Trustnet highlights the IA UK Smaller Companies funds bucking the downturn.

The FTSE 100 has been on a strong run over the past year, with some of the UK’s largest companies, including Natwest, Lloyds and Ashtead Group, propelling the index to new heights. The same can’t be said for smaller UK businesses, however.

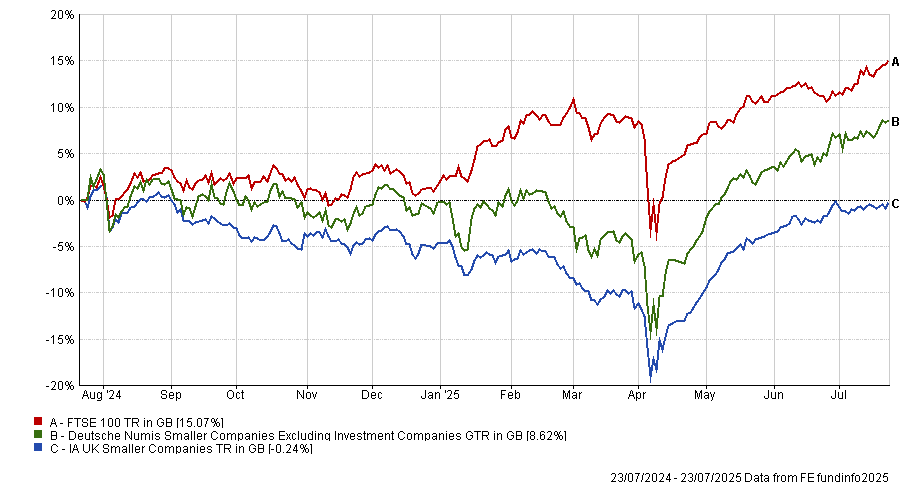

Funds focused on the smaller end of the market have fallen flat over the past 12 months, as the chart below shows.

Performance of index and sectors over 1yr

Source: FE Analytics

Although the average UK small-cap fund has made a loss over the past year, tough markets aren’t just about containing the downside, with some funds thriving in this environment.

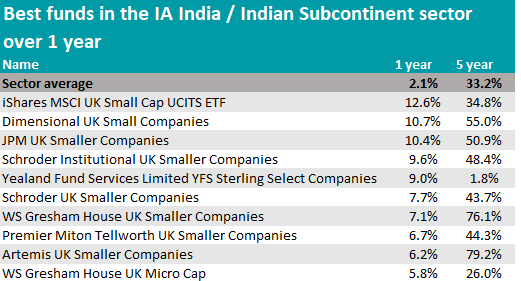

Below, Trustnet highlights the IA UK Smaller Companies funds that have managed to leave their peers behind and posted good returns in the past 12 months, despite the adversities.

Only three strategies have achieved a double-digit return in the period analysed: iShares MSCI UK Small Cap UCITS ETF (12.6%), Dimensional UK Small Companies (10.7%) and JPM UK Smaller Companies (10.4%).

Source: FE Analytics

The iShares exchange-traded fund (ETF) is designed to replicate the performance of the MSCI United Kingdom Small Cap index. The benchmark is key here, however, as the top end of the portfolio is made up of larger names such as financial advice firm St James’s Place, engineering firm Weir Group and distribution firm Diploma. All three are FTSE 100 names.

Among active managers, the closest to the top were one percentage point behind this tracker. In second place was £246.6m Dimensional UK Small Companies portfolio, which is made up of small positions (the largest is 1.7% in Direct Line Insurance Group) in as many as 320 stocks.

Meanwhile, the JPM strategy is co-managed by Georgina Brittain and Katen Patel, whose bottom-up stock selection has generated a 5.1% three-year alpha for the portfolio.

Chris Metcalfe, chief investment officer at iBoss, noted this fund when it outperformed during the most difficult time for UK smaller companies funds – Liz Truss’s failed mini-Budget in 2022.

“If we were to invest in the UK smaller companies sector again, it would potentially be through a fund such as this, where the managers have been in place for several years,” he told Trustnet last February.

The fund was also highlighted as one of the most consistent regional small-cap funds of the decade at the beginning of the year.

The managers’ largest overweights to the fund’s benchmark (the Numis Smaller Companies plus AIM) are banks (4.7%), construction companies (4.4%) and financials (4.1%).

Further down the list, Schroder UK Smaller Companies and its institutional version stood out, both managed by Andrew Brough.

These strategies performed in the high single digits, all the while maintaining relatively low volatility, as previously covered on Trustnet.

However, they haven’t always been as consistent and featured in Bestinvest’s Spot the Dog report in March last year. It was one of the only two IA UK Smaller Companies funds to end up in the study, which highlights consistent underperformers based on three-year data.

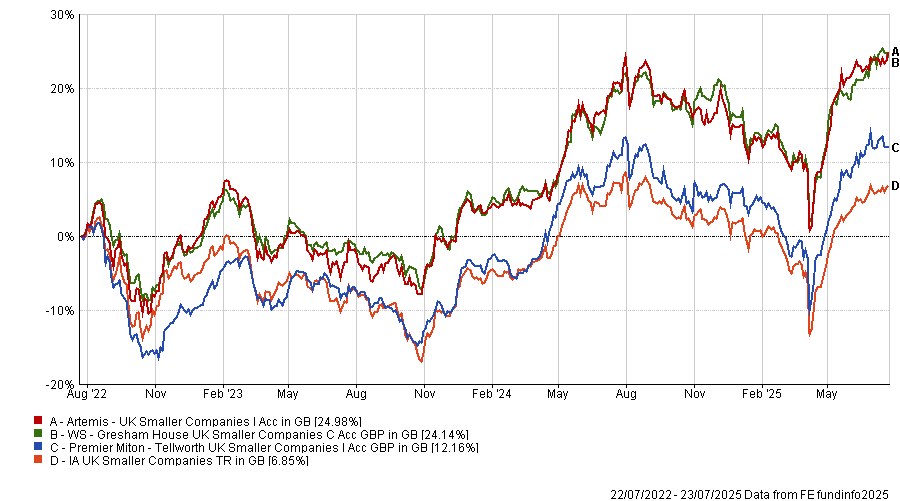

WS Gresham House UK Smaller Companies, Premier Miton Tellworth UK Smaller Companies and Artemis UK Smaller Companies also stood out.

Performance of fund against index and sector over 3yrs

Source: FE Analytics

These are popular names that have been recommended by experts multiple times on Trustnet. The Gresham House (£303m of assets under management, run by Ken Wotton) and Artemis strategies (£577m, co-run by Mark Niznik and William Tamworth) both have an FE fundinfo Crown Rating of five.

RMSR analysts praised the latter for its record of “steady and significant” outperformance, “deep understanding of individual companies” and “willingness to patiently build long-term positions”.

The team follows an anti-momentum approach and is comfortable buying stocks during downturns, “especially when valuations are attractive and risks are favourably skewed”.

Finally, the Tellworth strategy, co-run by FE fundinfo Alpha Managers John Warren and Paul Marriage, has a number of elements that set it apart from its peers, according to analysts at Square Mile.

They highlighted the managers’ commitment to a style-agnostic approach that remains true to the UK smaller companies universe.

While some rivals drift up the market-cap scale, this team continues to back often-overlooked businesses “where others may fear to tread”.

Most importantly, they said, it is managed by a “pragmatic and knowledgeable” team with a proven ability to navigate different market cycles.

This article is part of an ongoing series analysing the best funds in the worst-performing sectors. Previously, we covered China and India.