Municipals were weaker Thursday as U.S. Treasury yields rose and equities rallied.

Triple-A yields rose by two to seven basis points while USTs rose four to five as volatility in both markets continued.

The past several trading sessions have seen “crazy volatility,” said Jennifer Johnston, director of research of municipal bonds at Franklin Templeton.

Following the extended market rally through Monday and then the extended selloff through Wednesday, the market is almost back to where it started, she said.

“So we sprung this way, and we’ve kind of come back,” she said. “We’re not quite there yet, but I think perhaps it was just people got scared, and then they come down a little bit, and now we’re kind of back to more even keel.”

However, it remains to be seen if that continues.

The employment report, the upcoming Federal Open Market Committee meeting and major shifts in the president election have also added to market volatility in August, Johnston said.

“This is a different political environment for August before an election in recent history,” with the assassination attempt of former President Donald Trump and the withdrawal of President Joe Biden from the race, she said.

“It’s not just that we’re worrying about who the next president is going to be; it’s what this uncertainty and volatility and maybe divisiveness will even mean for how a market reacts between now and November,” Johnston said.

The market volatility led Chicago to pull its planned deal of $643.11 million of GOs, which was set to price Wednesday, she said.

More issuers may end up pulling deals as they wait and allow “everything cool down a little bit,” Johnston said.

With more than five weeks until the Federal Reserve’s September meeting, issuance will slow as it draws closer, but until then, issuers are not going to completely “hold off,” she said.

The question then becomes whether there is enough demand for the upcoming supply, Johnston noted.

There has been growth on the separately managed account side, but participants are wondering when the money is going to return to open-ended mutual funds, she said.

If rates start to come down, the curve may straighten out, she said.

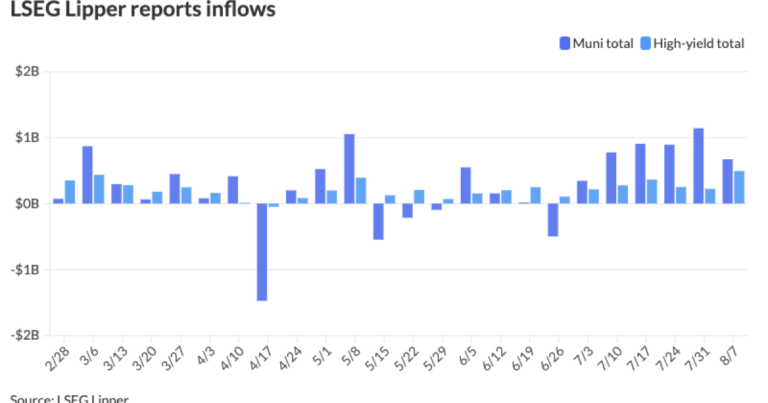

Municipal bond mutual funds saw inflows as investors added $671.5 million to funds after $1.1142 billion of inflows the week prior, according to LSEG Lipper. This marks six straight weeks of inflows.

The recent spat of large inflows has been “good news,” Johnston said.

“We have money coming in from redemptions and calls,” she said. “If the idea that the Fed is going to lower rates, if that brings your traditional investor back into an open-end fund, there’s going to be money to invest.”

While yields have risen, relative value is still on the lower side on bonds 10 years and in. Muni to UST ratios remain in a range. The two-year muni-to-Treasury ratio Thursday was at 66%, the three-year at 68%, the five-year at 68%, the 10-year at 68% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 67%, the three-year at 68%, the five-year at 68%, the 10-year at 69% and the 30-year at 84% at 3:30 p.m.

In the primary market Thursday, J.P. Morgan priced for the Hillsborough County Aviation Authority (Aa3//AA-/AA/)

Wells Fargo priced for the National Finance Authority, New Hampshire, $167 million of Tamarron Project special revenue bonds, Series 2024, with 5.25s of 12/2035 at par, callable 12/1/2025.

Frost Bank priced for the Pecos-Barstow-Toyah Independent School District, Texas, (/AAA//) $141.755 million of PSF-insured unlimited tax school building bonds, Series 2024, with 5s of 2/2025 at 2.98%, 5s of 2029 at 2.82%, 5s of 2034 at 3.15%, 5s of 2039 at 3.43% and 4s of 2043 at 4.13%, callable 2/15/2030.

Goldman Sachs priced for the Massachusetts Development Finance Agency (Aa1/AA+/) $105.82 million of Williams College issue revenue bonds, Series 2024V, with 5s of 7/2035 at 2.78%, callable 7/1/2034.

In the competitive market, Oyster Bay, New York, sold $135.24 million of bond anticipation notes to Wells Fargo, with 4s of 8/2025 at 3.00%.

AAA scales

Refinitiv MMD’s scale was cut three to six basis points: The one-year was at 2.68% (+3) and 2.66% (+3) in two years. The five-year was at 2.59% (+5), the 10-year at 2.70% (+6) and the 30-year at 3.58% (+5) at 3 p.m.

The ICE AAA yield curve was cut two to four basis points: 2.72% (+2) in 2025 and 2.68% (+4) in 2026. The five-year was at 2.57% (+4), the 10-year was at 2.71% (+4) and the 30-year was at 3.57% (+4) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut three to seven basis points: The one-year was at 2.70% (+3) in 2025 and 2.68% (+3) in 2026. The five-year was at 2.57% (+5), the 10-year was at 2.69% (+7) and the 30-year yield was at 3.57% (+5) at 3 p.m.

Bloomberg BVAL was cut two to four basis points: 2.69% (+2) in 2025 and 2.66% (+2) in 2026. The five-year at 2.60% (+3), the 10-year at 2.67% (+4) and the 30-year at 3.59% (+4) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.047% (+5), the three-year was at 3.885% (+5), the five-year at 3.834% (+5), the 10-year at 4.000% (+5), the 20-year at 4.377% (+4) and the 30-year at 4.288% (+4) at 3:30 p.m.