mysticenergy

FlexShares Morningstar Global Upstream Natural Resources Index Fund ETF (NYSEARCA:GUNR) touches on all angles of commodities and uncovers the growth potential and the natural resources industry.

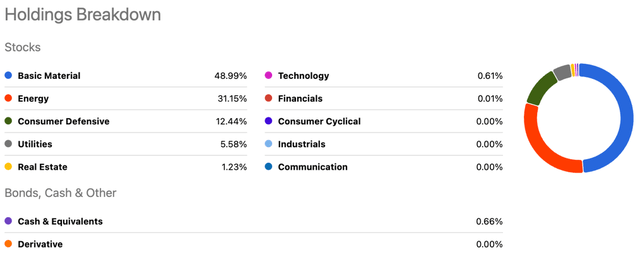

GUNR is an exchange-traded fund launched by Northern Trust Corporation. The fund invests in stocks of companies operating across energy, materials, metals and mining, paper and forest products, timber tracts, lumber manufacturing, consumer staples, food, beverage and tobacco, agricultural products, and water utilities sectors. Here is a breakdown of the holdings, with discussion below.

About half of the ETF comes from the basic materials sector, a third from energy, and the remaining comprised of defensive, utilities and real estate. This ETF is index-based, not actively managed. It has 165 holdings, though with 10 stocks making up 36% of assets, that means 64% of GUNR is spread across 140 stocks. Those 140 positions average less than one half of 1% of the fund each. In other words, none of those stocks by themselves can significantly alter the returns of GUNR like the big energy names at the top of the ETF can.

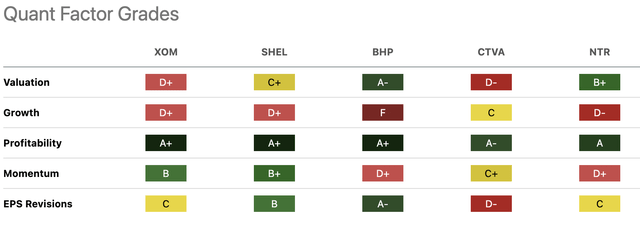

Of the top 5 holdings, three are companies relating to hard commodities, two relate to soft. The quant factor grades show the impressive profitability among this group, with all exhibiting A+ or A ratings. But most evident is the lack of growth potential and the fact that all of these companies have had negative year over year revenue growth.

Natural resources are the foundation of human civilization and economic development. These resources, which include minerals, fossil fuels, water, forests, and agricultural land, are integral to the functioning of societies and economies around the world.

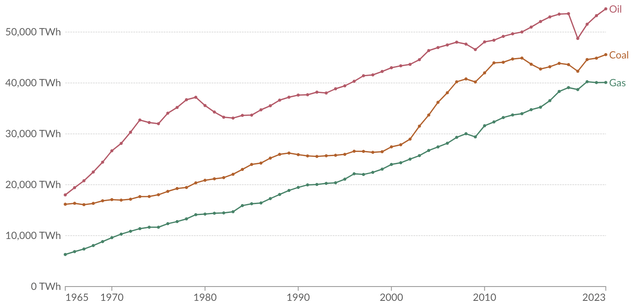

Fossil fuels like oil, coal, and natural gas are primary energy sources that drive transportation, electricity generation, and heating. Minerals such as iron, copper, and aluminum are essential for manufacturing everything from electronics to infrastructure. Additionally, fertile soil and water resources support agriculture, ensuring food security for billions of people.

Although natural resources are imperative, they do come with many challenges, especially environmentally. As the world shifts toward more sustainable resources and energy efforts, certain natural resources like the fossil fuels are seen in a negative scope because of their pollution output.

Unfortunately, GUNR does not carry much weight in terms of the clean energy industry-leading companies. The good news for the ETF is that oil, coal, and gas aren’t going anywhere soon. Below, you can see the consumption of these fossil fuels over decades. Other than some smaller dips, there are no signs of slowing down, at least for a while.

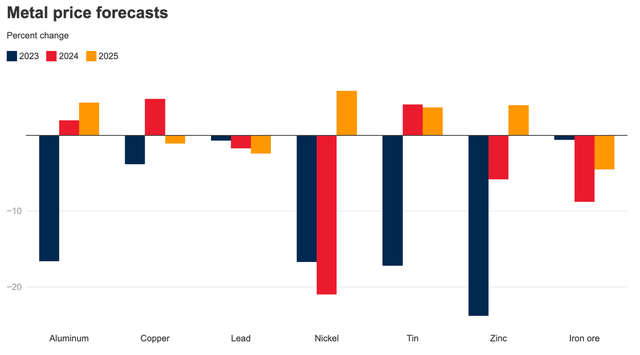

GUNR also holds many metals and mining companies. Metal price forecasts are somewhat all over the map, but we do know they have been relied on for centuries, and that is not going to change. Recent price increases reflect positive sentiment about stronger demand amid concerns of supply disruptions for several metals.

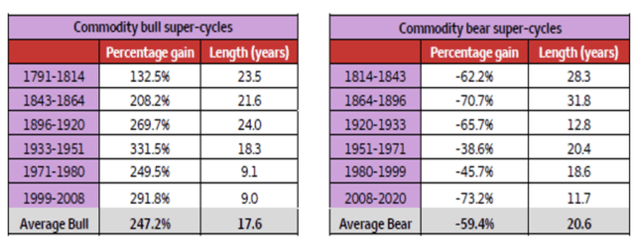

Another perspective to consider with GUNR is from the commodity standpoint. Commodities are known to go through “supercycles” that last much longer than a typical business or economic cycle. Analysts and strategists are grappling with the question of whether resurgent demand and insufficient supply will create a new commodities’ supercycle. This is certainly something to consider and keep an eye on in the coming months.

GUNR has a P/E ratio around 13, showing there is some potential value here, with that statistic representing about a 50% discount to the S&P 500. With $5.58 billion in AUM, the ETF is much larger than many of its counterparts. A 3.37% dividend yield quarterly is respectable and right on pace among the industry. It is also nearly triple the yield of the S&P 500 index.

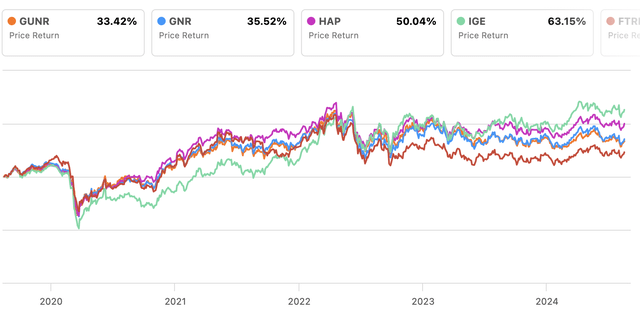

Although GUNR has underperformed several of its peers, we have the ETF as a buy right now. The recent 100% gain since the pandemic and the possible “supercycle” are very positive signs. Commodities are a popular investment to hedge against inflation, so even though inflation has come down, another uptick wouldn’t be a worry for GUNR.

This ETF also offers significant global diversification, following a period in which US stocks have dominated. 36% is allocated to US stocks, but the UK and Canada represent 13% and 15% respectively, and Europe accounts for about another 13%. Asia and Australia follow at about 8% each.

Lastly, we like the global diversification and see that is a great benefit for investors of GUNR to gain access to the natural resource industry worldwide. All of the above considered, we are issuing a buy rating on GUNR, with a 3-5 year outlook.