The beauty of exchange-traded funds (ETFs) is that they allow you to invest in many companies at once, providing instant diversification in many cases. Instead of picking dozens or hundreds of individual stocks, you can now get a well-rounded portfolio with just a few ETFs.

Four Vanguard ETFs in particular can do the trick for you: the Vanguard S&P 500 ETF (VOO 0.21%), Vanguard Russell 2000 ETF (VTWO 0.67%), Vanguard Mid-Cap ETF (VO -0.16%), and Vanguard Total International Stock ETF (VXUS -0.10%).

Investing in these four ETFs will give you exposure to companies of all sizes, industries, and geographic locations. When you’re looking for a well-rounded portfolio, that’s what you want.

Image source: Getty Images.

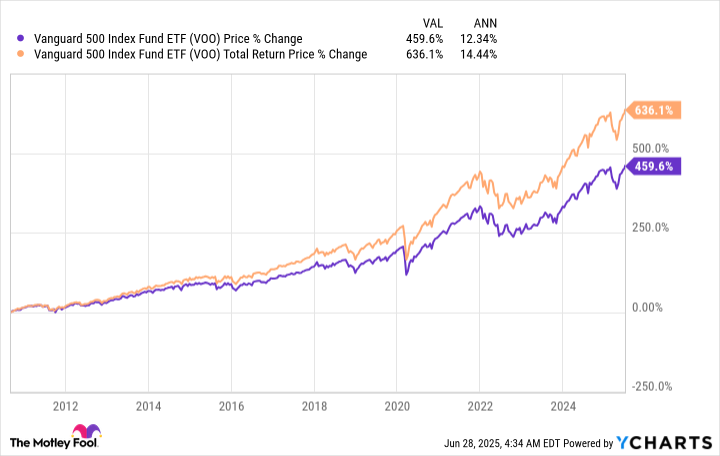

1. The Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO) contains around 500 of the largest American companies on the market. When you invest in VOO, you know you’re getting three things: blue chip companies, a low-cost ETF, and proven results.

Since debuting in September 2010, VOO’s annual returns have been impressive. Every $10,000 invested then would be worth over $73,000 today when accounting for dividends (as of June 27).

By no means does this mean VOO will continue delivering those same returns, but it does show its long-term potential and how lucrative an investment it has been and can be.

Given the size, importance, and influence of the companies in the S&P 500, it’s often considered a reflection of the U.S. economy. They aren’t directly tied, but as the U.S. economy has grown, so has the S&P 500. That’s a relationship that has consistently paid off over time.

I recommend considering making VOO the bulk of your portfolio.

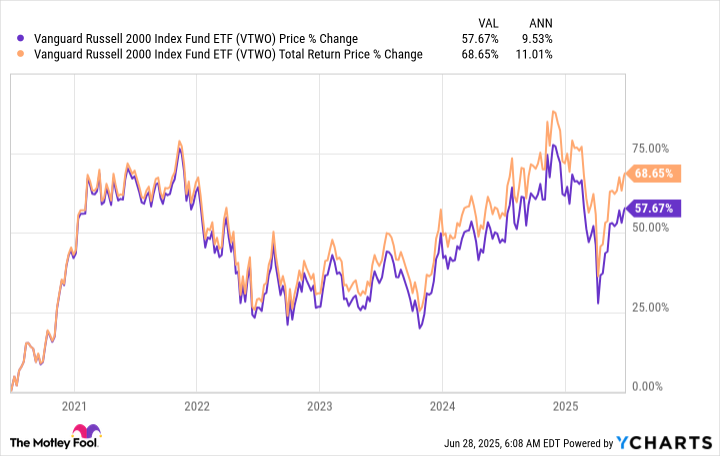

2. Vanguard Russell 2000 ETF

What the S&P 500 is to large companies (those with a market capitalization of over $10 billion), the Russell 2000 index is to “small” companies (those with a market cap between $250 million and $2 billion).

The small size of the companies in the Vanguard Russell 2000 ETF (VTWO) can make them more volatile, but it also gives them greater growth potential in many cases. It’s a high-risk, high-reward trade-off.

VTWO has often outperformed the market during periods of economic expansion, as smaller companies tend to benefit more from increased consumer and business spending. You don’t want to put a lot of your portfolio in small-cap stocks due to their high volatility, but that alone warrants some exposure to take advantage of these potential growth opportunities.

I personally keep around 5% of my portfolio in small-cap stocks.

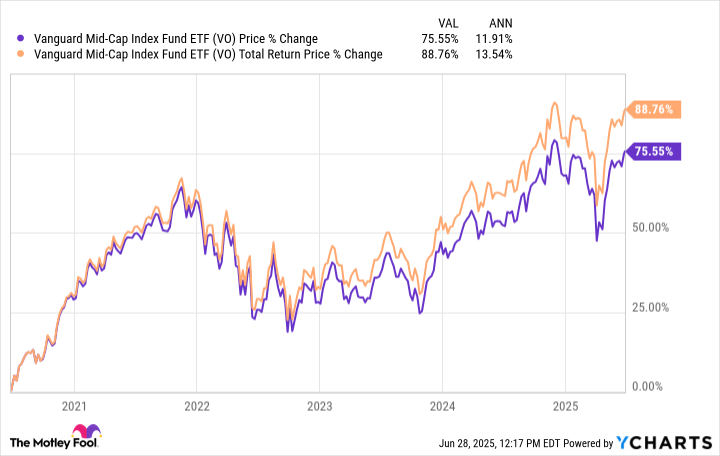

3. Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF (VO) can be a nice middle ground between the S&P 500 and Russell 2000.

With market caps between $2 billion and $10 billion, mid-cap companies generally have proven business models and financial stability yet are small enough to be flexible and innovate quicker than many larger corporations. Some notable names in VO include DoorDash, Robinhood, Roblox, and Kroger.

Mid-cap companies may not have the same resources and reach as large-cap companies, but they also don’t come with as much risk as small-cap companies. It’s a worthwhile trade-off, in my opinion. As with small-cap stocks, I try to keep around 5% of my portfolio in mid-cap stocks.

4. Vanguard Total International Stock ETF

Part of having a well-rounded portfolio is being invested in companies across different regions. The Vanguard Total International Stock ETF (VXUS) accomplishes this aim by containing companies from both developed and emerging markets around the world.

Developed markets include countries such as the United Kingdom, Japan, Australia, and South Korea. Emerging markets include countries such as Mexico, Brazil, India, and South Africa.

Containing over 8,500 companies in total, VXUS is the best of both worlds. On one end, you have the stability that typically comes with established markets. On the other end, you have the high growth potential that typically comes with emerging markets as they begin to expand.

VXUS Dividend Yield data by YCharts.

One of my favorite parts of VXUS is its dividend, with an average yield of close to 3% over the past five years. A 3% dividend yield isn’t mind-blowing, but it’s impressive for an 8,500-plus-stock ETF. Around 10% is a solid amount of a portfolio to be in international stocks in most cases.

Stefon Walters has positions in Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool has positions in and recommends DoorDash, Roblox, Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.