- US spot Bitcoin ETFs faced $1.2B in weekly outflows as Bitcoin fell to a four-month low.

- BlackRock, Fidelity, and Grayscale saw major redemptions amid Bitcoin’s 10% weekly drop.

- Schwab says crypto interest is rising, with clients holding 20% of US crypto ETPs.

The United States’ spot Bitcoin exchange-traded funds (ETFs) faced a challenging week, with over $1.2 billion in total outflows as Bitcoin prices tumbled.

Despite the decline in institutional inflows, Charles Schwab says investor engagement with crypto-related products is rising, reflecting a growing interest among retail and institutional clients in digital assets.

Heavy outflows hit Bitcoin ETFs

Data from SoSoValue shows that the eleven US-listed spot Bitcoin ETFs collectively recorded $366.6 million in outflows on Friday, closing out a negative week for both the products and the broader cryptocurrency market.

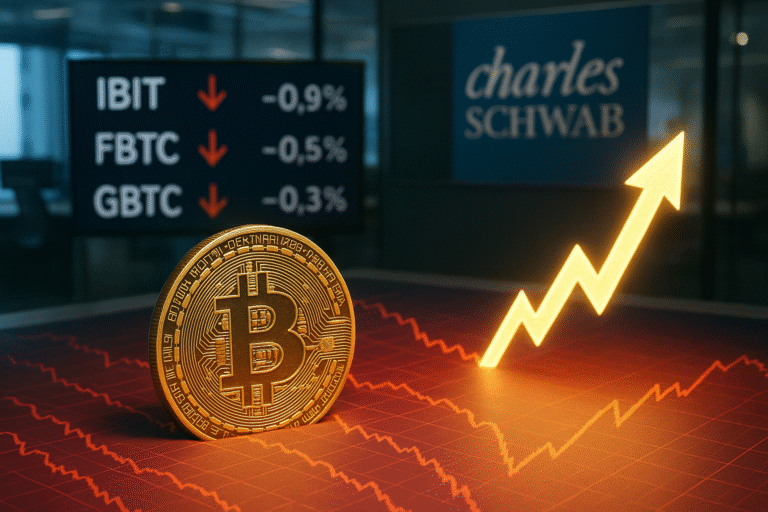

The largest withdrawal came from BlackRock’s iShares Bitcoin Trust (IBIT), which lost $268.6 million in a single day.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) also saw substantial redemptions totaling $67.2 million, while Grayscale’s GBTC experienced $25 million in outflows. A smaller withdrawal was reported from the Valkyrie Bitcoin ETF, while the remaining funds saw no activity on Friday.

In total, spot Bitcoin ETFs in the US witnessed $1.22 billion in outflows over the past week, with only one day—Tuesday—showing minor inflows.

The downturn coincided with sharp declines in Bitcoin’s price, which fell from above $115,000 on Monday to just below $104,000 on Friday, marking a four-month low.

The steep decline highlights how sensitive institutional products remain to Bitcoin’s price movements, with ETF investors appearing to pull back amid growing market uncertainty.

Charles Schwab reports rising engagement in crypto products

While ETF redemptions signal cooling sentiment among some investors, Charles Schwab remains optimistic about the long-term potential of digital asset investment products.

Speaking on CNBC, CEO Rick Wurster revealed that Schwab’s clients now hold 20% of all crypto exchange-traded products (ETPs) in the US.

He added that interest in crypto has grown substantially over the past year, with visits to the company’s crypto-related webpages up 90%.

“Crypto ETPs have been very active,” Wurster said, emphasizing that the topic continues to draw high engagement from investors.

ETF analyst Nate Geraci noted that Schwab’s large brokerage platform positions it well to capture future demand.

The firm already offers crypto ETFs and Bitcoin futures and plans to launch spot crypto trading for clients in 2026, signaling a long-term commitment to the sector even amid short-term volatility.

Bitcoin faces rare October downturn

October, historically one of Bitcoin’s strongest months, has so far delivered disappointing results.

Data from CoinGlass shows that Bitcoin has gained in ten of the past twelve Octobers, but this year, the asset is down 6% month-to-date.

Despite the slump, some market analysts remain hopeful that the trend of “Uptober” could return in the second half of the month.

Many point to the potential for Federal Reserve rate cuts later this year as a catalyst that could reignite demand for risk assets, including Bitcoin.

For now, however, the combination of ETF outflows, price pressure, and macroeconomic uncertainty has weighed heavily on crypto sentiment—leaving investors to watch whether the coming weeks can reverse October’s red start.