ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research on trends in the global ETFs industry, organising 5 annual regional ETFGI Global ETFs Insight summits and the ETF TV show, reported Korean retail investors were active purchasers of ETFs listed in the United States in July. Twenty-seven of the top fifty overseas securities purchased by Korean retail investors were ETFs listed in the United States and Japan. The number of ETFs on the list increased by 1 from 26 in June, is up by 4 from 23 in May 2024, and it is up by 2 from April 2024. Source, Korea Securities Depository. (All dollar values in USD unless otherwise noted)

Highlights

- Sixteen of the twenty-seven ETFs on the top 50 list provide leverage or inverse exposure.

- The largest purchase was US$3.05 billion of the Direxion Daily Semiconductors Bull 3X SHS ETF listed in the United States.

Top 10 overseas ETFs purchased in July 2024

|

ETF Name

|

Purchase Amount in USD

|

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF

|

3,047,634,931

|

|

DIREXION DAILY TSLA BULL 2X SHARES

|

1,417,225,685

|

|

GRANITESHARES 2.0X LONG NVDA DAILY ETF

|

997,034,925

|

|

DIREXION SHARES ETF TRUST DAILY

|

861,260,406

|

|

PROSHARES ULTRAPRO QQQ ETF

|

739,820,231

|

|

PROSHARES ULTRAPRO SHORT QQQ ETF

|

351,315,758

|

|

DIREXION DAILY 20 YEAR PLUS DRX DLY 20+ YR TREAS BULL 3X

|

335,714,172

|

|

2X BITCOIN STRATEGY ETF

|

270,742,993

|

|

T-REX 2X LONG TESLA DAILY TARGET ETF

|

247,126,180

|

|

INVESCO QQQ TRUST SRS 1 ETF

|

216,210,838

|

Source, Korea Securities Depository

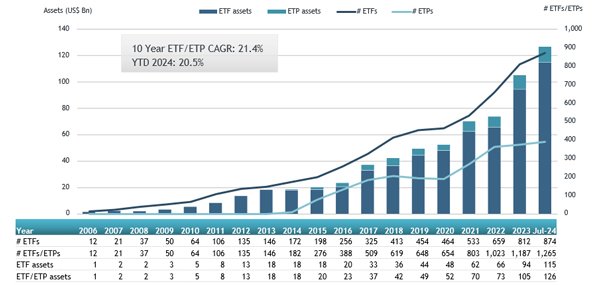

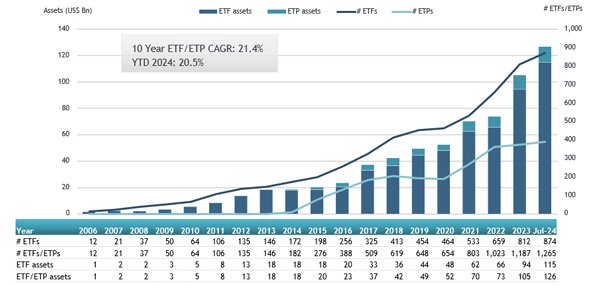

The ETFs industry in Korea has 1,265 products with assets of $126.37 billion, from 36 providers listed on the Korea Exchange at the end of July 2024. According to data from ETFGI, 26.0 percent of the local products provide leverage or inverse exposure which account for 9.8% of the assets in the ETFs industry in Korea.

Asset Growth in South Korean ETF and ETP as of the end of July 2024