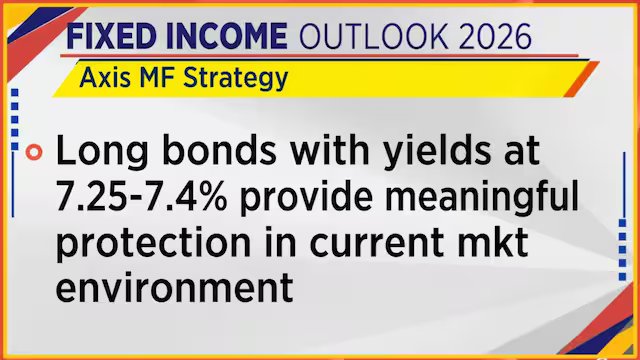

Shah stated that SGS spreads are trading at a premium of 70 to 90 basis points over central government securities. He highlighted a recent five-year SGS auction where bonds were issued at yields of 7.25% to 7.50%, sharply higher than the 6.45%–6.50% available on comparable central government bonds and even above five-year AAA-rated corporate bonds yielding 7.15%–7.20%. Despite the higher yield, Shah emphasised that SGS remain secure instrument, with settlements managed by the Reserve Bank of India (RBI).

To tap this opportunity, Shah advised investors to consider Gilt funds with meaningful exposure to state government securities. “You can start looking at these tactical opportunities, build across some portfolio in Gilt funds which are heavily invested in such state government securities,” he said. He added that funds with portfolio durations in the three-to-seven-year range are better positioned to benefit from higher SGS allocations and widening spreads.

Beyond sovereign-linked opportunities, Shah also identified a second tactical theme in the accrual space for investors willing to take calibrated credit risks. He drew attention to the sharp yield differential between top-rated and slightly lower-rate corporate bonds. “Today, a two-year AAA bond is trading around 7%, but the two-year AA bonds are trading closer to 7.75% to 8%,” he noted. This 75–100 basis point premium, he said, creates a strong case for allocating to accrual-focused funds with higher exposure to AA-rated corporate bonds, particularly within a lower-duration framework that limits volatility while enhancing income.

Also Read: ICICI Lombard sees strong demand in motor, health even as growth costs bite

While these tactical strategies cater to investors with higher risk appetite, stable categories such as money market solutions and income-plus-arbitrage funds continue to remain “pristine categories” for conservative investors focused on capital preservation and tax efficiency.

On that front, Aditya Pagaria, Senior Fund Manager at Axis Mutual Fund, highlighted the growing appeal of Income Plus Arbitrage Funds, especially after changes in tax rules. Pagaria explained that these funds fall under the ‘non-specified category’ introduced in last year’s budget, offering significantly lower taxation compared to traditional debt funds. “The taxation becomes 12.5% if you hold this particular fund for say more than two years,” he said, compared with debt mutual funds that are taxed at an investor’s marginal income tax rate.

Pagaria explained that these products are typically structured as Funds of Funds. “The fund manager has to choose a minimum 35% should be in the arbitrage funds and the rest, 65% odd, has to be in the fixed income schemes,” he said. This allocation allows the funds to qualify for favourable tax treatment while maintaining a predominantly fixed-income profile.

In terms of returns, Pagaria said the yield to maturity of these funds is currently around 7%, broadly like bank fixed deposits. The advantage, however, becomes clear after tax. “If you hold it for two years, then taxation becomes 12.5%. So broadly, you have a benefit of… you’re getting it post-tax close to 6 to 6.25% for that two-year period,” he explained. That post-tax outcome, he said, compares favourably with fixed deposits, particularly for investors in higher tax brackets.

Also Read: Trade deal hopes can boost mood, but earnings matter more: BofA’s Arbind Maheswari

Pagaria concluded that Income Plus Arbitrage Funds make more sense than traditional deposits or pure fixed-income schemes for investors with a minimum two-year horizon, combining stability, tax efficiency and predictable returns in the current market environment.

For the entire discussion, watch the accompanying video

Catch the latest BMC election voting updates here

Also, catch the latest Budget 2026 expectations updates here