Since they were introduced to the stock market in the 1990s, exchange-traded funds (ETFs) have been among the most useful tools for investors. They offer all the broad market exposure of mutual funds, but they come in a more investor-friendly package — their fees are typically lower, and they can be bought and sold in a brokerage account just like stocks. Investing made simple(r).

There are countless ETFs on the stock market, covering virtually any sector, industry, interest, or theme you could be interested in. Whether it’s technology, cannabis, or space exploration, if you want to find an ETF for it, you likely can. That said, not all ETFs are equally helpful, and some are worth avoiding.

One ETF in particular I wouldn’t touch with a 10-foot pole right now is the Vanguard Information Technology ETF (NYSEMKT: VGT) — even with its recent success.

Too few companies are leading the charge

This 320-stock ETF contains large-cap, mid-cap, and small-cap companies in the information technology sector. These companies’ specialties include semiconductors (29.9% of the ETF), systems software (22.2%), technology hardware and storage (18.1%), application software (13.4%), communications equipment (3.1%), and a handful more.

Since the ETF is weighted by market cap, larger companies exert more influence than smaller companies. Unfortunately, that’s part of the problem. Here are the ETF’s top three holdings and how much of the fund they make up:

-

Microsoft (NASDAQ: MSFT): 16.66%

-

Apple (NASDAQ: AAPL): 16.07%

-

Nvidia (NASDAQ: NVDA): 14.63%

Three companies that make up less than 1% of the ETF’s companies account for more than 47% of its weight. There’s a lack of diversification, and then there’s this.

When it’s great, it’s great; when it’s not, it’s bad

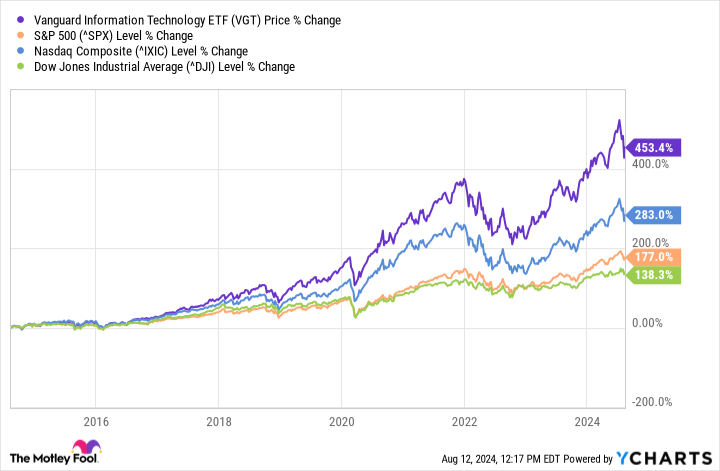

It’s only fair to acknowledge that the ETF has been wildly successful over the past decade, far outperforming the U.S. stock market’s three major indexes. In fact, none of the indexes have come even remotely close to the ETF’s returns over that span.

It’s also fair to acknowledge that Microsoft, Apple, and Nvidia are three of the best companies in the world. Microsoft has been at the top of the tech food chain for almost 50 years, Apple is arguably the gold standard for consumer electronics, and Nvidia is one of the companies at the forefront of AI technology.

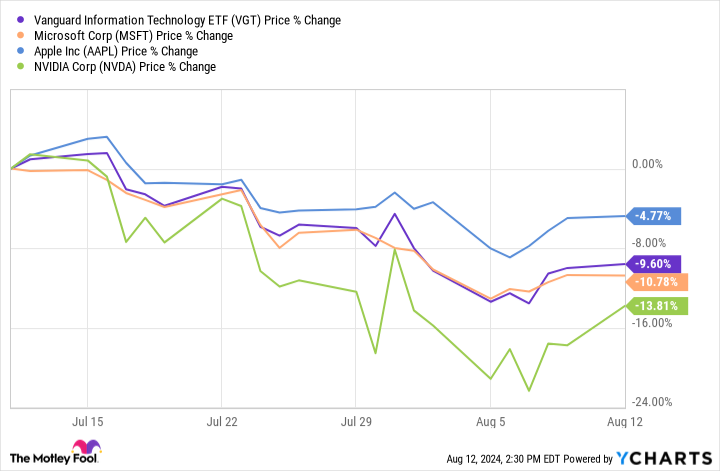

However, as the saying goes, “The same thing that makes you laugh can make you cry.” The success of the above three companies has pushed the index forward over the past decade, but any down period for the three could drag down the ETF’s performance. As an example, let’s look at the past month when the three companies experienced a pullback.

Of course, Microsoft, Apple, and Nvidia aren’t solely responsible for the ETF’s decline over that span. But considering how much of it they account for and their declines, they bear a decent amount of the responsibility. As they go, so goes the ETF.

Do I expect these three companies to have bad years? Not at all. Are they priced at a premium and susceptible to a correction if market conditions change? For sure.

There may be a better route for investors

Instead of investing in this ETF and putting its success (or lack thereof) in the hands of a few companies, you should consider a similar but more diversified ETF like the Invesco QQQ Trust ETF (NASDAQ: QQQ). It mirrors the Nasdaq-100, an index that contains the largest 100 nonfinancial companies trading on the Nasdaq exchange.

It’s not a pure tech ETF like the Vanguard ETF, but 50% of the ETF is made up of information technology companies, and its top three holdings are the same:

-

Apple: 9.14%

-

Microsoft: 8.32%

-

Nvidia: 7.10%

This gives you a chance to get the benefits of investing in some of the world’s best tech companies without relying too much on their success to boost the ETF’s performance.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 ETF I Wouldn’t Touch With a 10-Foot Pole was originally published by The Motley Fool