Summary: Leveraged exchange-traded funds seek to deliver some multiple of an underlying index or reference asset’s return over a day, before fees. Owing to compounding effects (“volatility decay”), these ETFs can’t be counted on to generate twice or thrice the return over periods longer than a day. Yet, I find the leading leveraged single-stock ETFs aren’t even delivering the target return on an average day as they’re meant to do. All told, this is potentially shortchanging traders who use these ETFs of billions in forgone gains.

Direxion Daily TSLA Bull 2x Shares ETF TSLL isn’t something most investors would consider. It aims to deliver 2 times Tesla’s TSLA return on a given day. That suits it more toward speculators betting on unpredictable changes in the electric car maker’s stock price in a day.

But the math is the math: The ETF should deliver 2 times the stock’s return each day before fees. It has not. Here’s the Direxion ETF’s average daily capture ratio—that is, Tesla’s return divided by the ETF’s return on an average day, broken down by whether TSLA had risen or fallen that day.

On the average up day, the ETF delivered less than twice Tesla stock’s return (and less than 1.5x when that was its target ratio earlier in its life), but on the average down day, it captured more than twice the stock’s change. For instance, on June 23, 2025, Tesla’s stock leapt 8.23% but the ETF rose only 16.42%, or 4 basis points shy of the 2x target. Then on July 1, 2025, Tesla fell 5.34% but the ETF sank 10.70%, which was 0.03% more than its target.

These were not isolated occurrences. Here is a time lapse of the past two years, in which I compare the Direxion ETF’s daily return against the return suggested by its target at the time (either 1.5x or 2x). For simplicity, I’ve averaged the daily shortfalls for each month.

On the average day, the ETF’s return lagged the target return by 4 basis points, a shortfall that far exceeded the fee it levied on a given day (around one-fourth of a basis point, give or take). Over a full year, those daily shortfalls would compound to a nearly 10% annual drag on returns.

How much did that amount to in dollar terms? From the Direxion ETF’s inception through Oct. 24, 2025, I estimate those daily shortfalls came to around $813 million in total. The ETF levied at least $70 million in cumulative fees over that span (based on the $43 million in total fees it reported in its filings from inception through April 30, 2025, and the $30 million or so I estimate it collected in the time since). So that would mean the ETF incurred nearly $740 million in frictional costs unexplained by standard management and other fees.

To put that figure in perspective, the ETF amassed around $4.9 billion in net income and gains over that span based on my estimates. Thus, the $740 million or so in forgone gains would have equated to around 14% of the dollar returns investors potentially could have earned had the ETF met its Tesla daily-return target.

Felt But Not Seen

The main culprit for the shortfall is financing costs. To obtain twice Tesla’s daily return, the ETF enters “total return swaps” with counterparties, typically banks or market makers. Each counterparty pledges to deliver a multiple of Tesla’s daily return, but to do so, it must borrow or otherwise use its balance sheet. To defray the associated costs, it charges a financing rate, consisting of a base component and a spread, both variable.

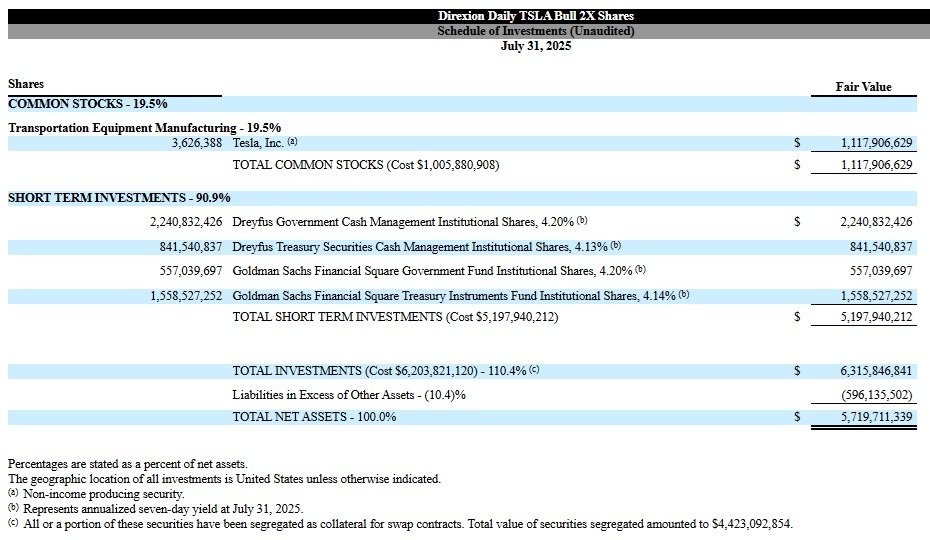

ETFs periodically disclose the swaps they’ve entered and their terms. Here’s an example from the Direxion ETF’s most recent report. Recently, the ETF was paying 8.66% all-in, on average (notionally weighted), for swap financing.

The ETF’s average annual financing rate rose even as its assets grew. That’s a function not only of rising short-term borrowing rates amid tighter Fed policy, but also widening spreads, as shown below.

But you wouldn’t know it judging from the ETF’s expense ratio, which hovered in a narrow range since inception (between 0.95% and 1.08% based on prospectus disclosures). That’s because these financing costs aren’t bundled into the expense ratio. Instead, they’re netted against the gains or losses on the swaps, similar to how brokerage commissions are backed out of returns. Thus, they’re felt but not seen.

