Inflows into equity schemes, however, more than doubled last fiscal to ₹4.17 lakh crore against ₹1.84 lakh crore in FY24

Thanks to uncertainty triggered by the Russian invasion of Ukraine and the Trump trade tariff war, debt mutual funds in India has delivered better returns than high-risk equity schemes.

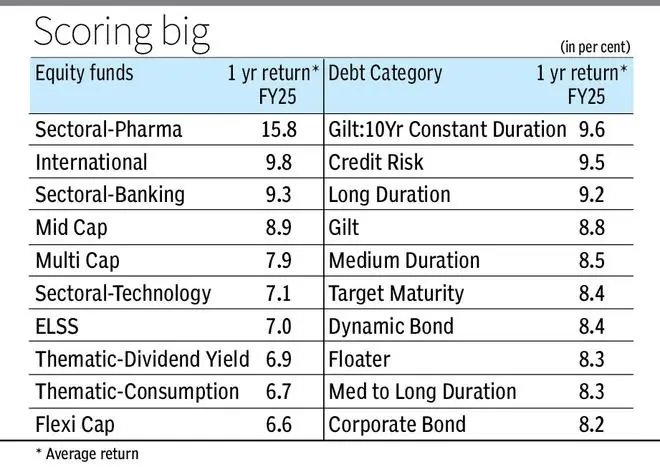

Equity mutual fund schemes across all categories have delivered a return of 6 per cent last fiscal while that of debt mutual funds were 8 per cent (excluding liquid and overnight).

In fact, the one-year return of 9.6 per cent from Gilt 10Yr Constant Duration fund was much higher than all categories of equity funds except for thematic pharma and international funds which gave 15 per cent and 9.8 per cent return. Interestingly, the return of 7 per cent and five per cent delivered by small and large cap funds were lower than most debt funds.

However, most investors were constantly betting big on equity schemes and ignored other asset classes. Inflows into equity schemes more than doubled last fiscal to ₹4.17 lakh crore against ₹1.84 lakh crore in FY24. In contrast, inflows into debt funds was up last fiscal at ₹1.38 lakh crore against a net outflow of ₹23,098 crore in FY24.

Though equity markets were on a dream run in the last two years, it was spooked by the Russian invasion of Ukraine and Israel’s attack on Palestine late last year. The stock market was further rattled after the US President Donald Trump levied trade tariffs against countries across the world to make America a “Great” country again.

Sriram BKR, Senior Investment Strategist, Geojit Investments, said while equity funds performance was driven by the overall market performance, which was in correction mode since last October, debt funds were driven by accrual additions and drop in yields.

“We always recommend people to follow asset allocation at all times, by keeping Equities, Debt and Gold in their portfolio. Excluding any one would have a direct impact of that factor in the portfolio and it will affect negatively at times,” he added.

Shriram Ramanathan, CIO, Fixed Income, HSBC Mutual Fund, said in an environment where global market volatility is sky high, debt funds offer an attractive opportunity to capitalise on lower rates by investing in longer duration products.

“With asset allocations for many investors heavily skewed in favour of riskier asset classes over the past few years, we believe it is an opportune time for investors to set right their medium term asset allocation towards debt mutual funds,” he added.

More Like This

Published on April 12, 2025