In 2025, mid cap mutual funds are gaining increasing attention from long-term investors—not because they offer higher returns, but because they provide access to an exciting part of the market that is frequently overlooked.

These are businesses that have the potential to grow and become tomorrow’s market leaders, driven by India’s growing economy.

Mid-caps are in the middle of the risk-return continuum—more growth-oriented than largecaps but less volatile than smallcaps.

For long-term holding periods, this space has traditionally provided an appealing trade-off between growth and diversification.

While these stocks can be volatile, their capacity to create long-term wealth makes them an integral component of a diversified equity portfolio.

In 2025, mid cap mutual funds are gaining increasing attention from long-term investors—not because they offer higher returns, but because they provide access to an exciting part of the market that is frequently overlooked.

These are businesses that have the potential to grow and become tomorrow’s market leaders, driven by India’s growing economy.

Mid-caps are in the middle of the risk-return continuum—more growth-oriented than largecaps but less volatile than smallcaps.

For long-term holding periods, this space has traditionally provided an appealing trade-off between growth and diversification.

While these stocks can be volatile, their capacity to create long-term wealth makes them an integral component of a diversified equity portfolio.

Past performance is not an indicator of future returns.

This list is not exhaustive.

The securities quoted are for illustration only and are not recommendatory.

(Source: ACE MF)

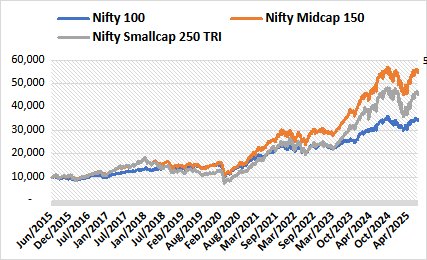

The divergence between midcaps and other categories has expanded in recent years, with the Nifty Midcap 150 TRI consistently outperforming largecap and smallcap indices, particularly since 2020.

As of July 2025, it’s up more than 21% this year, supported by robust earnings growth, increasing domestic manufacturing, and the formalisation of the economy.

Midcaps are transforming into a structural story of growth, rather than a cyclical theme.

In this editorial, we introduce a carefully curated list of five high-conviction mid cap mutual funds that have the potential to give good returns in the long term.

Read on…

Past performance is not an indicator of future returns.

This list is not exhaustive.

The securities quoted are for illustration only and are not recommendatory.

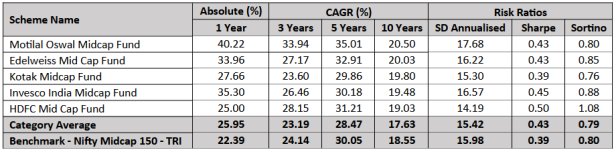

Rolling Returns in %. Direct Plan – Growth option considered

(Source: ACE MF)

#1 Motilal Oswal Midcap Fund

Motilal Oswal Midcap Fund has shown a knack for identifying scalable businesses early and staying with them across market cycles—making it a top performer among midcap mutual funds.

It has a stellar 10-year rolling CAGR of 20.50%, which is among the highest in midcap space. This performance is due to the fund managers’ keen stock-picking ability and the ability to stay on top of secular growth trends in industries such as IT services, consumption, and new-age manufacturing.

The assets under management (AUM) of the fund is Rs 330.53 bn as of July 2025. It has a fairly concentrated portfolio with buy-and-hold approach so that compounding works to its advantage over the long run.

Its major holdings are Coforge (10.48%), Persistent Systems (9.59%), and Trent (9.39%), all three being leaders in their respective midcap spaces.

Sectorally, the fund has a strong bias towards information technology (24.63%), electricals (12.01%), and retail (9.39%), putting it in line to gain from both digitalisation and increased domestic consumption.

The strategy of the fund is a deep conviction in select midcaps. It concentrates on companies with clear earnings visibility, good quality management, and sustainable competitive adavntages.

#2 Edelweiss Mid Cap Fund

Edelweiss Mid Cap Fund has consistently established itself by practicing disciplined stock picking with a high emphasis on earnings visibility. It follows a bottom-up investment approach.

One of its main strengths is the fact that it has consistently generated alpha over the benchmark while maintaining portfolio risk under control. As of July 2025, the fund has a 10-year CAGR of around 20.03%, reflecting its good performance through various phases of the market.

The fund has an AUM of Rs 109.88 billion and a reasonably well-diversified portfolio of roughly 55 to 65 stocks.

The top investments are Persistent Systems (3.64%), Max Healthcare Institute (3.46%), and Coforge (3.34%).

The fund is skewed towards three sectors that are essential to India’s medium-term growth story: healthcare (10.21%), IT (11.1%), and financial services (14.96%).

What sets Edelweiss Mid Cap Fund apart is the combination of growth and comfort on valuation. The fund also shows flexibility in riding across cyclical and structural themes according to macro tailwinds and bottom-up triggers.

#3 Kotak Mid Cap Fund

Kotak Mid Cap Fund has developed a track record of picking well-performing mid-sized companies that have the potential for structural growth.

As of July 2025, the fund has delivered an impressive 10-year CAGR of 19.8%, underscoring its consistent long-term performance and ability to generate steady alpha over its benchmark, the Nifty Midcap 150 TRI.

With an AUM of Rs 571.01 bn, it is one of the largest midcap schemes in the industry.

Its key holdings are Fortis Healthcare (3.44%), Mphasis (3.3%), and Solar Industries India (3%). Sector-wise, the scheme has a high exposure to IT (12.19%), chemicals (10.97%), and healthcare (10.95%).

Kotak’s fund management adopts a bottom-up approach to stock selection with an evident accent on selecting scalable mid-sized companies early in the growth path.

The fund shuns speculative pockets and exercises valuation discipline. In the process it has done well even in turbulent times.

#4 Invesco India Mid Cap Fund

Invesco India Mid Cap Fund has reflected a keen ability in detecting companies with sustainable business models, strengthening financials, and robust corporate governance. It’s a consistent outperformer in its space.

Through July 2025, the fund has produced a 10-year CAGR of about 19.48%, which is higher than the market return. The fund has a capacity to maintain its lead by virtue of good stock picking. Invesco’s strategy is different in that it focuses on quality growth instead of pursuing short-term momentum.

Having an AUM of Rs 74.05 bn, the fund operates a portfolio of 40–50 stocks, reflecting a focused philosophy under which every stock has significant share.

Major holdings are BSE (5.7%), L&T Finance (4.7%), and Prestige Estates Projects (4.5%), reflecting good diversification across financials, engineering, and consumer-facing businesses.

Sector exposure is a little skewed toward financial services (20.18%), healthcare (18.98%), and retailing (11.80%).

The fund takes a bottom-up stance, with a focus on balance sheet quality, return on capital employed (ROCE), and leadership position. It has also performed relatively well in market downturns compared to its rivals.

#5 HDFC Mid Cap Fund

HDFC Mid Cap Fund which is renowned for its cautious stock-selecting, emphasis on quality management, and long-term investment mindset being a popular pick for investors in search of stability in the mid cap segment.

As of July 2025, the fund has given a 10-year CAGR of 19.03%, reflecting its capability to take part significantly in bull periods while remaining fairly stable during bear markets.

The fund holds a huge AUM of Rs 840.61 bn, and with its typical well-diversified portfolio, it stays away from speculative bets and rather focuses on capital-efficient, cash-generating businesses.

Its prominent holdings are Max Financial Services (5.02%), Coforge (3.4%), and Federal Bank (2.8%).

The highest sectoral exposure is towards automobile & ancillaries (14.8%), banking (13.49%), and healthcare (10.43%).

The investment strategy of the fund eschews momentum and constructs positions in businesses with good performance history, unencumbered balance sheets, and durable earnings visibility.

Final Thoughts: Investing for the Next Decade

With India embarking on a new decade of economic growth due to rising manufacturing capacity, burgeoning domestic consumption, and an emerging digital ecosystem, midcap businesses are set to play a major role in creating the next decade of wealth.

But with that power comes the need for more diligence in choosing funds. Midcap mutual funds could be powerful tools, but only when used with a plan that considers volatility, valuation risks, and long-term viability.

Instead of following recent winners or responding to market momentum, it would be wise to take a thoughtful, diversified approach—selecting funds that offer quality, conviction, and consistency.

Remain invested over market cycles, have realistic expectations, and wait long enough for compounding to create wealth.

The next 10 years in the midcap universe offers substantial wealth creation potential for investors who are willing to hold on and stay disciplined.

Invest wisely.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.