Telegram:- In a buzzing $35 billion market for tokenized assets, equities are rapidly emerging as the next major frontier. What began as an experiment on niche blockchains has now become a full-fledged race among major exchanges and Web3 platforms.

From Gemini’s early pilots in tokenized securities to blockchain networks like BNB Chain and Solana expanding into offering tokenized RWAs, the shift toward on-chain equities is accelerating. Now, in a move that is signaling the sector’s move into mainstream consumer products, Telegram, is joining the competition. Here’s How

Wallet in Telegram Launches Tokenized Equities

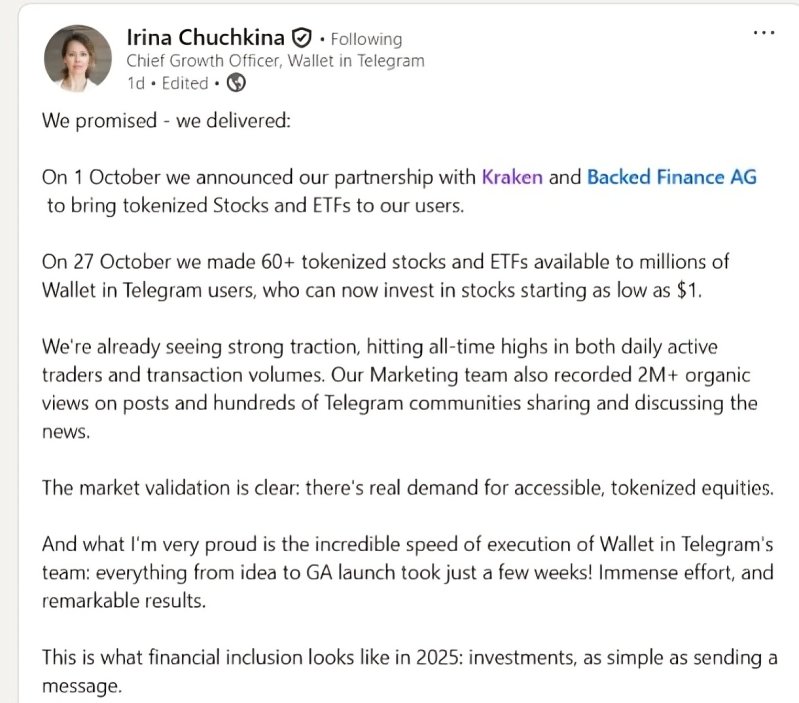

Earlier this month, Irena Takina, Chief Growth Officer of Wallet in Telegram, announced the company’s entry into the organized equities market. On 1 October, Telegram revealed its partnership with Kraken and Backed Finance AG to bring tokenized stocks and ETFs to users through the app’s built-in wallet.

Less than four weeks later, on 27 October, the company made trading for over 60 tokenized stocks and ETFs officially live for millions of users. The rollout, which Telegram describes as a full launch rather than a pilot, marks one of the fastest go-to-market timelines in the tokenization sector—“from idea to general availability in just a few weeks,” as Takina put it.

