The mega-cap stocks that have been the biggest winners in the current bull market might not lead the way going forward.

Four-leaf clovers have been a symbol of good luck for years. Finding one supposedly causes good things to happen. Are there any four-leaf clovers in the investing world? Maybe.

There is an economic indicator that often bodes well for investors: U.S. money supply is increasing. This could portend a big stock market move. And there are two Vanguard exchange-traded funds (ETFs) to buy that could be especially big winners.

Image source: Getty Images.

Why the recent money supply bounce matters

What exactly is money supply? It’s the total amount of money in circulation. The definition of what is considered money depends on which money supply metric you use. Economists typically prefer using a money supply measure called M2. It includes physical currency, demand deposits, savings deposits, and money market mutual funds.

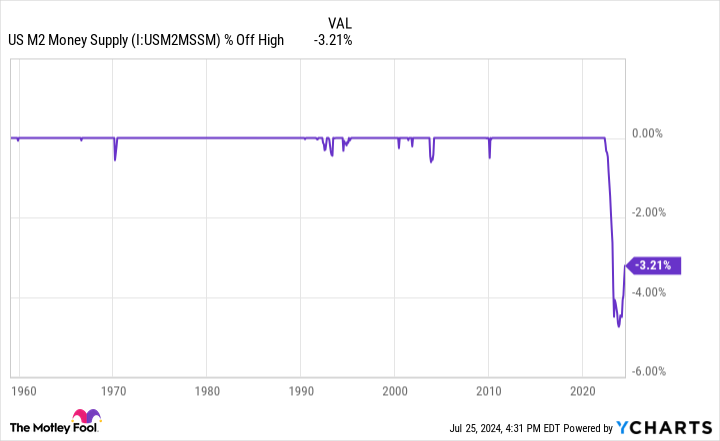

Historically, when M2 declines sharply, it often foreshadows bad news for the economy and the stock market. Nick Gerli with Reventure Consulting researched the history of M2 from 1870 through the present. He found that every time the money supply measure fell by 2% or more, an economic depression followed.

Some investors were understandably concerned when M2 slid more than 2% below its high in early 2023. As the money supply metric continued to fall, worries intensified. But over the past several months, M2 has bounced back.

US M2 Money Supply data by YCharts.

An increasing M2 can signal positive things ahead for investors. The increase is usually connected with an expanding economy, which is good for stocks. The current M2 rebound, therefore, could very well portend a big upward move for the stock market.

Two smart Vanguard ETFs to buy

How can investors best profit from a potential big stock market move foreshadowed by an increasing M2 money supply? When M2 rises, small-cap stocks often deliver greater gains than large-cap stocks. This is true largely because higher M2 often leads to lower interest rates. Smaller companies as a group tend to benefit more from rate cuts because they rely more heavily on borrowing than larger companies do.

This is where two Vanguard ETFs enter the picture. Now could be a great time to buy the Vanguard Small-Cap ETF (VB 1.72%) or the Vanguard Small-Cap Value ETF (VBR 1.64%).

The Vanguard Small-Cap ETF attempts to track the CRSP US Small Cap Index. Its portfolio currently includes 1,403 stocks. This ETF has an annual expense ratio of only 0.05%, much lower than the 0.99% average expense ratio for similar funds.

As its name indicates, the Vanguard Small-Cap Value ETF focuses on stocks with relatively small market caps and attractive valuations. This fund currently owns 848 stocks with an average price-to-earnings ratio of 14.1. Its annual expense ratio is a low 0.07%.

The performance of these two Vanguard ETFs has long lagged behind the S&P 500. However, both funds have surged in recent weeks while the S&P 500 declined. The predictive power of a rising M2 may be beginning to appear.

A win-win scenario

Now for an opposing view. Goldman Sachs economist Manuel Abecasis believes M2 hasn’t been a reliable indicator for the economy in decades. Banks aren’t held back by reserve requirements as in the past. Consumers use credit cards, debit cards, and other digital payment methods much more frequently now and use cash much less. Abecasis argues that these factors make M2 practically useless in predicting what the economy will do.

If he’s right, does that mean the two Vanguard small-cap ETFs aren’t good picks now? Nope. Over the long run, small-cap stocks have outperformed large-cap stocks, and small-cap value stocks have performed best of all. The Vanguard Small-Cap ETF and Vanguard Small-Cap Value ETF give patient investors a good opportunity to beat the market, in my view.

We’re essentially looking at a win-win scenario here. If rising M2 leads to a stronger stock market, these Vanguard ETFs should deliver big gains over the near term. If M2 is a useless indicator, the funds should still perform well over the long term. Forget trying to find a four-leaf clover — buy one of these two Vanguard ETFs.

Keith Speights has positions in Vanguard Small-Cap Value ETF. The Motley Fool has positions in and recommends Goldman Sachs Group and Vanguard Index Funds-Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.