in the United States.

Grayscale recently added staking to its Solana Trust, following the SEC’s September statement clarifying that certain staking activities do not constitute securities offerings.

Bitwise’s proposed Solana ETF, which could be approved on Tuesday, also includes staking features.

Thomas Uhm, chief operating officer of Solana-based liquid staking and MEV protocol Jito, told Cointelegraph that the Solana ETF approvals are just the beginning.

“We’re already working with tier 1 investment banks on products related to these ETFs and on accumulation strategies using staked Solana ETF options,” he said.

Magazine: Most wealthy Hong Kong investors plan to buy crypto, Japan’s Bitcoin plan: Asia Express