SINGAPORE: It was in 2019 when Mr George Tan, a retiree, first dipped his toes into cryptocurrency. At the time, the crypto market was still reeling from a crash in 2018 – Bitcoin alone had tumbled more than 80 per cent that year after an astronomical rise of nearly 2,000 per cent in 2017.

Regulators in Singapore had repeatedly warned of the high risks and volatility of cryptocurrency trading.

Being cautious, Mr Tan took up various courses on blockchain and crypto mining so that he could better understand how the market worked. Convinced of the technology’s potential, he began investing in a range of cryptocurrencies through a dollar-cost averaging strategy.

Over time, he invested nearly S$23,000 (about US$17,893), building a portfolio largely made up of XRP and bitcoin cash that is currently worth around S$50,000.

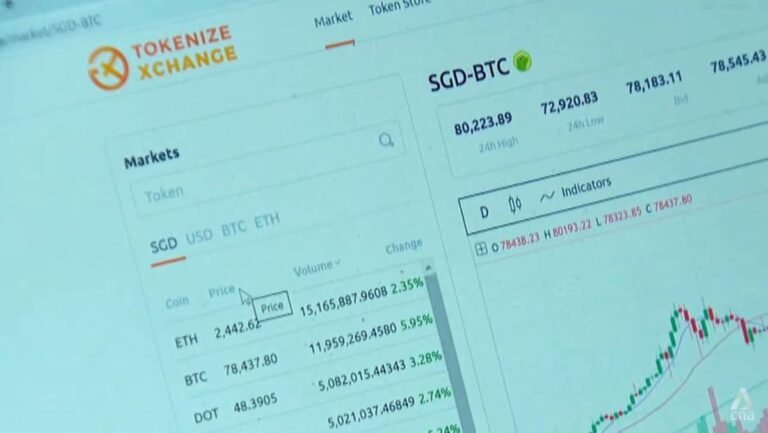

But these impressive paper gains have turned hollow after the Singapore-based trading platform he was using, known as Tokenize Xchange, abruptly ceased operations and has come under police investigation.

Trouble began in mid-July when Tokenize Xchange announced it would cease its Singapore operations after failing to secure a digital payment token licence from the Monetary Authority of Singapore (MAS). The platform had been operating under a temporary exemption.

For Mr Tan, things went south quickly on Aug 1 when the authorities said they were investigating AmazingTech, the operator of Tokenize Xchange, for potential offences including fraudulent trading. MAS noted that it found indications of “false representations” made by the firm over the segregation of customers’ assets.

Hong Qi Yu, a director of AmazingTech and the founder-CEO of Tokenize Xchange, was charged on Jul 31 with fraudulent trading.

“When I saw that news (on Aug 1), my heart sank,” said Mr Tan, who is in his 60s. “This is serious.”

Users told CNA how they were blindsided by recent developments. Tokenize Xchange never had issues with trading or making withdrawals on the crypto exchange, they said.

The company, which was founded in 2017, appeared to be growing, having expanded into regional markets such as Malaysia where it was among the first three digital asset exchange operators to receive full approval from the Securities Commission Malaysia in April 2020.

Last year, it secured an additional US$11.5 million in funding and had plans to expand its team in Singapore to focus on enhancing compliance and operations, according to various media reports.

As recently as Jul 8, roughly one and a half weeks before its shutdown, an email titled “Important regulatory updates from Tokenize Xchange” was sent out to users stating that the platform had secured a licence to operate in Labuan, a federal territory in Malaysia, and was in the “final phase” of obtaining another from the Abu Dhabi Global Market, a financial zone located in Abu Dhabi.

In Singapore as well, it was in “final discussions” with regulators regarding its licensing status, according to the email seen by CNA.

In an earlier statement, MAS said it had rejected Tokenize Xchange’s application for a digital payment token licence on Jul 4. It added that sufficient notice would be given to unsuccessful applicants before a final decision is issued.

It is unclear how many users Tokenize Xchange has. An interview that Hong Qi Yu, a graduate of the Nanyang Technological University, did with online content site Vulcan Post in 2021 cited the chief executive as saying that Tokenize Xchange had “close to 200,000 users globally” then.

But a press release issued by the firm in Mar 2022 said the platform had more than 100,000 customers across Malaysia, Singapore, Thailand and Vietnam.