As the games industry moves on from “survive til 25,” 2024 games investment and M&A data revealed recovery and improvement, according to market analyst firm Digital Development Management (DDM).

In order to properly compare 2024 to 2023, it’s important to remember that in Q4 2023 Microsoft acquired Activision Blizzard for $68.7 billion, the largest gaming M&A in history by over 5.4 times its nearest counterpart of Take-Two Interactive’s $12.7 billion acquisition of Zynga.

Removing Microsoft’s acquisition as an outlier, 2024 was a stronger year totaling $17.5 billion across 985 in combined investments and M&As (+39% in value and +16% in volume compared to 2023’s $12.6 billion across 848 investments and M&As). This is particularly evident by dissecting 2024 in totality.

DDM is the latest party to report on deals for games in 2024. Other data has already come in from Konvoy Ventures, Drake Star Partners, and Quantum Tech Partners. One thing unique about DDM is that it has a 2025 forecast.

“While the games industry has made it through ‘survive til’ 25,’ DDM’s outlook remains cautiously optimistic. However, the belt-tightening is certainly not over as DDM expects the games industry to suffer more layoffs, pivots from in-house game development to external, and divestitures of non-core business offerings,” said Mitchell Reavis, manager of the DDM Games Investment Review, in a statement.

The game industry’s 2024 investments totaled $7.7 billion across 812 investments (+68% in value and +18% in volume over 2023’s $4.6 billion over 691 investments) which show volume is bouncing back towards 2022’s record highs of 1001 investments.

And 2024 M&A deals totaled $9.9 billion across 173 transactions, which is +22% in value and +10% in volume compared to 2023’s $8.1 billion across 157 transactions (excluding Microsoft acquisition of Activision Blizzard $68.7 billion as an outlier).

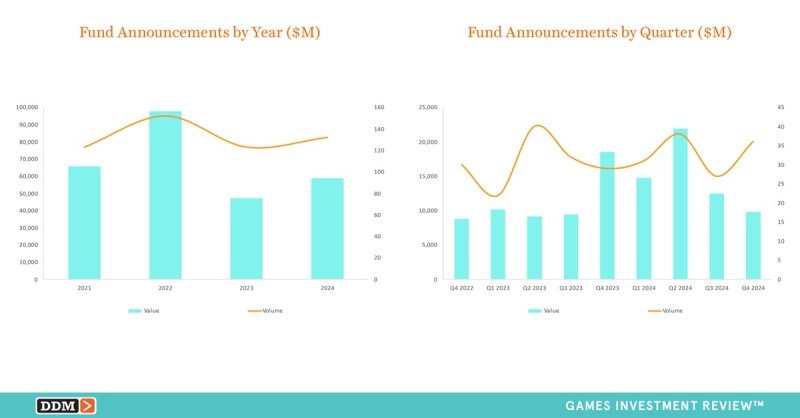

And 2024 new fund announcements totaled $58.9 billion in new capital raised across 132 funds (+25% in value and +7% in volume compared to 2023 totaling $47.2 billion across 123 funds)

Although Q4’s $6.0 billion across 236 investments and M&As was the largest quarter in 2024, Q4’s high M&A values disguised a regression in investment values:

DDM said Q4 2024 investments saw a sizable decline in value — $906.2 million across 201 investments (−35% in value and +4% in volume compared to Q3’s $1.4 billion and 193 investments) marks the lowest value since Q3 2018 ($650.6 million). Volume remained strong as Q4 was +7% above the 2-year quarterly average of 187 investments. Investment values were dampened from early-stage investments representing the majority (66%)

·Meanwhile, Q4 2024 M&As saw a large increase in value — $5.0 billion across 35 transactions (+572% in value and -30% in volume compared to Q3’s $751.1 million across 50 transactions) enabling Q4 to surpass the combined value of Q1-Q3 M&As of $4.8 billion; this was achieved through EQT Groups and others’ $2.7 billion acquisition of Keywords Studios and Playtika’s $2.0 billion acquisition of Superplay (collectively 94% of the total M&A value).

While games investments slowed as the year progressed, 2025 is looking to build on a more stable ground.

While investors are being more cautious, top gaming giants and publishers including Hasbro, Krafton, My.Games, Nazara Technologies, and Say Games have all announced cash reserves to invest in games, DDM said.

In the second half of 2024, M&As totaled $5.8 billion across 85 transactions (+43% in value and -3% in volume compared to H1 2024’s $4.1 billion across 88 transactions). 2025 has already hit the ground running with Miniclip’s $1.2 billion acquisition of Easy Brain, MTG’s $820.0 million acquisition of Plarium, and Scopely eyeing a megadeal this year.

In 2024, private equity firms snapped up a few large gaming studios including Keywords Studios, Jagex, and Kahoot. And if interest rates decrease, private equity firms will continue to have interest in large gaming M&A deals, DDM said.

“DDM forecasts that studio and game financing will slowly grow in 2025 as many companies end their fiscal year in March and loosen their purse strings for 2026/2027 games and strategic investments,” said Reavis. “In addition, DDM predicts to see a slight increase in activity throughout 2025 with a rise in artificial intelligence and blockchain.”

Investments

Q4 2024 investments totaled $906.2 million across 201 investments (-35% in value and +4% in volume compared to Q3’s $1.4 billion and 193 investments) recording the lowest value since Q3 2018 of $650.6 million; while investment values were dampened from early-stage investments representing the majority (66%), volume remained strong as Q4 was +7% above the two-year quarterly average of 187 investments.

Q4 2024 game developer investments totaled $679.5 million across 134 investments (−39% in value and -4% in volume compared to Q3’s $1.1B across 140 investments).