(Jason Zweig wrote about this topic in a recent column, and you can find some interesting research that Arizona State professor Hendrik Bessembinder published as well. I’ve also attempted to estimate some of these swap costs in a different article I wrote.)

Yet, they unquestionably drag on performance, largely explaining why the Direxion ETF hasn’t been able to do its one job: deliver 2 times Tesla’s daily return target. That’s really brought home when you compare the ETF’s actual since-inception annual returns against those of Tesla stock, as well as that of a hypothetical ETF that met its daily return target (that is, the leverage multiple times Tesla’s return each day).

The actual ETF’s returns badly lagged Tesla’s from inception through Oct. 24, 2025, which is to be expected. After all, leveraged daily ETFs aren’t meant to be held for periods longer than a day due to volatility decay.

What’s more surprising, though, is that the Direxion ETF’s annual returns would have been nearly 10 percentage points higher than they were had it met its daily return target as advertised (around 9% after factoring in the ETF’s fee). That would still lag Tesla, but it reinforces how much these frictions cost traders, even if they are an unavoidable part of executing the strategy.

More Where That Came From

This isn’t an issue just for this Direxion ETF. To illustrate, here are the 10 largest leveraged single-stock ETFs by assets and how much of their reference stock’s return they captured on an average up or down day since inception.

Every ETF but one captured less than its target on its reference stock’s average up day and more than its target on the stock’s average down day since inception. (I excluded data for ETFs that were on a 1.5x or 1.75x target before adopting a 2x target. The results were the same: They lagged their targets on up days and fell to deeper losses than the target on down days.)

(The lone ETF to capture less than its target on the average down day appears to be a fluke: GraniteShares 2x Long AMD Daily ETF AMDL inexplicably gained 10.3% on March 18, 2024, a day AMD AMD lost 0.2%, and then lost 18.6% the following day when AMD slid 4.8%. Excluding those two days, which came very early in the ETF’s life, it would have captured 2.12 of AMD’s return on the average losing day, exceeding its 2x target like every other ETF on the list.)

Big Whiff

I estimate these shortfalls cost traders around $3.3 billion in returns from the ETFs’ inceptions through Oct. 24, 2025. That figure excludes the roughly $230 million in fees these ETFs collected in aggregate over their lifetimes through Oct. 24, 2024 (those fees are netted against the income and gains shown).

Put another way, had these ETFs not whiffed the daily targets they advertised, traders would have reaped $13.4 billion in income and gains instead of the $10.1 billion they actually saw, with fees, financing costs, and other frictions eating away the difference.

Poster Children

A few of these ETFs stand out for the sheer amount they appear to have forgone in returns: Based on my estimates, T-Rex 2x Long MSTR Daily Target ETF MSTU looks to have incurred nearly $600 million in cumulative daily shortfalls to its target from its Sept. 17, 2024, inception through Oct. 24, 2025. Meanwhile, Defiance Daily Target 2x Long MSTR MSTX racked up almost $520 million in these shortfalls since launching on Aug. 14, 2024.

The T-Rex ETF lagged its target return by 17 basis points on the average up day and 14 basis points on the average down day, while the Defiance ETF fell shy by 17 basis points and 16 basis points, respectively.

What held these ETFs back? Swap financing costs that appear to have become more onerous as the ETFs’ net assets swelled. For instance, here is a time lapse of the Defiance ETF’s notionally weighted average financing costs based on disclosures in its periodic reports. As the ETF’s assets climbed, its financing costs rose—diseconomies of scale.

What’s notable is that the spreads on these swaps widened as the ETF grew, indicating the swap counterparties’ hedging and balance-sheet costs mounted faster than assets rose. Thus, the ETF was recently paying more than 20% per year, all-in, to obtain swap exposure.

Conclusion

Daily single-stock leveraged ETFs don’t deliver as advertised. They appear to routinely fall shy of their daily targets before fees, and those shortfalls have compounded to shortchange traders to the tune of billions in forgone gains. Moreover, given the nature of swap financing costs, it doesn’t appear that these ETFs have been able to realize economies of scale as they’ve caught on with speculators. In several cases, I found that the financing costs became more onerous, further blunting the ETFs’ ability to meet their daily return targets.

Switched On

Here are other things I’m saying, reading, listening to, or watching:

- The new sharks and jets? Christine Benz on maximizers vs. satisficers

- Amy Arnott draws lessons from the global market portfolio

- Cathie Wood called indexing “a form of socialism”; I had some thoughts

- Mark Maron reflects on nearly 1,700 podcasts with Matt Groening and Judd Apatow

- “It’s called suitcasing”: The New York Times interviewed former jewel thieves about the Louvre heist, and let’s just say it wasn’t boring

- “A House of Dynamite”!!!

- Soundgarden “Badmotorfinger”; Ingrid Andress “All the Love”; Kyuss “Green Machine” (it’s been a weird week)

Don’t Be a Stranger

I love hearing from you. Have some feedback? An angle for an article? Email me at jeffrey.ptak@morningstar.com. If you’re so inclined, you can also follow me on Twitter/X at @syouth1, and I do some odds-and-ends writing on a Substack called Basis Pointing.