In an interview with CNBC-TV18, Anuj Kumar, Managing Director of Computer Age Management Services (CAMS), spoke about the impact of regulatory changes on fund houses, the company’s growth outlook for FY27, and why he expects non-MF businesses to play a larger role in CAMS’ future growth.

CAMS reported a steady quarter-on-quarter performance in the October-December quarter of 2025 (Q3FY26), with revenue rising 3.6% to ₹390.14 crore from ₹376.70 crore in the previous quarter. earnings before interest, taxes, depreciation and amortisation (EBITDA) grew 6.7% to ₹178.86 crore from ₹167.60 crore, reflecting improved operating efficiency. EBITDA margin expanded by 135 basis points to 45.85% from 44.49%, while net profit rose 9.9% to ₹125.50 crore compared with ₹114.20 crore in the preceding quarter.

The market capitalisation of Computer Age Management Services stands at around ₹16,943 crore, with the stock having declined close to 18% over the past year.

Below are the edited excerpts from the interview.

Q: Has Computer Age Management Services (CAMS) seen any discussions with mutual funds on renegotiating contracts or pricing, given the regulator’s push to lower fees and the potential pressure this could place on fund houses’ cost structures?

A: The objective of the regulator is to make the product cheaper for the marketplace and investors. All the recent discussions, I wouldn’t call it a marginal impact. It is not substantive, not marginal, but has a small impact on the larger mutual funds. As we’ve always said, we deliver. We are at the high end of value delivery for the mutual funds in terms of running the entire liability-side operations. So, we believe we deliver sterling value to them. Let this play out over the next four or five months. If we have conversations, we will see how they go. But right now, there is nothing that’s happening on that front.

Q: Is that because of the nature of these contracts and when they come up for renegotiation, or is it just that it hasn’t happened? I mean, they’re not clear yet, so they’ve not asked you or renegotiated their rates and what you charge them.

A: I would just cleave the market into two parts. One large part of maybe the top 10 mutual funds will see some impact on account of the exit load going away. The rest of them will see balancing out of the impact of the exit load versus what is positively accretive to them from the GST front. So, if you take the top 10, they are perhaps going to see some impact. They are also evaluating, so are we. So, this hasn’t commenced yet in terms of a formal dialogue. The other thing, of course, you’re aware is that our unit price comes down every year. So, there are scale benefits baked in. The unit price falls almost every year, which I think is anyway in favour of our customers. There are very few marketplaces which operate like this. So, when you put the impact of these two things together, we are just waiting and seeing whether they want to have a conversation on this, or whether they have figured out ways to absorb this.

Q: So, you’re saying 10 large mutual funds, and you’d be dealing with all of them, will see some impact?

A: We deal with seven out of the 10 mutual funds.

Q: So, there will be an impact on them because of the exit load going away. So, they’re watching in terms of how to navigate this.

A: That is correct.

Also Read: Crypto hacks and scams surged in 2025 amid rise in regulation and institutional adoption

Q: And when will this renegotiation come up, sir, sometime during 2025-26 (FY26)?

A: Yes. I mean, if they choose to come back to us, it will perhaps be in a three- to four-month time frame.

Q: So maybe in the April-June quarter of 2025 (Q1FY26) of 2026-27 (FY27) is when we should expect it?

A: I would not set any definite expectation on it, because the entire exit load is about five bps. They run pretty large P&Ls, but if it has to happen, it will probably happen in the first quarter of FY27 itself.

Q: Let’s focus on the numbers then. Revenues year to date are up only around 5%, with margins being maintained in the mid-40s for the year. What kind of growth are you looking at this year, as well as the next? And in terms of your share, you were telling us that the non-MF business will grow at a faster clip, so the contribution will gradually move up. Give us the guidance on that front as well.

