An obscure ETF tax perk for wealthy investors might soon get more attention.

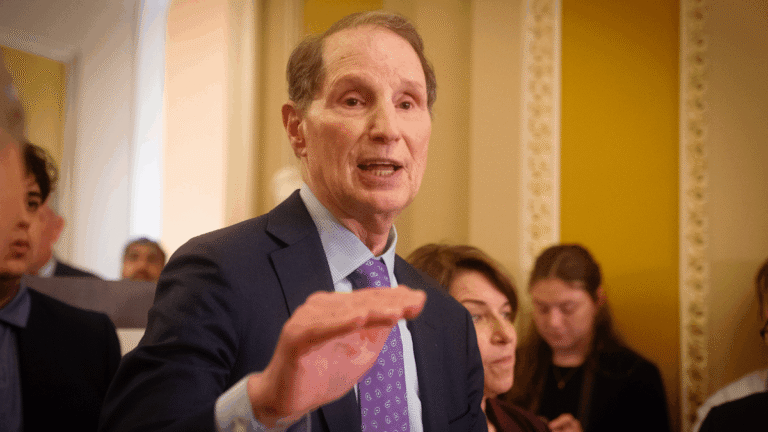

So-called 351 exchanges, which can allow stocks to be transferred into ETFs on a tax-deferred basis, are attracting scrutiny from Congress. At least one lawmaker has proposed a bill that would seek to limit 351s, which take their name from the relevant section of the US tax code. The strategy is somewhat new, and there are a handful of ETF issuers and RIAs that are focusing on seeding new exchange-traded funds with assets from separately managed accounts or big stock positions with untaxed gains. It’s unclear if the legislative package introduced earlier this month by Sen. Ron Wyden, D-Ore., has much support in the current Congress, but the sponsor is hopeful about his proposal’s longer-term prospects.

“This loophole-closing proposal raises revenue without increasing any tax rates, and it makes our tax code simpler and more fair,” Wyden said in an announcement. “You can bet we’ll have this on the shelf when it comes time for Democrats to pass an agenda that cleans up the harm Trump is doing to American families.”

READ ALSO: Calamos Launches First Autocallable ETF and ETF Investors Lured to AI, Crypto, Fintech

Importantly for companies focused on this tax technique, the legislation, as currently worded, would not apply retroactively. Firms such as Cambria Investments and Alpha Architect offer 351 exchange ETF services, and some RIAs have started up ETFs with clients’ SMA assets, said Jeffrey Colon, a tax law professor at Fordham University. Alpha Architect is preparing its US Equity ETF (AAUS), which has a minimum investment of $1 million for contributed portfolios and is slated for a July 23 launch. By moving assets to an ETF, wealthy investors can effectively adjust their portfolios with no immediate tax consequences, Colon said. “That’s not an income tax system we should have. I call it a tax arbitrage,” he said. “Congress really should look at this.”

There are some diversification rules governing 351 exchanges. No individual stock can account for more than 25% of the assets seeding an ETF, and the five largest holdings can’t represent more than half of the total assets. Additionally, the investors seeding the fund must collectively control 80% of it. “I am considering a 351 exchange for a client right now. It looks like a great solution for the client’s issue which is that they have a separately managed account with individual stocks where the manager has decided to drop out and stop managing,” said David J. Haas, owner of Cereus Financial Advisors. “Using a 351 exchange, they can transition the portfolio within a new ETF and delay any taxable gains until the ETF shares are sold.”