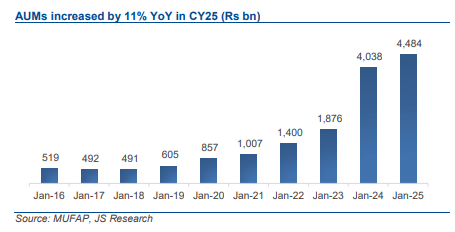

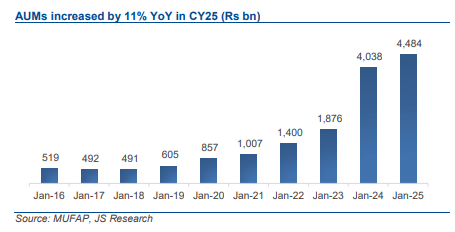

Mutual fund assets under management (AUMs) have tripled over the past three years, recording 11 percent year-on-year growth in December 2025, driven by fresh inflows, capital market gains, and a shift from fixed-income instruments to equities.

According to JS Global, expansion has enabled the equity market to absorb foreign outflows and has supported the re-rating of the KSE-100 Index amid improving macroeconomic stability. The index delivered a cumulative return of 331 percent over the 2022–2025 period, with mutual fund inflows emerging as a key supporting factor.

Within total AUMs, investments in equity portfolios increased by 56 percent, while allocations to debt portfolios—including income, fixed income, and money market funds—rose by 5 percent during calendar year 2025.

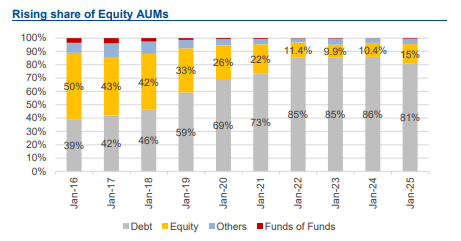

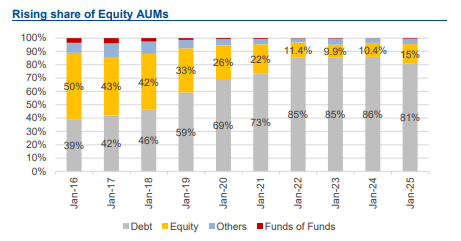

The sharp decline in interest rates, marked by a cumulative reduction of 1,150 basis points in the policy rate and 630 basis points in three-year PIB yields since December 2023, alongside higher taxes on fixed-income investments in the latest budget, has increased the appeal of equities.

As a result, equities’ share of total AUMs rose from a low of 10 percent in December 2023 to 15 percent currently. However, this remains well below the 40–50 percent levels recorded during the 2016–2018 period.

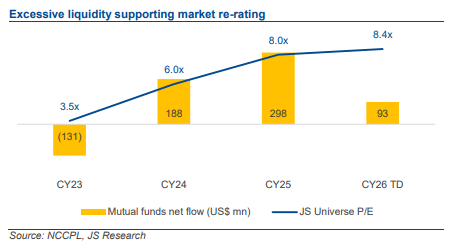

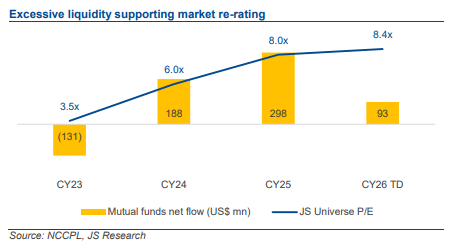

Excess domestic liquidity continued to support the market’s upward trend, with most foreign selling absorbed by mutual funds and individual investors. In calendar year 2025, combined net inflows from these groups amounted to approximately $561 million, including $298 million from mutual funds alone, against net foreign outflows of $370 million.

The trend has extended into the new year, as year-to-date net foreign outflows of $53 million in calendar year 2026 were more than offset by mutual fund inflows of $92.5 million.

Improved domestic liquidity and stronger equity market appeal have contributed to a broad-based re-rating of the market, with valuations rising from 3.5 times in December 2023 to 8 times in December 2025.

JS Global added that this trend has further upside potential.