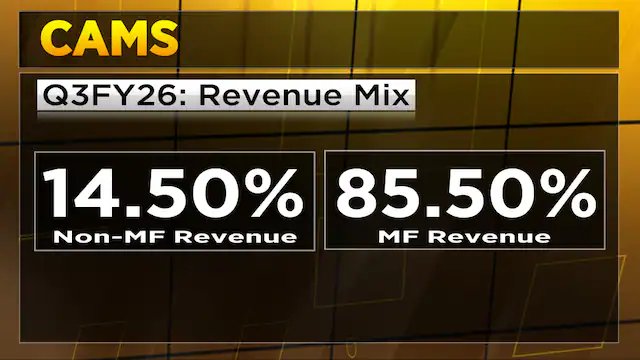

A: If you see this entire year, I would just say that it is in the backdrop of a large price reset we had taken about a year back, about nine months back. So, year-on-year growth numbers for the quarter and for the year will be in single digits. That’s point number one. Despite that, you would have seen that the operating margin from the April-June quarter of 2025 (Q1FY26) of 2025-26 (FY26) has climbed up from about 43% to 46%. A large part of that is just productivity delivered out of our technology initiatives, largely playing out. You would have seen the CAMS’ brand go live. The non-MF business for the quarter grew about 25%. A broad statement of the market has been that this will grow ahead of the overall enterprise revenue growth. So, you set that baseline. This quarter was better.

When you look at FY27, we would not be comparing revenue growth with the larger base; it will be with the smaller base after the price reset. So, we are expecting FY27, and again, this is not a formal guidance, we don’t issue those — but we’re expecting that revenue growth at the enterprise level should be about 12% to 13%. Non-MF revenue growth next year, FY27, should be upwards of 20%, and operating EBITDA growth should be upwards of 15%. These are broad, indicative numbers. We don’t issue guidance, but just the way we think the year will play out, all of that should be possible.

Q: Revenue growth of 12–13% in FY27?

A: Yes, absolutely.

Q: Since you’re sharing those numbers, and you said these negotiations will take place, could you give us a sense of how to think about the impact — worst case, base case and bull case?

A: I’ll give you a very broad, indicative number, not percentages, only absolute numbers. We expect our revenue increase in absolute rupees to be between ₹150 crore and ₹200 crore a year. If any of this happens, the impact could be about ₹20 crore to ₹25 crore annually. So, it will be a small fraction, or a manageable fraction, of the overall revenue increase that we get in a year. We are mentally prepared for any of these dialogues to commence. Like I’ve always said, the amount of value, expanding value that we deliver to the market, we don’t expect any dialogues with friction. They will be fairly amenable to listening to our side, to our expanding scope and the value we contribute. So, it is not an in-your-face kind of dialogue that we are expecting.

Also Read: What cautious mutual fund investors are buying right now

Q: So, you’re saying that the worst-case impact with respect to mutual fund negotiations led by attempts to lower fees by the regulator annually could be about ₹20 crore to ₹25 crore. I just want to get that right.

A: That’s correct, in that range.

Q: The other bit, which is a more structural thing, of course, is this move towards passives, ETFs. And we’ve seen this happen in the Western world in a big way. And here, many believe it will happen, and their cost structures are much lower. So, any thoughts on that? That is, as I said, a slightly longer-driven theme. Will that have a sobering impact on your profitability as well?

A: It’s a slow reset. It’s a very slow reset. Whatever you’ve seen in the world of ETFs in the last maybe 12 months has been led by gold and silver; it hasn’t so much been the impact of equity ETFs. I also believe — and as an investor, not as part of the ecosystem — that in falling markets, actively guided mutual funds have given a much better cushion to investors. So, what we see is that between active equity and passive funds, there is perhaps a 1% shift every year. That 1% shift has been there at this rate for about the last five years. If it stays that way, you could see about 0.5% to 1% of active equity give way to index funds and ETFs — and I’m saying net of the metals, this is purely equity. We are prepared for that, because overall, as you’ve seen, the AUM growth in the market has been 20% last year. Despite whatever has happened in the market, the asset growth for CAMS has been 19%. Within that, if a 1% shift happens, I don’t think it is a material impact to our financials.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Also, catch the latest Budget 2026 expectations updates here