Q4 2024 game industry blockchain investments totaled $179.6 million across 54 investments (−70% in value and -17% in volume compared to Q3’s $607.7 million and 65 investments) while game industry artificial intelligence investments totaled $120.7 million across 26 investments (−39% in value and +30% in volume compared to Q3’s $197.2 million across 20 investments).

Highest segment by value led by mobile (43%), followed by console/PC (26%), MCG* (14%), tech/other (10%), AR/VR (3%), esports (3%), and browser (2%).

Using historical averages to estimate the undisclosed investment values, Q4 2024 reached $1.3 billion [+/- $120.0 million].

M&A deals

Q4 2024 M&As totaled $5.0 billion across 35 transactions (+566% in value and -30% in volume compared to Q3’s $751.1 million across 50 transactions), surpassing the combined total M&A value of $4.8 billion from Q1-Q3; Q4’s M&As were propped by EQT Groups and others’ $2.7 billion acquisition of Keywords Studios and Playtika’s $2.0 billion acquisition of Superplay (94% of the total M&A value).

Q4 2024 game developer M&As totaled $2.0 billion across 27 transactions (+41% in value and -47% in volume compared to Q3’s $1.4 billion across 32 transactions).

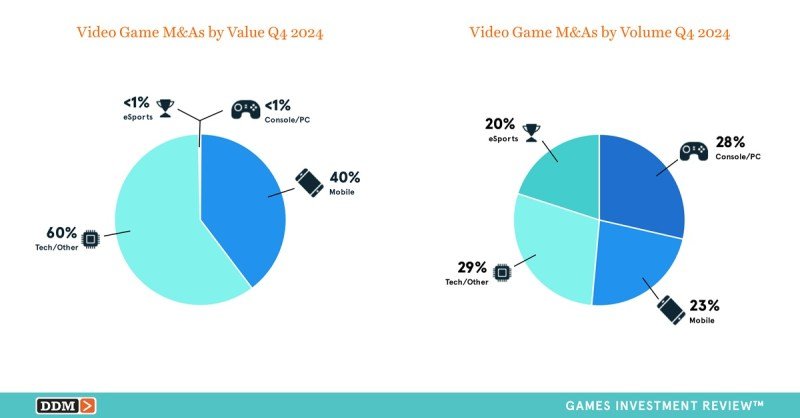

Highest M&A segment by value was led by tech/other (60%), followed by mobile (40%), esports (<1%), and console/PC (<1%).

Europe and Asia were the most active regions by M&A value and volume with Europe totaling $2.7 billion across 13 transactions (57% of the value and 37% of the volume) and Asia totaling $2.0 billion across 4 transactions (40% of the value and 11% of the volume).

Exits (M&A and IPOs)

Q4 2024 Exits (M&As + IPO) totaled $5.1 billion across 38 transactions (+33% in value and -30% in volume compared to Q3 2024’s $3.8 billion in value and 54 in volume); despite Q4 recording lowest exit volume since Q2 2023’s 36 exits, Q4 achieved the highest exit value in 2024.

Q4 2024 IPOs totaled $15.9 million in total combined market capitalizations across three IPOs (−99% in value and -25% in volume compared to Q3’s $3.0 billion across four IPOs).

Poland continues to provide the games industry with a steady rate of IPOs per quarter with 3 in Q4 2024 (100% of the volume); all of which were PC game developers including Dark Point Games ($9.2 million market capitalization), G-DEVS ($1.8 million market capitalization), and Madnetic Games ($4.9 million market capitalization).

Highest exits (M&A + IPOs) by segment value was led by tech/other (60%), followed by mobile (40%), console/PC (<1%), and esports (<1%).

Fund Announcements

DDM tracks announcements from venture capital firms and funds on the new capital they raise that eventually become deployed in the investments in its reports.

Q4 2024’s new fund announcements totaled $9.8 billion across 36 funds (-21% in value and +33% in volume compared to Q3 2024’s $12.4 billion across 27 funds); this funding was driven by three funds collectively raising over $5.0 billion (51% of the capital raised): Founders Fund ($3.0 billion), Coatue Management ($1.0 billion), and General Catalyst ($1.0 billion).

Artificial intelligence and blockchain continue to receive interest from venture capital firms as funds targeting AI totaled $2.2 billion across 12 funds (-77% in value and +72% in volume compared to Q3 2024’s $9.8 billion across seven funds) and blockchain totaled $1.7 billion across 13 funds (+13% in value and +44% in volume compared to Q3’s $1.5 billion across nine funds).

New fund announcements focused solely on early-stage companies dominated by volume representing 75% of the fund announcements in Q4 2024; however, the funding distribution by value was more balanced, with early-stage funds raising $3.4 billion across 27 funds (35% by value), mid/late-stage funds raising $3.1B over 3 funds (31% by value), and stage-agnostic funds raising $3.3 billion across six funds (34% by value).

*Mass Community Games (MCG) are games driven by online community play. Includes MMOs, MOBAs, battle royale, and metaverse games.

In reporting values, DDM only includes deals when the investment or acquisition closes, not simply announced. This methodology has been used consistently with the data for 17 years and it ensures that DDM is measuring actual activity instead of potential activity.

Additionally, with SPACs, DDM said it considers the investment value to be what was raised in the transaction, not the company valuation afterward. This is consistent with how it tracks investment data, where DDM tracks the money raised in the transaction and, separately, its effect on the company’s overall enterprise value.

The exclusion of announced deals may result in a large difference between DDM’s quarterly total and other firms, but the methodology gives a clearer picture of the money deployed in the last quarter, providing valuable data consistency for companies evaluating game industry investment and acquisitions, DDM said.

Source link