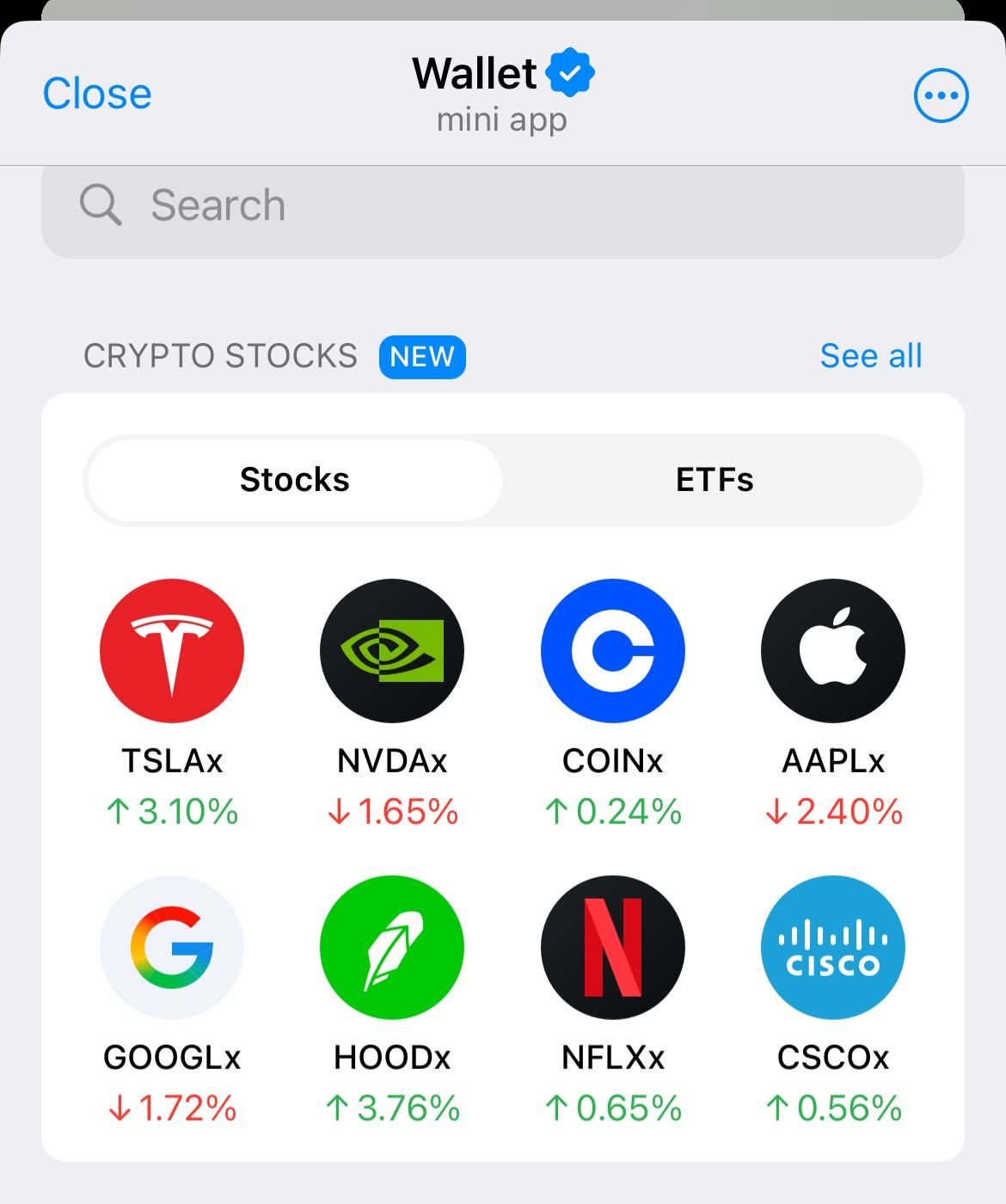

The new feature allows users to purchase fractionalized shares of major global equities – from Tesla to Nvidia – starting from as little as $1. While giving access to US stocks for global investors, $1 is a stark contrast to the minimum ticket sizes typical of brokerage accounts. The assets are represented as tokenized versions of underlying stocks and ETFs. The wallet is making them compliant and tradable via Backed Finance’s regulated infrastructure and Kraken’s exchange connectivity.

All transactions will take place inside Wallet in Telegram, the in-app crypto and payments layer built around The Open Network (TON) blockchain. For users, this means investing is as simple as sending a message or sticker – an interface Telegram hopes “will make finance as intuitive as chat.”

Also Read: Who Generates the Bulk of Crypto’s $20B in Revenue?

Race for the 1% Share of the Stock Market

Even though Telegram’s entry into tokenized equities marks a bullish signal for the sector, the road ahead remains long. According to the recent Block of Fame report, the total value of tokenized stocks on-chain currently stands at just $686.9 million – a mere 0.0007% of the global equity market. Yet, this figure is enough to ignite a race. From Web3 startups to legacy fintechs, every player now seems determined to capture even 1% of the world’s $100 trillion stock market.

For instance, Ondo Finance recently named Chainlink as the official oracle provider for its tokenized stocks and exchange-traded funds (ETFs), aiming to improve how financial data moves across blockchain networks.

Chainlink will supply custom price feeds for the more than 100 tokenized equities on Ondo’s platform, including U.S.-listed stocks and ETFs. The platform has also expanded to BNB Chain with the launch of tokenized equities by PancakeSwap.

Also Read: Can the TRUMP Memecoin Power Startup Fundraising?

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share