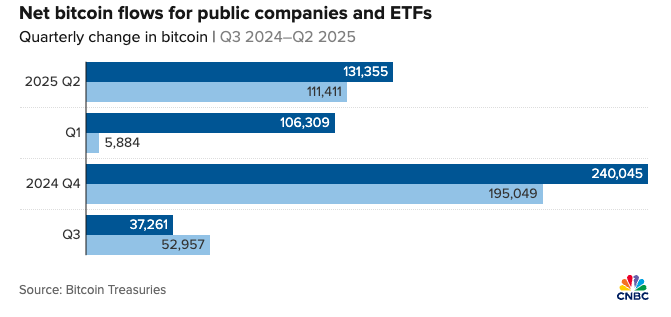

Corporate treasuries have surpassed exchange-traded funds (ETFs) in Bitcoin accumulation for the third consecutive quarter, according to new data from Bitcoin Treasuries. Public companies acquired approximately 131,000 BTC in Q2 2025—an 18% increase from the previous quarter—compared to an 8% uptick, or 111,000 BTC, among ETFs.

“The institutional buyer who is getting exposure to Bitcoin through the ETFs are not buying for the same reason as those public companies who are basically trying to accumulate Bitcoin to increase shareholder value at the end of the day,” said Nick Marie, head of research at Ecoinometrics.

In April alone, public company holdings rose 4% while ETFs increased just 2%. “They don’t really care if the price is high or low, they care about growing their Bitcoin treasury so they look more attractive to the proxy buyers,” Marie said. “It’s not so much driven by the macro trend or the sentiment, it’s for different reasons. So it becomes a different kind of mechanism that can push Bitcoin forward.”

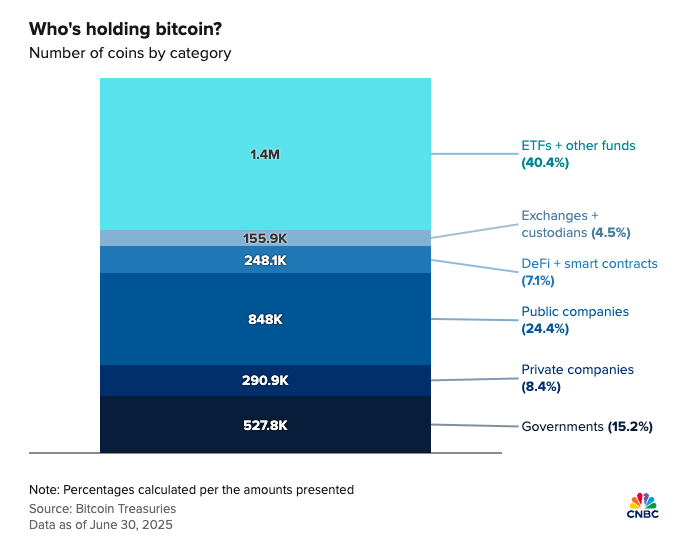

Despite the surge in corporate adoption, ETFs remain the largest entity holders of Bitcoin, controlling more than 1.4 million BTC—about 6.8% of the fixed supply cap. Public companies now hold around 855,000 BTC, or 4%.

Some analysts have linked the surge in corporate participation to the favorable policy shift under the Trump administration. In March, Trump signed an executive order for a U.S. Bitcoin reserve, signaling strong federal support for Bitcoin. The last quarter where ETFs led in BTC accumulation was Q3 2024, prior to Trump’s reelection.

Recent moves include GameStop’s entry into Bitcoin holdings, KindlyMD’s merger with David Bailey’s Bitcoin treasury company, Nakamoto, and ProCap’s launch of a Bitcoin treasury strategy ahead of its public debut via SPAC.

Still leading the pack is Strategy (formerly MicroStrategy), which holds 597,000 BTC. “It’s going to be very hard to catch Strategy’s scale,” said Ben Werkman, CIO at Swan Bitcoin. “They’re going to be the preferred landing spot for institutional capital.”

Looking ahead, Marie believes the current pace of corporate Bitcoin adoption may not last forever, suggesting this could be a temporary opportunity. “You can think about this wave as a bunch of companies that are trying to benefit from this arbitrage,” he said.

Still, Werkman sees long-term value in the model. “What people really like about these companies is that they can do something spot Bitcoin holders can’t: go out and accumulate more Bitcoin on your behalf,” he explained.

Disclosure: Nakamoto is in partnership with Bitcoin Magazine’s parent company BTC Inc to build the first global network of Bitcoin treasury companies, where BTC Inc provides certain marketing services to Nakamoto. More information on this can be found here.