Taiwan Semiconductor TSM is set to report third-quarter 2024 results onOct. 17, 2024, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $1.74 per share on revenues of $22.72 billion.

The company surpassed estimates in the first two quarters of 2024, as demand for its chips to power AI technology have remained in high demand. The company has a trailing four-quarter earnings surprise of 7.83%, on average. The TSMC stock has gained steadily from August lows and is currently trading around record levels, up roughly 75% this year.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Inside the Upbeat Trend Brewing Ahead of Earnings Release

September sales increased at Taiwan Semiconductor, with the chipmaker on Wednesday reporting numbers that indicated better-than-expected third-quarter revenues. The company, which supplies tech heavyweights such as Apple AAPL and NVIDIA NVDA, reported September sales of 251.87 billion New Taiwan dollars ($7.82 billion), up just under 40% from the year-ago period.

Added to its results for August and July, TSMC reported NT$759.69 billion ($23.58 billion) in revenue for the third quarter of 2024, above the NT$749.88 billion that analysts tracked by Visible Alpha had expected and up about 36% year over year. The results topped TSMC’s own outlook, as the company expected third-quarter revenue between $22.4 billion and $23.2 billion.

Q3 Earnings Whispers for TSMC

Our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat.

The Taiwan Semiconductor stock has an Earnings ESP of 0.00% and a Zacks Rank #2 (Buy).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The TSM stock comes from a top-ranked Zacks industry (top 1%) and top-ranked Zacks sector (top 13%).

What’s Shaping Q3 Results?

Taiwan Semiconductor’s revenue growth is expected to be strong and steady over the next few quarters. The demand from artificial intelligence (AI), is the main tailwind. The company’s aggressive investment in research and development has allowed it to maintain a dominant position in the space. Sales estimate growth for the upcoming two quarters are 31.48% and 23.36% and for the next two fiscal years are 23.55% and 23.49%, respectively.

Management believes that AI-related chips will grow at a 50% compounded annual growth rate (CAGR) through 2028, when they will make up around the low teens of its overall revenue. That’s quite a lot of growth rate, and much of the future growth will be aided by its 2 nanometer (nm) chip design, per a Motley Fool article.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

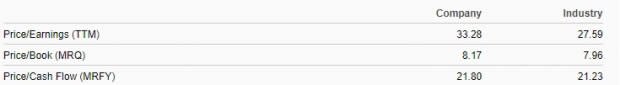

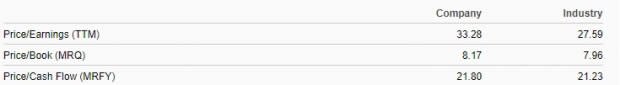

Decent Valuation

Despite TSMC’s strong outlook, the stock doesn’t possess a high valuation. On a trailing price-to-earnings (P/E) ratio basis, Taiwan Semiconductor currently trades at 33.28X versus 27.59X possessed by the underlying industry. Price/Book (most recent quarter) ratio of the TSMC stock is pegged at 8.17X versus 7.96X recorded by the industry. Price/Cash Flow (most recent fiscal year) ratio of the TSMC is pegged at 21.80X versus 21.23X recorded by the industry.

Image Source: Zacks Investment Research

Price Target

Based on short-term price targets offered by seven analysts, the average price target for TSMC comes to $204.71. The forecasts range from a low of $170.00 to a high of $250.00. The average price target represents an increase of 10.2% from the last closing price of $185.78.

TSMC ETFs in Focus

Apart from the TSMC stock itself, investors can also play the stock in the ETF form. The TSMC-heavy ETFs include SP Funds S&P World (ex-US) ETF SPWO (TSMC’s weight 15.75%), SP Funds S&P Global Technology ETF SPTE (TSMC’s weight 15.50%), Matthews Emerging Markets ex China Active ETF MEMX (TSMC’s weight 14.41%) and VanEck Semiconductor ETF SMH (TSMC’s weight 12.65%).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

SP Funds S&P Global Technology ETF (SPTE): ETF Research Reports

SP Funds S&P World (ex-US) ETF (SPWO): ETF Research Reports