Intel’s first Ohio factory delayed again. Here’s when it may open

Intel, the financially embattled chipmaker, has delayed the opening of its first Ohio factory to 2030 or 2031, multiple years after it was to open.

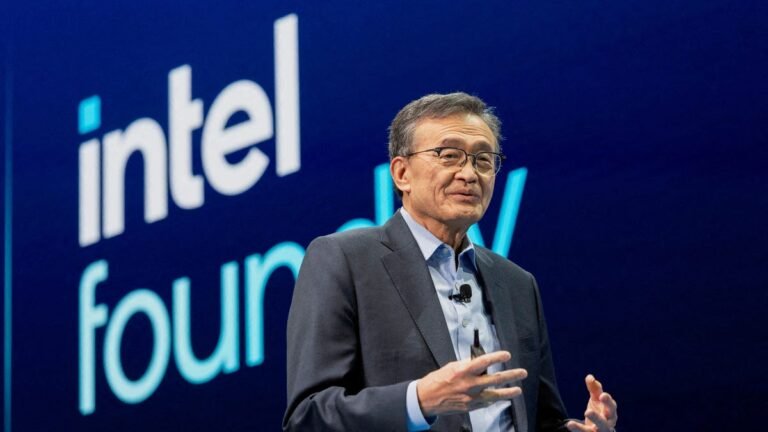

President Donald Trump is demanding the immediate resignation of Intel Chief Executive Officer Lip-Bu Tan, accusing him of having problematic investments in Chinese companies.

His comments came after Sen. Tom Cotton, R-Ark., wrote a letter to the chipmaker’s board chair questioning Tan’s ties to international advanced manufacturing and semiconductor firms.

Tan has invested at least $200 million in hundreds of Chinese companies, including some linked to the country’s military, according to Reuters. He has made those investments both directly and through venture funds.

“The CEO of INTEL is highly CONFLICTED and must resign, immediately,” Trump wrote in a post on Truth Social. “There is no other solution to this problem. Thank you for your attention to this problem!”

Kiana Cacchione, a spokesperson for Intel, said the company is “deeply committed to advancing U.S. national and economic security interests.” She said the chipmaker is making “significant investments” aligned with Trump’s agenda.

Later, Tan said in a message to employees that there was “a lot of misinformation” circulating. He said he has “always operated within the highest legal and ethical standards,” and that he was “engaging” with the Trump administration to “ensure they have the facts.”

“The United States has been my home for more than 40 years,” he said. “I love this country and am profoundly grateful for the opportunities it has given me. I also love this company.”

“My reputation has been built on trust — on doing what I say I’ll do, and doing it the right way,” he added. “This is the same way I am leading Intel.”

But Trump’s remarks signal yet another headache for the struggling chipmaker. Here’s what to know.

Who is Lip-Bu Tan?

Tan — a naturalized U.S. citizen born in Malaysia — was appointed to his position at Intel earlier this year.

He touted a long career as a venture capitalist with expertise in the semiconductor industry. He was tasked with turning around the struggling chipmaker, which has lost ground in recent years to international competitors.

In April, he told employees that he wanted to revamp Intel’s culture. He vowed to flatten the company’s executive team, empower its engineers and streamline its teams, among other actions.

Months later, he executed significant layoffs. Intel shed thousands of employees, including nearly 700 in Arizona. The chipmaker is a major employer in Chandler.

Since then, he has said the company will take a much more cautious approach to building out its footprint.

“We have a lot to fix to move the company forward,” Tan said on a recent earnings call, adding that it would “take time.”

What sparked Trump’s ire?

It’s highly unusual for a sitting president to demand the resignation of a corporate executive.

But Trump’s second term has been marked by his ever-evolving relationships with tech titans — and his comments about Tan highlight the pressure he is willing to exert on businesses to get the outcomes he wants.

His remarks come amid the backdrop of national conservatives’ concerns about China taking advantage of advanced U.S. technologies.

Cotton, a national security hawk, referenced Tan’s longtime position as a top executive at Cadence Design Systems in his letter to Intel’s board. That software company recently agreed to pay $140 million in fines for violating U.S. export restrictions by selling chip design products to a Chinese military university.

Tan has also garnered criticism for investments made by his venture capital firm, called Walden International. That company was a seed investor in Semiconductor Manufacturing International Corp., which is China’s largest chip foundry. It has also invested in other foreign companies.

It is not illegal for U.S. citizens to hold stakes in Chinese companies — even if those entities have ties to the country’s military. But Americans cannot hold stakes in companies that have been added to the U.S. Treasury’s Chinese Military-Industrial Complex Companies List.

There’s currently no evidence that Tan is invested directly in any company on that list, according to Reuters.

How did the markets react?

Intel shares dipped by more than 3% on Aug. 7 following Trump’s post.

The company’s stock was trading at roughly $19.70 per share at around 2:30 p.m. Eastern Time. It had been trading at $20.41 at the previous day’s close.

What does the news mean for Intel?

Intel has struggled in recent years after a slew of strategic missteps.

It has faced manufacturing delays, quality-control issues, marketing errors, expensive acquisitions that didn’t work out, executive management turnover and more in a highly competitive industry.

It has also struggled to remain viable against tough competition, falling behind on developing new technology devoted to mobile devices and high-powered chips for artificial intelligence. It is now fighting to maintain its dominance in personal computer and data center operations.

Trump’s comments add to the swirl of uncertainty around the chipmaker’s future.

Sasha Hupka covers utilities and technology for The Arizona Republic. Reach her at sasha.hupka@arizonarepublic.com or 480-271-6387. Follow her on X: @SashaHupka. Connect with her on LinkedIn: Sasha Hupka. Follow her on Instagram or Threads: @sashahupkasnaps. Follow her on Bluesky: @sashahupka.bsky.social.