As the number of companies listed on the JSE continues to decline, together with the absence of major new listings, the issue of concentration continues to grow for local investors.

This adds significant risk, especially when it comes to retirement and pension funds.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Fresh wave of JSE delistings looms

Currently, the JSE has a total market capitalisation of R20.9 trillion. The top five – Prosus, BHP Group, AB InBev, British American Tobacco and Richemont – account for half of this value (R10.7 trillion).

When you combine the top 20, that number rises to 80% (R16 trillion).

An excellent analysis of this problem by Alyssa Viljoen, equity analyst at Merchant West Investments, shows just how big this problem is for the country’s larger asset managers.

According to Viljoen, when it comes to daily volumes, micro- and small-cap stocks account for just 2% of daily volume (compared to the Top 40’s more than 80%).

She argues that because these asset managers are managing tens or hundreds of billions of rands in assets, they “simply cannot build meaningful positions in illiquid stocks without moving the price against themselves”. Plus, with Sanlam effectively outsourcing its asset management function to Ninety One, this problem is arguably exacerbated.

Read/listen:

Digging into the best unit trusts halfway through 2025

What is catching the eye of smart money on the JSE?

How to build a core portfolio

The flagship equity funds of the country’s five largest asset managers all hold Prosus/Naspers among their top 10 holdings, with four holding Standard Bank and AngloGold Ashanti, three holding Capitec, Gold Fields and Sanlam, and two holding AB InBev, Gold Fields and FirstRand.

To illustrate this, the team ran a simple thought experiment that assumed a South African fund manager with approximately R700 billion in assets under management.

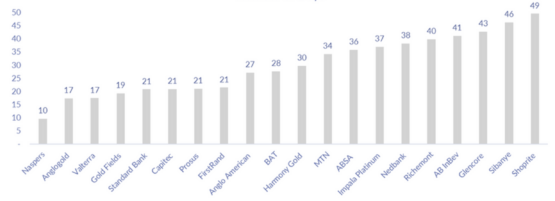

“If that manager wanted to build a 1% position across their business in Naspers – the largest stock in the JSE All Share – while limiting themselves to 30% of daily trading volume, it would take roughly 9.5 days to build the position … It would take almost 50 days just to exit a 1% position in Shoprite’s stock, for example,” says Viljoen.

Number of days for a manager to build or exit a 1% position across the 20 most liquid stocks on the JSE, assuming they participate in 30% of the daily volume:

“For a fund manager, taking that long to exit a position raises the risk,” says Viljoen.

“Market conditions can change materially over such a long execution window. Earnings results, macroeconomic developments, or even company-specific news can move the share price before the full trade is complete …

“For large managers, this makes it very difficult to adjust positions quickly in response to new information, which is a key part of active management. Past events such as the Steinhoff collapse highlight the potential downside.”

Read:

Harmonising Africa’s financial markets is crucial for foreign investment

Why smart investors are moving beyond traditional share portfolios

Viljoen argues that while many active managers will sell the fact that they will pick stocks based on fundamental analysis and bottom-up research, in reality “many portfolios converge on the same names”.

ADVERTISEMENT:

CONTINUE READING BELOW

“This is down to the simple fact that there are precious few liquid stocks on the JSE that are investable at scale.”

She says “the result is a form of forced indexing where active portfolios start to resemble the benchmark simply because there are not enough scalable alternatives”.

This has obvious knock-on effects for investors, but most – especially those saving for retirement – may be completely oblivious to these.

Because portfolios have increasingly become concentrated in a few large shares, single-stock risk has increased.

This also means that active managers are less likely to outperform as there are fewer stocks that they can utilise to generate this performance.

While managers can diversify with offshore markets, when it comes to retirement funds (under Regulation 28), there are strict limits on the amount of offshore exposure a fund can have.

Viljoen says Merchant West believes “this situation is causing inefficient valuations across a broad range of stocks” on the JSE.

Of course, smaller boutique asset managers (which Merchant West is) are and have been seizing this opportunity. This is obvious as they have a smaller amount of capital to deploy and can therefore take “meaningful positions in under-researched, small- and mid-cap stocks” – and in companies that are too illiquid for larger investment houses.

One can see this when studying the fund fact sheets of smaller managers. Even those with equity funds sub-R10 billion show some interesting names in their top 10 holdings such as Premier Group, WBHO and Tiger Brands in a R4 billion fund, Super Group and WeBuyCars in one R6 billion fund, and Northam Platinum and AECI in another R11 billion one.

Listen/read: SA’s small and mid caps have been flying

What Viljoen doesn’t say is that while smaller managers are able to patiently build positions in these less liquid small and mid-cap stocks over time, exiting these can be as difficult and slow as entering them. You could conceivably have the situation where the only buyer of a 10% stake in one of these small- and mid-caps is another fund manager – retail investors would never be able to snap up the supply of shares on offer.

This means these smaller managers are, in some ways, relying on future bids from another manager or some sort of other liquidity event such as a bid from a listed rival or a private offer (meaning a delisting).

A Steinhoff-type event would be as catastrophic for holders of these shares as it was for holders of that retailer (albeit at a smaller absolute scale).

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.