After “record-breaking layoffs, closures and business turmoil” in the first half of 2024, the video game business is showing signs of recovery, according to a new report from DDM Games.

DDM, short for Digital Development Management, is an agency providing representation, consulting and investment services, conducts regular studies of the sector.

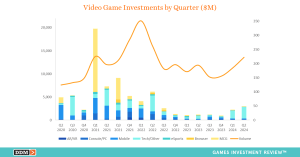

Each of the first two quarters of the year has surpassed $2.3 billion in investments, a stark contrast with 2023, when no single quarter topped $1.3 billion. The first-half tally of $8.1 billion across 488 investment transactions brings the total to a two-year high and has already exceeded the full-year total in 2023 of $4.5 billion. (See chart below.) The first half was aided by investments like Disney‘s $1.5 billion investment in Fortnite maker Epic Games and GameStop’s $2.1 billion sale of shares after a meme-stock runup, DDM noted.

Despite the upswing, the report expresses concern about the low level of M&A activity. The first-half total of $2.9 billion across 82 transactions declined 61% in value and 5% in volume over the same period in 2023. (The drop-off occurred even when Microsoft’s $68.7B acquisition of Activision Blizzard was not counted.)

IPOs also suffered, as no company had a public debut in the second quarter. That marked the first quarter since 2019 when no gaming company went public.

While trends are not especially encouraging in M&A and IPOs, Mitchell Reavis, Manager of the DDM Games Investment Review, sees reason for optimism about the rest of 2024 and 2025.

“When you look at our dataset, which covers 16 years of games investments, M&As, and IPOs, I can’t help but be excited for the near future,” he said. “The last year has been a really shaky time for the games industry, and with the resurgence in games investments, it appears the shakeout is coming to an end.”

Reavis added, “The unfavorable conditions have allowed companies to be more strategic by not disclosing the purchase price of a company. As studio financials become more stable, we expect more values to be disclosed boosting the major exits that are currently in the works like EQT Group’s £2.2B ($2.8 billion) acquisition of Keywords Studios and Animoca Brands’ potential IPO in 2025.”

Here is a multi-year chart of video game investments: