Newly launched spot Ethereum ETFs generated inflows Monday, a rare bright spot on a day when risk-on assets, including cryptocurrencies, plunged.

The positive flows occurred even as ether, the crypto that the spot Ethereum funds track, dropped more than 25% at one point Monday from the previous day, according to data from CoinMarketCap. It has recently recovered some of the lost ground to trade at about $2,500, up 4.5% from Monday, same time.

The Ethereum ETFs recorded $48.8 million in inflows, according to data from U.K. asset manager Farside Investors.

BlackRock’s iShares Ethereum Trust (ETHA) led the pack with $47.1 million in inflows. VanEck Ethereum ETF (ETHV) and Fidelity Ethereum Fund (FETH) each pulled in about $16 million. The Grayscale Ethereum Mini Trust (ETH) saw inflows of $7.6 million.

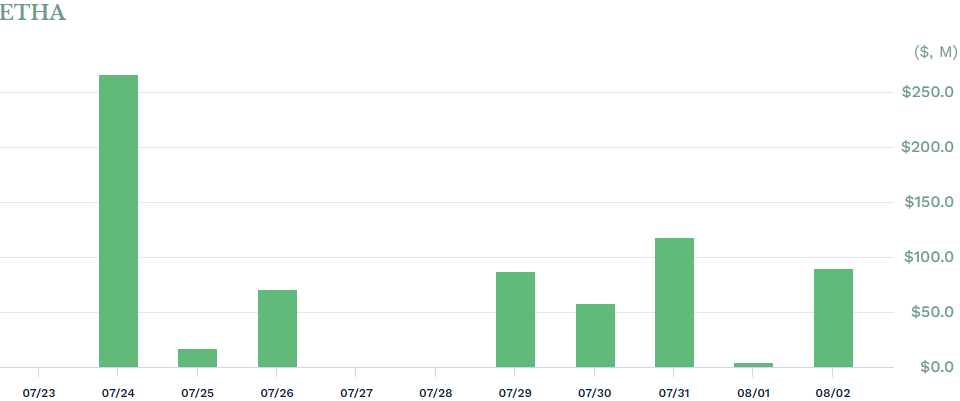

The nine spot Ethereum ETFs debuted on July 23—the second group of funds based on the ongoing price of a major cryptocurrency. Spot Bitcoin ETFs started trading on Jan. 11 following nearly a decade of resistance by the Securities and Exchange Commission (SEC) to such products.

Ether is second largest cryptocurrency by market capitalization with a roughly $300 billion market capitalization. Bitcoin has a more than $1.1 trillion market cap, according to CoinMarketCap.

Spot Ethereum Net Outflows

The Grayscale Ethereum Trust (ETHE) had $46.8 million in outflows, the only product to experience outflows on Monday. The fund differs from the other spot Ethereum funds because it is a conversion from an existing trust and carries the highest expense ratio, 2.5%.

Spot Ethereum ETFs have recorded net outflows of $462.4 million in their nearly two weeks of trading, as ETHE’s over $2.1 billion in outflows have outpaced inflows to the other spot Ethereum funds. Still, the funds’ debut has been considered largely a success.

A market downturn tied to fresh angst over a potential U.S. recession and other macroeconomic uncertainties caused all three major indices to sink and tech and consumer discretionary ETFs to slump on Monday. The S&P 500 and tech-heavy Nasdaq dropped 3% and 3.4%, respectively.

Spot Bitcoin ETFs on Monday generated $168.4 million in net outflows, according to Farside. The Grayscale Bitcoin Trust ETF (GBTC) and ARK 21Shares Bitcoin ETF (ARKB) led the outflows, with each shedding about $69 million in assets. The 11 spot bitcoin funds have generated about $17.3 billion in net inflows since their start.