Many investors look at leveraged ETFs as a way to really magnify their returns. In reality, they usually do much more harm than good.

One of the fastest-growing categories in the exchange-traded fund (ETF) marketplace is leverage. What started as a relatively small group of funds focused mostly on major indexes and sectors has grown to several hundred funds. About half have launched just since the beginning of 2025.

In reality, leveraged products can be very dangerous if used improperly. Even when used as intended, these ETFs can expose investors to huge downside risk very quickly. As always in investing, the mantra of “know what you’re investing in” is especially appropriate here.

In most cases, leveraged and inverse ETFs aren’t appropriate for everyday retail investors. They’re not meant for anything outside of very short holding periods. But there are situations in which they can be useful. To provide a balanced picture, let’s run down the pros and cons of investing in leveraged products.

Image source: Getty Images.

Pro: Cheaper than doing it yourself

If you were to attempt the strategies of these leveraged ETFs on your own, you’d need to get approved for a margin account. Trading on margin can be costly and confusing if you don’t know what you’re doing.

By using a leveraged ETF instead, you don’t need any special approval or cash requirements up front. You simply buy and sell as you would with any other ETF. The ease of use is one of the key advantages.

Con: Volatility is the enemy of leverage

Volatility drag can be a real problem for leveraged ETFs. In choppy markets, big price swings often hurt returns, as the cost of daily leverage resets increases. That can actually result in negative returns for the leveraged ETF even if you get the direction correct.

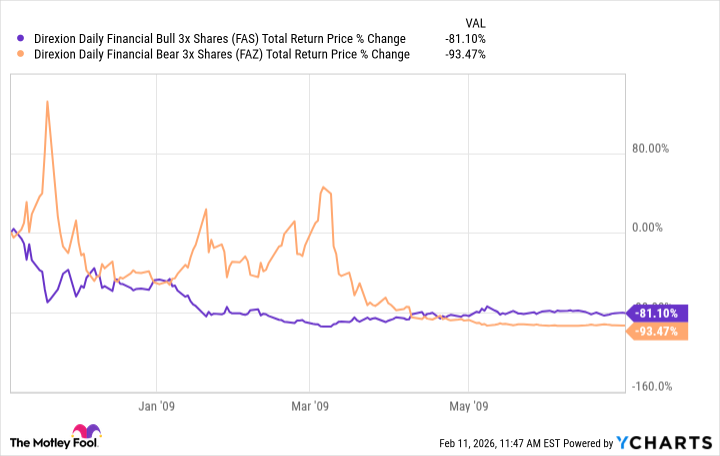

The best example of this happened during the financial crisis. The sector was swinging so violently that the returns for both the Direxion Daily Financial Bull 3x Shares ETF (FAS 0.14%) and the Direxion Daily Financial Bear 3x Shares ETF (FAZ +0.22%) were hugely negative.

FAS Total Return Price data by YCharts

The more volatile the security, the more likely you are to experience losses at some point.

Pro: Doesn’t require sophisticated trading knowledge

Understanding how to layer leverage correctly and execute the trades to accomplish it can be very complex. By owning a leveraged ETF, all of that work is done for you. Traders can simply use the ETF as a tool for expressing the trade without needing to worry about the mechanics.

Con: Decaying returns over time

Leveraged ETFs are designed to magnify a single day’s return for a given security. Holding on to that ETF for more than a single trading day can result in much different returns over time.

If you own a 2x leveraged ETF on a sector that moves exactly sideways, the return on that ETF will almost certainly be negative. That’s because the fund incurs costs to reestablish its leveraged position every day. Those costs will eat away at returns over time. The longer you hold the leveraged ETF, the larger the return decay.

Overall, leveraged ETFs should be considered trading tools, not investments. They are meant to be held only for a single day, not for an indefinite period. That makes them better suited for tactical, short-term use. They’re not appropriate for a long-term buy-and-hold investing strategy.

While they can be tempting as a way to juice returns, the downside risk is significant. Most everyday investors should just resist the temptation and avoid them altogether.