TLDR

- FSOL ETF recorded $5.91M in daily inflows and contributed 41.13K Solana tokens on January 13.

- FSOL’s cumulative net inflow reached $139M, with net assets valued at $156.23M and a 2.73% price gain.

- Other Solana ETFs like BSOL, GSOL, VSOL, and TSOL saw no inflows but recorded moderate price increases.

- BSOL held $656.66M in cumulative inflows and saw a 2.64% price increase, closing at $19.04.

- GSOL, VSOL, and TSOL also experienced stable performance with no inflows and slight price gains between 2.64%-2.83%.

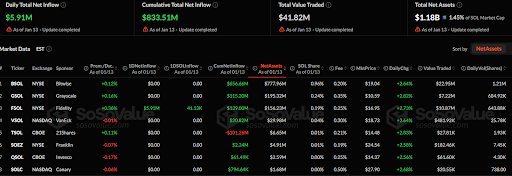

According to a recent update as of January 13, the daily total net inflow for the Solana ETFs reached $5.91 million. Following that, the available market data shows a cumulative total net inflow of $833.51 million. The total net assets across all listed products amounted to $1.18 billion, representing 1.45% of Solana’s market capitalization.

FSOL ETF Leads with $5.91M Inflows and 2.73% Price Gain

The FSOL ETF, listed on the NYSE and sponsored by Fidelity, led in daily net inflow with $5.91 million. The ETF also showed the highest single-day Solana token inflow, contributing 41.13K tokens. FSOL’s cumulative net inflow is $139.00 million, with its net assets valued at $156.23 million. The ETF’s price increased by 2.73%, closing at $16.95 per unit.

Other Solana ETFs, such as BSOL, GSOL, VSOL, and TSOL, experienced no daily inflows, maintaining stable performance with minimal movement in inflow or outflow. BSOL, sponsored by Bitwise, held $656.66 million in cumulative net inflows and $777.96 million in net assets. It experienced a price increase of 2.64%, closing at $19.04

Stable Performance for GSOL, VSOL, TSOL, SOEZ, and SOLC ETFs

GSOL, sponsored by Grayscale, saw no inflows and holds cumulative net assets of $195.32 million. It also recorded a 2.82% price increase, reaching $10.59 per unit. VSOL, sponsored by VanEck, showed no change in inflows and saw a modest price increase of 2.64%, closing at $18.73.

TSOL, listed on CBOE and sponsored by 21Shares, recorded stable performance with no inflows. Its price rose by 2.83%, closing at $14.48 per unit, with total net assets of $29.98 million.

SOEZ and SOLC Solana ETFs also showed stable performances with no inflows. SOEZ, sponsored by Franklin, holds net assets of $61.49 million, and SOLC, listed on NASDAQ, saw a price rise of 2.68% to $27.90. Overall, FSOL led with strong inflows and price gains, while other Solana ETFs remained stable.