Artificial intelligence (AI) is becoming more advanced, which means explosive growth in data centers.

Massive amounts of computing power will be needed to support AI, especially as it becomes an essential tool for workflows.

Investors who believe AI will continue advancing and play a growing role in everyday life may want to take a closer look at Vistra (VST 0.97%) and two exchange-traded funds (ETFs), the Global X Data Center & Digital Infrastructure ETF (DTCR 2.14%) and the Global X MLP & Energy Infrastructure ETF (MLPX 1.36%).

Image source: Getty Images.

A hidden way to play the AI/data center spending boom

Lee Samaha (Vistra): The growth in demand for AI applications is creating expectations for long-term power demand, which has hyperscalers (large-scale data centers providing cloud services) like Microsoft Azure, Alphabet‘s Google Cloud, and Amazon Web Services wondering how to secure their power needs.

At the same time, hyperscalers need to meet their emissions goals, which means aiming for environmentally friendly power sources. One solution to both these questions comes in the form of nuclear power, and it’s notable that all three inked deals last year to procure nuclear-powered energy over the long term.

That’s music to the ears of Vistra, a merchant power generation company increasing its investment in low- and zero-carbon power generation. Vistra stock soared in 2024 due to speculation that it could also sign lucrative long-term deals given the strength of its growing nuclear power generating capacity.

Vistra started the year with 2,400 megawatts (MW) — only to add 4,000 MW more following its acquisition of Energy Harbor Corp.

The potential for data center demand is at the forefront of the narrative around the stock. For example, Vistra Chief Strategy & Sustainability Officer Stacey Dore recently told investors, “we’re in early discussions with some of the hyperscalers about nuclear uprates, and some new build” and outside of nuclear “we’re in discussions with two particular large companies about building new gas plants to support a data center project.”

As such, Vistra is a back-door way to invest in the boom in AI demand.

Global X Data Center & Digital Infrastructure ETF is a conservative way to play the boom in data center demand

Scott Levine (Global X Data Center & Digital Infrastructure ETF): It seems to be just the beginning of the boom in AI, and with its rapid growth, data centers are developing into increasingly critical components of the nation’s infrastructure. Those interested in gaining exposure to this burgeoning industry, however, shouldn’t feel that conservative options are off the table. The Global X Data Center & Digital Infrastructure ETF, for example, is an ETF that provides exposure to some of the leading data center stocks. Plus, the fund doesn’t require investors to pay an arm and a leg to hold it, with a modest 0.5% total expense ratio.

With the stated goal of “invest[ing] in companies that operate data centers and other digital infrastructure supporting the growth of communication networks,” the Global X Data Center & Digital Infrastructure ETF has $219.5 million in net assets and 25 holdings. Digital Realty Trust and Equinix, two data center real estate investment trusts (REITs), are the second- and third-largest positions in the ETF, representing a combined 22% of the holdings. The fifth-largest position, GDS Holdings, operates data centers throughout China and represents 6.7% of the ETF’s net assets.

It’s not merely data center operators that are held in the ETF. Investors also gain exposure to leading semiconductor stocks that are benefiting from the growth in AI and generative AI — stocks like Nvidia, Broadcom, and Super Micro Computer.

For those interested in benefiting from the rapidly growing demand for data centers, the Global X Data Center & Digital Infrastructure ETF is a worthwhile consideration.

Power your passive income stream with this midstream ETF

Daniel Foelber (Global X MLP & Energy Infrastructure ETF): Data centers are needed to power increasingly complex AI workflows. But they are also energy-intensive.

Exploration and production companies profit from selling oil and natural gas for more money than it cost to produce. Meanwhile, midstream pipeline and infrastructure companies charge fees for handling hydrocarbons, making the industry less reliant on oil and gas prices.

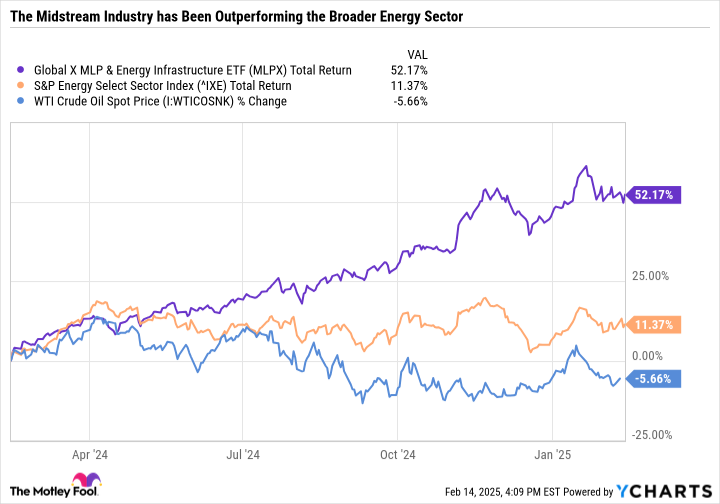

As you can see in the following chart, oil prices are down over the last year. The energy sector has produced decent gains, which have been primarily driven by the midstream segment.

MLPX Total Return Level data by YCharts

The Global X MLP & Energy Infrastructure ETF has far outpaced gains in the energy sector because it targets midstream companies and master limited partnerships (MLPs). Top holdings include high-yield infrastructure companies like Oneok, Enbridge, Williams Companies, and Kinder Morgan.

The fund is a good fit for investors who want to avoid some of the volatility that can come from companies whose profit margins are highly sensitive to swings in oil and gas prices.

Share prices of major midstream companies have been on the rise as investors reevaluate oil and gas infrastructure assets. Fossil fuels may gradually make up a smaller share of the energy mix over time, but overall demand could still increase if AI demand leads to higher energy consumption.

The current U.S. administration’s emphasis on boosting U.S. jobs and industry by imposing tariffs on imports could result in higher domestic energy output, which would be a boon for the midstream industry.

The Global X MLP & Energy Infrastructure ETF has an expense ratio of 0.45%, which is higher than the low-cost expense ratios folks can find from a diversified index fund. But the fee could be worth it for investors looking for a catch-all way to invest in the midstream industry.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Digital Realty Trust, Enbridge, Equinix, Kinder Morgan, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and Oneok and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.