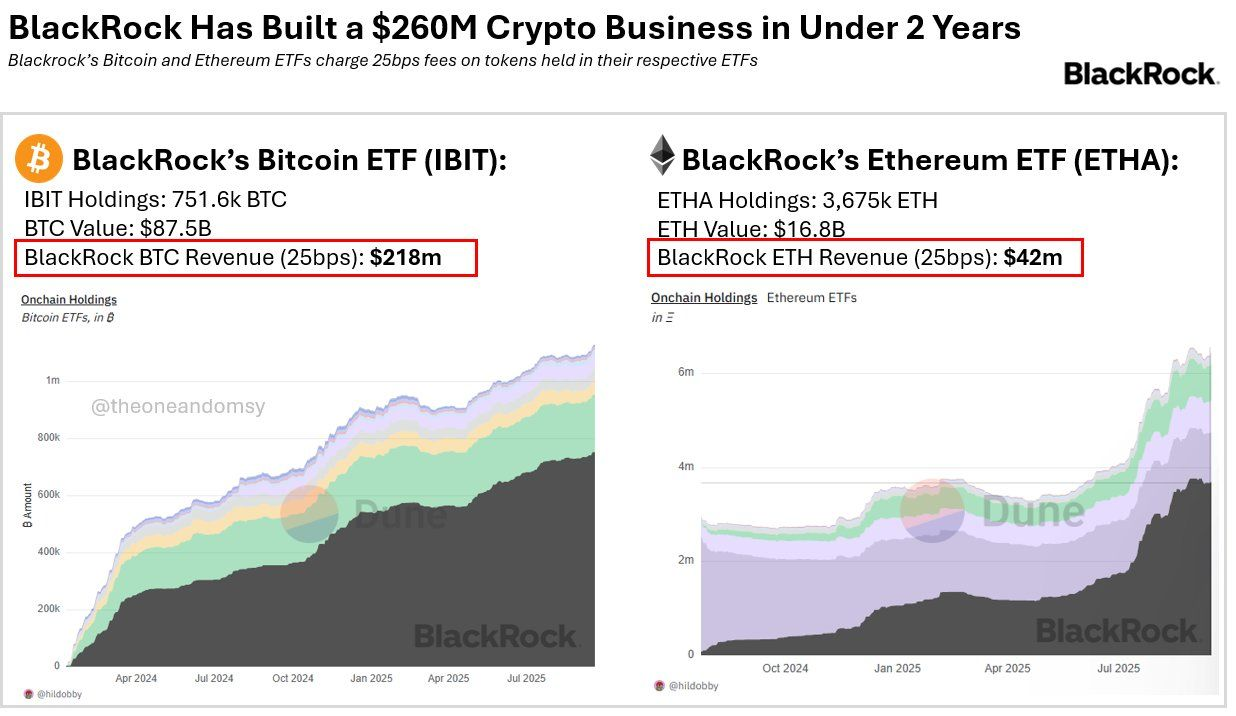

BlackRock’s cryptocurrency-based exchange-traded funds (ETFs) have become a revenue-generating machine, bringing in $260 million in revenue for the world’s largest asset manager, signaling a “benchmark” model for traditional investment funds seeking lucrative business models.

BlackRock’s Bitcoin (BTC) and Ether (ETH) ETFs are generating a total of $260 million in annualized revenue, including $218 million from Bitcoin ETFs and $42 million from Ether products, according to data shared Tuesday by Leon Waidmann, head of research at the nonprofit Onchain Foundation.

The profitability of BlackRock’s crypto-focused ETFs may drive more investment giants from the traditional finance (TradFi) space to launch regulated cryptocurrency-based trading products, with BlackRock’s crypto ETFs serving as a “benchmark” for institutions and traditional pension funds, Waidmann said.

“This isn’t experimentation anymore. The world’s largest asset manager has proven that crypto is a serious profit center. That’s a quarter-billion-dollar business, built almost overnight. For comparison, many fintech unicorns don’t make that in a decade.”

Waidmann compared the ETFs to Amazon, which started with books before scaling to everything. He said the ETFs are the “entry point into the crypto world.”

Related: Hyperliquid whale withdraws $122M HYPE tokens as Arthur Hayes exits

The growth of BlackRock’s ETFs is seen as evidence that institutions could extend the current crypto market cycle. Inflows from ETFs and corporate treasuries may continue to fuel demand beyond the industry’s traditional four-year halving cycle, some analysts said.

The inclusion of cryptocurrency in US 401(k) retirement plans may also be a major source of capital for Bitcoin and push its price to $200,000 before the end of the year, accoridng to André Dragosch, head of European research at crypto asset manager Bitwise.

Related: Machi Big Brother exits $25M HYPE bet at $4M loss as rivals eat Hyperliquid market share

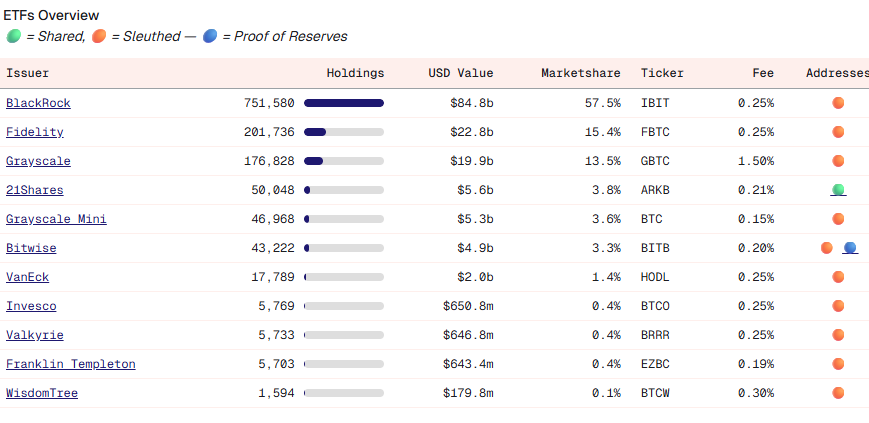

BlackRock’s Bitcoin ETF nears $85 billion milestone

Meanwhile, BlackRock’s fund is approaching $85 billion in total assets under management (AUM), accounting for the lion’s share or 57.5% of the total spot Bitcoin ETF market share in the US, according to blockchain data from Dune.

The milestone comes less than two years after the Bitcoin ETFs first debuted for trading on Jan. 11, 2024.

In contrast, Fidelity’s ETF only holds $22.8 billion, accounting for 15.4% of the total market share as the second-largest US spot Bitcoin ETF.

This makes BlackRock’s spot Bitcoin ETF the world’s 22nd largest fund across both crypto and traditional ETFs, up from the 31st largest in January, according to data from VettaFi.

Meanwhile, ETF inflows may help Bitcoin see another price discovery rally to new all-time highs in the next couple of weeks, according to Ryan Lee, chief analyst at Bitget exchange.

“With BTC and ETH ETFs already attracting massive inflows, the macro backdrop favors a ‘buy the dip’ approach, as institutional entry amid policy noise helps cement a bullish floor for risk assets,” the analyst told Cointelegraph.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds