Gold is on fire. The yellow metal smashes records on Friday, soaring past the $3,200 per ounce mark for the first time. This surge followed Thursday’s close at $3,175 per ounce. Meanwhile, U.S. gold futures jumped nearly 2% to $3,237.50, adding to the bullish momentum. While spot gold soared to record highs, ETFs like SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and SPDR Gold MiniShares Trust (GLDM) saw inflows pick up. All three funds rose around 2.5% on Thursday and are up roughly 8% over the past 30 days.

Stay Ahead of the Market:

At the same time, gold mining stocks are riding the rally too, with Barrick Gold (GOLD) up 24% year-to-date and Newmont Mining (NEM) climbing 37%.

What’s Behind Gold’s Record-Breaking Rally

A weaker dollar, rising geopolitical tensions, and a renewed trade war between U.S.-China fears sparked a rush to safety, reaffirming gold’s status as a reliable haven.

On top of that, a big bond sell-off made gold seem less risky. Additionally, lower U.S. inflation data raised hopes for a Fed rate cut in May or June. Notably, lower rates often push gold prices higher. Finally, fresh demand by central banks and renewed interest in gold ETFs also add support to gold prices.

Kyle Rodda, a market analyst at Capital.com, stated that $3,500 is the next level investors will keep an eye on, though it’s unlikely to reach there right away or without some volatility.

Deep Dive into ETFs with TipRanks’ ETFs Comparison Tool

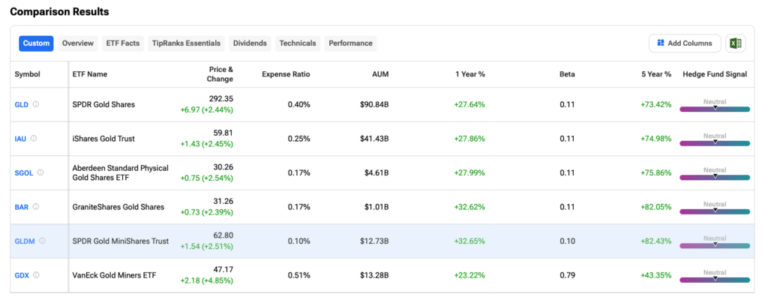

During this time of market volatility, investors often turn to gold ETFs for stability. To compare top-performing gold ETFs, investors can use the TipRanks ETFs Comparison tool. It helps filter ETFs based on key factors like expense ratio, assets under management (AUM), and annual returns. Below is a screenshot for reference.

Disclaimer & DisclosureReport an Issue

Source link