Mutual fund fees have dropped by more than half so far this century across both equity and bond funds, as the most popular 401(k) investment tool has met with increased competition and plan fiduciary scrutiny, according to a report released Tuesday by the Investment Company Institute.

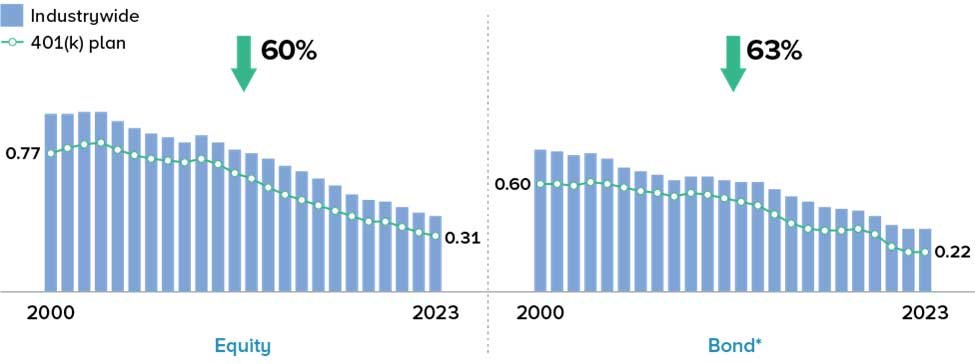

The ICI, an association representing regulated funds, released research showing a steady, multi-decade decline in equity mutual fund fees in 401(k) plans resulting in a 60% drop since 2000 to 0.31%. Meanwhile, fees for bond mutual funds fell 63% to 0.22% and fees for a hybrid of both equity and bonds fell 42% to 0.42%.

The association noted the fee compression happened even as the cost of many other things in the life of the average American rose—such as school tuition, tax preparation services and rent.

“This is great news for American workers looking to invest for the long term and drive growth in their 401(k) plan nest eggs,” said Sarah Holden, ICI senior director of retirement and investor research, in a statement. “Our study shows that retirement savers continue to see high value investing in mutual funds, which are diversified, professionally managed, and cost-effective.”

Holden cited competition in the marketplace, clear disclosures, the rise of index funds and plan participants’ investment choices as reasons for the continued fee compression. The report also noted the pressure from plan fiduciaries to keep fees low, with regular reviews and increased shopping for the best options.

Mutual Fund Expenses From 2000 to 2023

Mutual Funds vs. CITs

As of year-end 2023, defined contribution plans held $7.4 trillion in assets, with mutual funds making up $4.8 trillion, or 65%, of the total, according to the ICI. The other $2.6 trillion are in other assets, including collective investment trusts and guaranteed investment contracts such as stable value funds.

The ICI report is a counter to the narrative of the rise of CITs, which generally offer even lower fees, as they are only available to 401(k) plans and do not have to manage SEC security regulations. As of March, Morningstar put CITs at 49% of the in-plan target-date market, making them on track to overtake mutual funds by the end of this year.

Meanwhile, an analysis of all long-term mutual fund flows by business intelligence firm Simfund shows net monthly outflows for every month except two since the beginning of 2022. In 2024, Simfund data show total net outflows from mutual funds of about $38 billion, with April seeing the largest asset loss for mutual funds at $41.9 billion. Simfund, like PLANADVISER, is owned by ISS STOXX.

Of the ICI-tracked mutual funds, 58% are equity mutual funds, 28% are a mix of equity and bonds known as hybrid, 11% are solely bonds and 3% are money market funds.

The data did show that target-date mutual funds have become more popular among 401(k) plan providers. At year-end 2023, $1.8 trillion of the mutual fund assets pool was in TDF mutual funds, usually held in a fund-of-funds structure, meaning they are invested in other mutual funds or exchange traded funds.

Fee Structures

Equity mutual fund fees tend to fall as 401(k) plan size increases, according to the research. Retirement plans with less than $1 million in assets have average fees of 0.53% for equity mutual funds, a figure that declines by plan size until hitting a low of 0.34% for plans with more than $1 billion in assets.

In the report, the ICI broke down the fee structure for investment funds in a 401(k) plan. It noted that fees for investments within the accounts can be paid either fully by participants, by a combination of participants and the employer, or by just the employer.

Investors in mutual funds generally pay two types of fees, according to the ICI: ongoing expenses, which cover management and other operating costs, and sales loads, which are paid at purchase, redemption or at specific points in time if held. Those sales loads are often waived for 401(k) plans and, in fact, 96% of mutual funds in 401(k) plans were being held in institutional and retail “no-load” share classes as of the end of 2023, according to the ICI, partly resulting in the lower fees when compared to retail mutual funds.

“The Economics of Providing 401(k) Plans: Services, Fees, and Expenses, 2023” is done in conjunction between the ICI and data and analysis firm Brightscope, which, like PLANADVISER, is owned by ISS STOXX.