The electric vehicle (EV) revolution in India has gained momentum in the past few years. With the government’s constant encouragement, increasing customer demand, and galvanizing investments by international players, the EV segment is witnessing a remarkable transformation.

By 2025, India’s electric vehicle market is expected to be among the world’s fastest-growing, fuelled by technological innovation, infrastructure growth, and supportive policies.

The government of India has led the charge in outlining the EV ecosystem with initiatives. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) Scheme has benefited EV consumers and producers, and the Production Linked Incentive (PLI) Scheme has supported local production of EVs and batteries.

Most state governments have also issued their policies, with tax concessions, subsidies, and infrastructure incentives provided to foster the adoption of EVs. India has set an ambitious target of 30% electric vehicle market penetration by 2030 and has established a clear roadmap for industry participants.

Elon Musk’s Tesla to Enter India: Will it be a Game-Changer?

Elon Musk’s Tesla has been in the news of late with its long-awaited foray into India. It is believed that this entry will upset the apple cart and trigger EV sales across the country.

Tesla’s entry into India has been a contentious issue for years, Musk has had his sights on the Indian market for years with its first launch planned for 2022. However, it was put on hold, the plan resumed efforts last year with a retail footprint, and now the launch appears to be imminent.

After decades of speculation and discussions, Elon Musk has now finally confirmed the launch of Tesla in 2025. The move is bound to revolutionize the Indian EV space by setting new benchmarks in terms of technology, performance, and infrastructure growth.

Tesla is eyeing an Indian factory under Make in India, to serve domestic and foreign markets. It will roll out Model 3 and Model Y with local tastes and prices tailored to local requirements. Expansion of the Supercharger network will support EV adoption.

To strengthen its supply chain, Tesla is negotiating with Indian component suppliers and manufacturers. Musk’s move into India is expected to make consumers more confident about EVs, promote competition, and compel conventional automakers to accelerate the shift to EVs.

India’s EV Market: Accelerating Towards a Green Future

Domestic players such as Tata Motors, Mahindra Electric, and Ola Electric led the way for EVs. Competition is being also increased by international majors like Hyundai, BYD, and now Tesla. The Indian EV ecosystem also expanded in the arena of battery technology, charging systems, and components manufacturing, supporting the sector as well as rendering it competitive.

Passenger electric vehicles have seen a sharp demand, with market leader Tata Motors leading the charge with products like Nexon EV and Tiago EV. Demand for two-wheelers has also picked up, with Ola Electric, Ather Energy, and TVS iQube dominating the space.

Commercial usage of EVs is also gaining traction, with logistics and fleet operators making the transition to electric vehicles in an attempt to reduce operational expenses and carbon footprints.

Charging infrastructure has been yet another significant progress. India has experienced significant expansion in its charging points in public and private spaces, increasing ease of use for EV consumers.

As of 2025, India’s electric vehicle adoption crossed 2.5 million units and is bound to grow manifold in the upcoming years. The expanding EV sector presents a unique opportunity for Indian investors, as mutual funds with significant exposure to EV-focused stocks could gain from the industry’s growth.

Here’s a list of the top 5 mutual funds that are betting big on the future of transportation called Electric Vehicles (EV):

#1 – Bandhan Transportation and Logistics Fund (Thematic Fund)

Launched in October 2022, Bandhan Transportation and Logistics Fund invests in stocks of companies engaged in the transportation and logistics sector in India. The scheme invests across market cap, and as of January 2025, it holds 59.89% allocation in large caps, 9.13% allocation in mid-caps and 23.33% in small caps.

Bandhan Transportation and Logistics Fund – Allocation to EV Stocks

Bandhan Transportation and Logistics Fund holds a maximum exposure of 6.83% in stocks of Tata Motors Ltd., which is a USD 37 billion organisation, a leading global automobile manufacturer with a portfolio that covers a wide range of cars, SUVs, buses, trucks, pickups and defence vehicles.

The scheme also carries an allocation to some of the best EV stocks in India, like – Hero MotoCorp Ltd., Bosch Ltd., Bharat Forge Ltd., Exide Industries Ltd. etc. Currently, the overall exposure to EV stocks accounts for 24.81% of the scheme’s assets.

Do note that the scheme is new in the market and does not carry a long performance track record; thus, investors may consider their suitability before investing in this scheme.

#2- Aditya Birla SL Transportation and Logistics Fund (Thematic Fund)

Launched in November 2023, Aditya Birla SL Transportation and Logistics Fund invests in securities of companies following transportation and logistics themes. The fund has exposure of 66.37% in large-cap stocks, 9.95% in mid-cap stocks, and 20.95% in small-cap stocks.

The overall allocation to EV stocks is around 21.08%, and the highest is in stocks of Tata Motors Ltd. 11.75%. The scheme offers exposure to the evolving EV ecosystem by investing in companies across automotive, logistics, and allied sectors benefiting from electrification trends. The scheme also holds a fair exposure to other EV stocks and currently has an AUM of Rs 1430.20 crore.

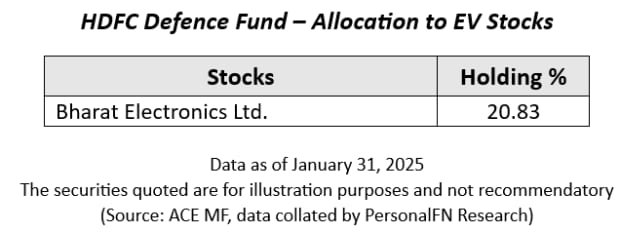

#3- HDFC Defence Fund (Sectoral Fund)

Launched in June 2023, the scheme endeavours to create a portfolio substantially constituted of equity and equity-related securities of Defence & allied sector companies. Do note that the scheme is new in the market and does not carry a long performance track record; thus, investors may consider their suitability before investing in this scheme.

Although the scheme focuses on stocks from the defence sector it holds a decent allocation to the EV stocks.

In terms of EV stocks, HDFC Defence Fund holds an overall exposure of around 20.83% in Bharat Electronics Ltd. (BEL), a key player in India’s defence and electronics sector, which is expanding its footprint in the electric vehicle (EV) ecosystem.

The company is developing advanced battery management systems, charging infrastructure, and power electronics components essential for EVs. With India’s push for EV adoption, BEL’s expertise in energy storage and power solutions positions it well to capitalize on the growing demand for indigenous EV technology.

As of January 2025, the fund has a 47.74% allocation in large-cap stocks and 9.79% in mid-cap stocks, whereas 39.60% in small-cap stocks. Bear in mind it has a high exposure to small-cap stocks, which are sensitive to price fluctuations and thus investors may consider their risk profile before investing in this scheme.

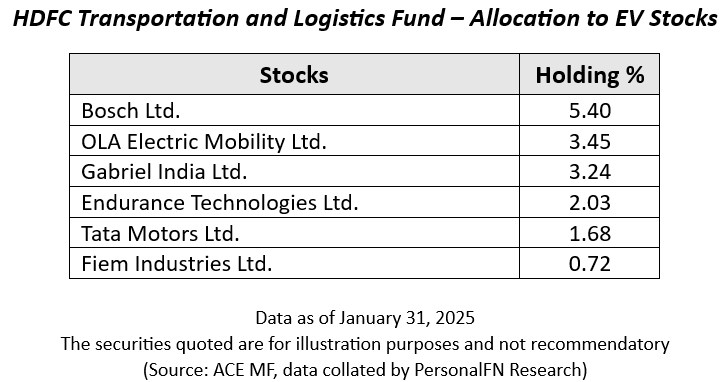

#4 – HDFC Transportation and Logistics Fund (Thematic Fund)

HDFC Pru Transportation and Logistics Fund is categorised as a thematic scheme that invests in a concentrated portfolio of equity & equity-related instruments of companies engaged in the transportation and logistics sector.

Currently, the scheme holds an AUM of Rs 1278.31 crore. As of January 2025, the fund has a 52.72% allocation in large-cap stocks and 15.03% in mid-cap stocks, whereas 23.57% in small-cap stocks.

The scheme has an overall allocation of 16.52% to EV stocks. The highest exposure of 5.40% is in Bosch Ltd., which is collaborating with OEMs to supply components for electric two-wheelers, passenger vehicles, and commercial EVs. Its focus on localization and R&D in India aligns with the growing shift towards sustainable mobility.

In addition, the scheme has decent exposure to market leaders like OLA Electric Mobility Ltd., Gabriel India Ltd. and Endurance Technologies Ltd. Launched in October 2022, the scheme does not carry a long performance track record; thus, investors may consider their suitability before investing in this scheme.

#5 – UTI Transportation & Logistics Fund (Thematic Fund)

UTI Transportation and Logistics Fund invest predominantly in a portfolio of stocks of companies engaged in the transportation and logistics business. Launched in April 2004, the scheme currently has an AUM of Rs 3,333.95 crore.

The scheme invests across the market cap, and as of January 2025, it holds 73.79% allocation in large caps, 9.20% allocation in mid-caps and 12.19% in small caps. UTI Transportation and Logistics Fund holds maximum exposure in EV stocks like – Tata Motors Ltd. at 6.72% and Hero MotoCorp Ltd. at 5% (leading companies from the EV sector). Currently, the overall exposure to EV stocks accounts for 16.23% of the scheme’s assets.

The Road Ahead for India’s EV Market

India’s electric vehicle market is transitioning to a never-seen-before growth phase fuelled by policy encouragement, technological evolution, and mounting investments. The entry of Tesla further cements India’s place as a vital contributor to the world EV landscape, boosting competition and speeding up the adoption of electric mobility.

With domestic and foreign players increasing their activities, the industry is likely to see continued growth in the years to come.

As the sector matures, long-term investors in EV-oriented mutual funds could gain from the sector’s metamorphosis. With India on the cusp of becoming a major EV hub, it is time for investors to shift their portfolios towards the nation’s electric future.

Evaluate your suitability based on risk tolerance and investment horizon before investing in sectoral/thematic funds and ensure a prudent allocation.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.