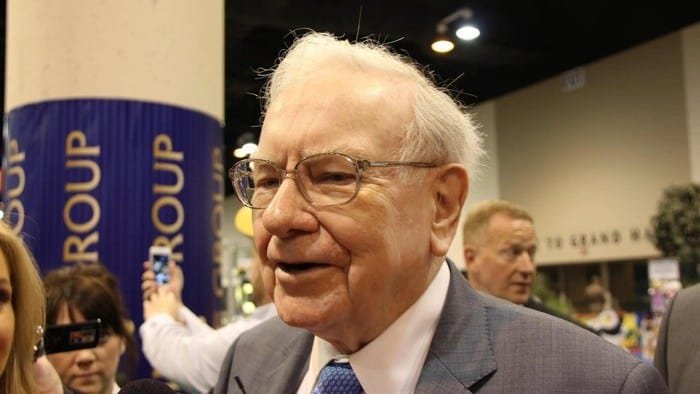

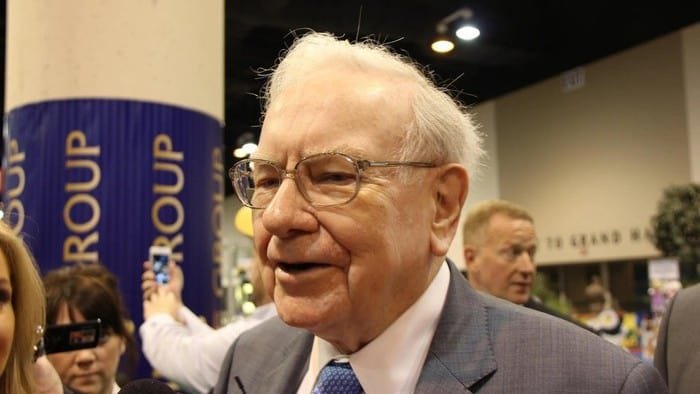

Image source: Getty Images

When Warren Buffett advocates for a particular investment strategy, investors listen.

Despite making his fortune in stock picking, Warren Buffett is a strong supporter of exchange-traded funds (ETFs).

An ETF contains a broad basket of assets. This allows investors to achieve instant diversification in a single trade. It also takes away the stress of having to predict which individual companies will succeed.

ETFs are highly transparent, with holdings readily available and frequently updated. Investors, therefore, know exactly what they own and how those investments are performing.

Buffett has also opposed the high fees typically associated with active management, which can be above 1%. This depletes investor returns over time, making it even harder to beat the market.

Buffett explained this in 2003 when he told Berkshire Hathaway Inc (NYSE: BRK.A) (NYSE: BRK.B) investors:

The people who buy those index funds, on average, will get better results than the people that buy funds that have higher costs attached to them, because it is just a matter of math.

But aren’t ETFs just for beginners?

Not according to Buffett.

In Berkshire Hathaway’s 2013 shareholder letter to investors, he wrote:

The goal of the non-professional should not be to pick winners – neither he nor his ‘helpers’ can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.

In other words, Buffett suggests that, after accounting for fees and errors, most investors cannot consistently beat the market. This applies to professional fund managers, too, with up to 90% of active public equity fund managers underperforming their index, according to S&P Global.

By betting on the long-term success of the market as opposed to selecting individual winners, ETFs offer the perfect solution.

Putting his money where his mouth is

In his will, Buffett has instructed that 90% of the cash he planned to leave his wife be invested in a very low-cost S&P 500 Index (SP: .INX) fund. The remaining 10% is to be invested in short-term government bonds.

While this strategy is unlikely to generate the 20% return Berkshire investors have become accustomed to, the U.S. market has an enviable track record. According to the 2024 Vanguard Index Chart, between 1994 and 2024, U.S. equities delivered a compound annual growth rate (CAGR) of 11.1%.

How ASX investors can adopt this strategy

ASX investors looking to invest like Buffett have several options.

The iShares S&P 500 ETF (ASX: IVV) is an index fund that replicates the S&P 500 Index (as described in Buffett’s will). It has a management fee of 0.04%, which is far below the likely cost of active management. It has an enviable five-year track record, climbing more than 100%.

For those looking to invest in the Australian market, the Betashares Australia 200 ETF (ASX: A200) fund might be a good option. It tracks the largest 200 listed companies in Australia. This ETF also charges a management fee of 0.04%, making it the lowest Australian shares index ETF available on the ASX. While not as successful as the iShares S&P 500 ETF in recent times, Betashares Australia 200 ETF investors have still generated a commendable 60% return over the past five years.

For a slightly higher fee of 0.07%, investors can gain exposure to smaller companies through the Vanguard Australian Shares Index ETF (ASX: VAS). This index fund, which tracks the 300 largest companies in Australia, is up more than 60% over the past five years.

Foolish takeaway

Despite building a reputation as the world’s most successful stock picker, Warren Buffett is a fan of keeping it simple and investing in low-cost ETFs. This can benefit a range of investors, from those starting out to busy professionals. If you want to invest like Buffett, check out one of the low-cost ETFs available on the ASX.