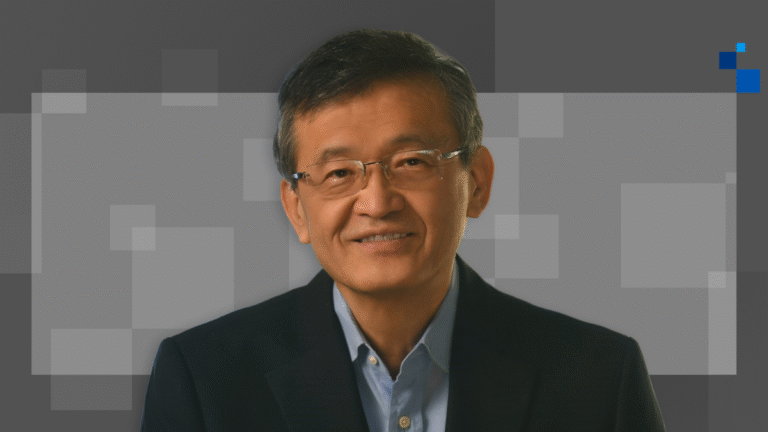

U.S. President Donald Trump has called for the immediate resignation of Intel CEO Lip-Bu Tan, just months after he took the top job at the chipmaker, following concerns over his ties to Chinese firms through several investments.

Tan has made hundreds of investments in Chinese companies over decades through Walden International, the San Francisco venture capital firm he founded in 1987, and two Hong Kong-based holding companies, Sakarya Limited and Seine Limited.

Here are some key investments uncovered by Reuters and their connections to Chinese state entities

Through Walden, Tan became a seed investor in Semiconductor Manufacturing International Corp, China’s largest chip foundry, in 2001, the year after it was founded, and served on the board until 2018. In 2020, SMIC was placed under sanction by the U.S. government for its close ties to the Chinese military, and Tan exited his SMIC investment in 2021, according to the U.S. House Select Committee on the Chinese Communist Party. SMIC did not respond to a Reuters request for comment.

The firm remains invested in 20 funds and companies alongside Chinese government funds or state-owned enterprises, according to Chinese corporate databases, including tech hubs like Hangzhou, Hefei, and Wuxi. Walden has also invested in six Chinese tech firms alongside leading PLA supplier China Electronics Corporation, which was sanctioned by President Trump in 2020 as part of an executive order that banned purchasing or investing in “Chinese military companies.” CEC did not respond to a Reuters request for comment.

Those joint investments, detailed in Chinese government databases, include Shanghai-based QST Group, whose sensors have been found in Russian military drones captured by Ukraine, according to a Ukrainian government database. QST Group did not respond to a Reuters request for comment. Another joint investment with CEC is a 2% stake in Intellifusion, a surveillance company that was placed on a U.S. Department of Commerce trade blacklist in 2020 for alleged involvement in human rights abuses in the Xinjiang region.

Two Walden funds currently own over 5% of Wuxi Xinxiang Information Technology Company Limited, a supplier of remote control equipment to leading Chinese memory chipmaker Yangtze Memory Technologies Co., Ltd, according to procurement data found in Chinese corporate databases. The Commerce Department added YMTC to a trade blacklist in 2022, and the Pentagon added it to a list of “Chinese military companies operating in the United States” on January 31, 2024. Intellifusion, Wuxi Xinxiang and YMTC also didn’t respond to comment requests.

Tan is listed as the sole owner of Sakarya Limited, a Hong Kong-based holding company that invests in China, according to an earnings report from a Sakarya-backed chipmaker published on October 31. Sakarya controls 38 Chinese firms, including Huaxin Yuanchuang (Qingdao) Investment Management Co., Ltd., which is Walden’s main investment entity in mainland China that ties Tan to over 500 Chinese companies, according to Chinese corporate databases.

Sakarya and Huaxin Yuanchuang did not respond to a request for comment and Walden declined to comment.

SEINE LIMITED

Tan holds stakes in 68 Chinese firms through Seine Limited, another Hong Kong-based entity controlled by Walden Technology Ventures III LP, according to Chinese corporate databases.

Seine holds a 3.1% stake in Guangdong-based component maker Dapu Technologies, which the U.S. House Select Committee on the Chinese Communist Party identified as a PLA contractor, and an 8.3% stake in HAI Robotics, a firm the committee said has bid for a PLA contract and works with Chinese surveillance companies, according to filings. Seine Limited and Dapu did not respond to requests for comment.

Hai Robotics confirmed Seine’s stake in the company and said it has never bid for any military contracts. “All technology R&D and commercialisation is centred on logistics technology innovation, focusing on civilian warehousing scenarios, and in strict compliance with the control laws and regulations of China, the U.S., and Europe,” the company said in a statement.