While mutual funds are purely investment products, ULIPs are a hybrid product that offers the dual benefit of investment and life insurance.

Both ULIPs (Unit Linked Insurance Plans) and Mutual Funds are popular investment avenues, but their core purpose and structure are quite different. Historically, ULIPs were often seen as a less attractive investment option compared to other market-linked instruments, such as mutual funds, because of their high cost structure. However, regulatory reforms by IRDAI, coupled with digital-first, online products, have transformed them into cost-efficient and transparent products.

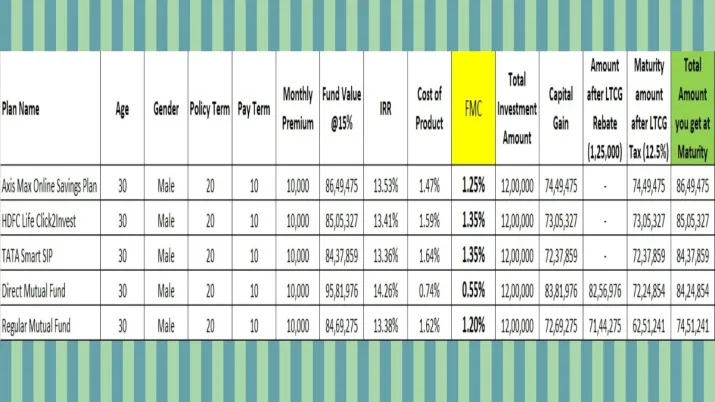

ULIPs vs Mutual Funds

While mutual funds are purely investment products, ULIPs are a hybrid product that offers the dual benefit of investment and life insurance. While a mutual fund’s payout is its current market value, a ULIP’s death benefit is higher because of the sum assured (a guaranteed minimum amount) or the fund’s value. This ensures your family receives a financial safety net, even if the market performs poorly. Moreover, investors can opt for Waiver of Premium options, which ensure that the family’s goals continue to be built upon even after the policyholder’s unfortunate demise. In this option, the insurer continues to fund all future premiums into the policy in case of an unfortunate event, and comes with multiple variations that the customer can select, such as a regular income to support the child’s school education, etc.

ULIP Offers Tax Advantage Beyond Section 80C

- Tax-Free Maturity and Death Benefits (Section 10(10D)): The entire returns and maturity proceeds from your ULIP are tax-exempt under this section. The maturity proceeds are tax-free if the annual premium is Rs 2.5 lakh or less, effectively enabling ZERO LTCG tax. Through market-linked growth and the power of compounding, a Systematic Investment Plan (SIP) in ULIPs can help investors accumulate a corpus worth crores over the long term, all of which can be tax-free upon maturity. The death benefit paid to the nominee is also fully tax-exempt, regardless of the premium amount.

- Tax Deduction on Premiums (Section 80C): Investors can claim a deduction on the premiums paid for a ULIP, up to a maximum of Rs 1.5 lakh every financial year. This deduction helps reduce an investor’s taxable income. This is a widely known Section and is available only under the old tax regime. The unique proposition that ULIPs offer is actually on maturity, as detailed below.

- GST Benefit: The recent GST 2.0 reform of September 2025 has eliminated GST on life insurance products. Thus, new age ULIPs emerge as highly efficient tax-saving instruments. They help one achieve their long-term corpus creation goals, whether it is retirement, child education, home purchase or any other big life goal. They are hence, now the only widely available market-linked instrument that can be opted for with ZERO Tax outlay (Direct & Indirect both).

According to Pavit Laul, Head of Investments at Policybazaar.com, online ULIPs have emerged as a superior choice for investors because they combine the best of both worlds — insurance protection and wealth creation.

“These new-age ULIPs deliver tax benefits under Section 80C and tax-free maturity proceeds under Section 10(10D) for annual premiums up to Rs 2.5 lakh, at highly competitive costs, given the online nature of distribution. Additionally, the recent scrapping of GST on Insurance products makes ULIPs significantly more cost-effective. The inclusion of the waiver of premium benefit and the flexibility of tax-free fund switching further enhance their appeal, providing a comprehensive and efficient solution for long-term financial planning. ULIPs help families build long-term wealth to achieve their goals and also secure them against life’s uncertainties,” Laul added.

How much will you save in 20 years with a monthly saving of Rs 10k

An investor considering two different investment options, a direct mutual fund and a ULIP, could expect the following outcomes based on the provided hypothetical scenarios, with a total investment of 12 lakh.

Investor A (30 years, male) has invested INR 10,000 monthly with pay term for 10 years & policy term for 20 years in Direct Mutual Fund, assuming fund value at around 15 per cent and the FMC (fund management cost) of 0.55 per cent, the pay out after 20 years could be Rs 84,24,854 after the application of LTCG tax of 10 lakh.

In contrast, if Investor B (30 years, male) has invested the same amount of INR 10,000 monthly with pay term for 10 years and policy term for 20 years in Axis Max Online Savings Plan assuming fund value at 15 per cent and the FMC (fund management cost) of 1.25 per cent, the pay out after 20 years would be Rs 86,49, 475. The LTCG on this payout would be zero, as ULIPs offer tax-free maturity proceeds.

ALSO READ | Firecracker insurance at just Rs 11: Here’s how to buy it under a minute – Step-by-step guide