jetcityimage

Everyone wants to hit a home run. Increasingly, batters in the major leagues are swinging for the fences. Sometimes, they succeed, but strikeouts are more frequent now than at just about any time in baseball history. Many times, those batters who swing for the fences while striking out kill rallies that could provide a positive outcome for their team.

There’s an analogy here for the stock market. Investors want to hit home runs. However, swinging for the fences with every investment is a risky proposition. Singles and doubles can still lead to running up a big score. That’s where established companies like PepsiCo, Inc. (NASDAQ:PEP) can provide long-term investors with solid returns.

Most people in the general public think of soft drinks (including Mountain Dew, my favorite) when they think of Pepsi. However, the company has many brands that have nothing to do with sugary drinks. Quaker Oats, Lays potato chips, and Doritos are popular brands that contribute to Pepsi’s bottom line.

The company has been around since 1898, producing soft drinks since that time. PEP combined with Frito-Lay in 1965, adding popular snack foods to its product line. To say the least, the company has a strong history. Rapid growth is likely in the company’s past, but that does not mean that it can’t provide a solid investment for those focused on the long term.

Financials

Revenue and income are important metrics to track when looking at companies that are worth an investment. Higher numbers over time can frequently turn into higher share prices and growing dividends.

Pepsi’s revenue has grown by nearly $25 billion on an annualized basis over the past 10 years. Most of this has come since the COVID pandemic. Revenue was basically flat between 2014 and 2019, coming in around $67 billion annually over that time. Over the past 12 months, that number has exceeded $92 billion. Over the first two quarters of the current fiscal year, revenue is up another 1.5%. This growth has shown that PepsiCo has been able to increase revenue during a period of higher inflation. Popular, mature companies frequently have pricing power that allows them to raise prices at or above the overall rate of inflation.

Net income has grown at a similar clip over the past decade, increasing from $6.5 billion to nearly $9.1 billion between 2014 and 2023. This has led EPS to grow by around 50% over the same period. Over the first six months of the current fiscal year, EPS is up by 10%.

Frequently, companies juice their EPS number by rapidly buying back shares of their own stock. This has not really been the case with PEP in recent years. The company has announced plans to buy back around $1 billion worth of shares as of its last annual report. Since the COVID pandemic, the number of shares has dropped from 1.385 billion to 1.376 billion as of the last annual report. The rapidity of buybacks has dropped over the past decade. Fewer shares on the market can lead to higher share prices as earnings are spread around fewer shares.

Net debt has increased in recent years. There was a big jump between 2019 and 2020. The global pandemic likely contributed to this, although low interest rates at the time cut the cost of borrowing. Net debt was nearly $28 billion in 2019; it’s currently at $38.3 billion. If this continues to grow, it could be a problem, but the current debt level looks manageable.

The products that PEP sells are popular. Because some of them are somewhat addictive (like Mountain Dew), people are likely to continue buying them regardless of the time of year or the economic outlook. PepsiCo has survived both world wars, the Great Depression, and many recessions. It’s likely to be around for the foreseeable future.

Dividends

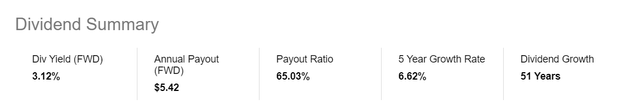

As an investor who is interested in dividends, I always check out a company’s dividend profile. PepsiCo does not disappoint here. The company has grown its dividends for 51 straight years.

Dividend Overview of PepsiCo (Seeking Alpha)

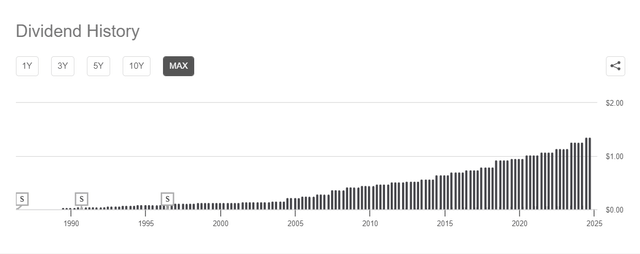

It’s dividend payout history is beautiful. The payout graph goes up from left to right, and the size of the payout has increased greatly over the long run.

PepsiCo Dividend History (Seeking Alpha)

Currently, the company’s payout is $1.355 per share per quarter. This has increased by 6.62% on an annualized basis over the past five years. With the current yield of 3.12%, a person who decided to reinvest their dividends could theoretically see their dividend payout increase by nearly 10% annually if the current growth rate continued into the future.

This does not mean the the share price will increase as rapidly, but income-focused investors should see their income grow in excess of the rate of inflation in this hypothetical scenario. Indeed, income would double in a little more than seven years with a 10% annual rate of growth.

Pepsi’s current payout ratio of 65% would require income and EPS growth to keep growing income at this rate. There have been a couple of years that were outliers on the low side of the payout ratio, but generally, the past 10 years have seen payout ratios in the 65% to 75% range. Therefore, the company has done a good job of showing dividend growth despite having a relatively high payout ratio.

Conclusion

PepsiCo is a company with a strong history of growth. The share price has increased by nearly 89% over the past decade. This is not a rapid rate of growth when compared to growth stocks, but it’s still a relatively decent amount of increase for long-term investors. The dividend payout has doubled over the past decade, from $2.53 to the current $5.15. Again, it’s a decent amount of growth. The company is likely to perform moderately well in all economic conditions, although it might lag during strong bull markets as it has over the past year. It’s a stodgy, mature company, but the current yield of 3.12% exceeds the overall market, and should the current rate of dividend growth continue, an investor’s income could come close to doubling again over the next decade. It’s a solid company to hold for the long term.