Last Updated:

HDFC Securities’ 20-year study finds picking mutual funds based on recent 1-year or 3-year returns does not predict future success, urging investors to avoid 1-Year Return Trap.

Mutual Fund Investment

A 20-year study by HDFC Securities has demystified the major inclination or behaviour of investors in picking up mutual funds based on their previous 1-year or 3-year returns. HDFC Securities in its analysis spanning mutual fund data from 2005 to 2025, finds that a fund’s recent stellar performance especially to its 1-year return is often a misleading boost that inflates its overall record and doesn’t reliably predict future success.

The 1-Year Return Trap

HDFC Securities warns investors to avoid investing on a particular mutual fund on the basis of “purple patch”, a period of excellent, recent outperformance.

In other words, a strong rally in the last year can inflate the 3-year or 5-year averages, even if earlier performance was average.

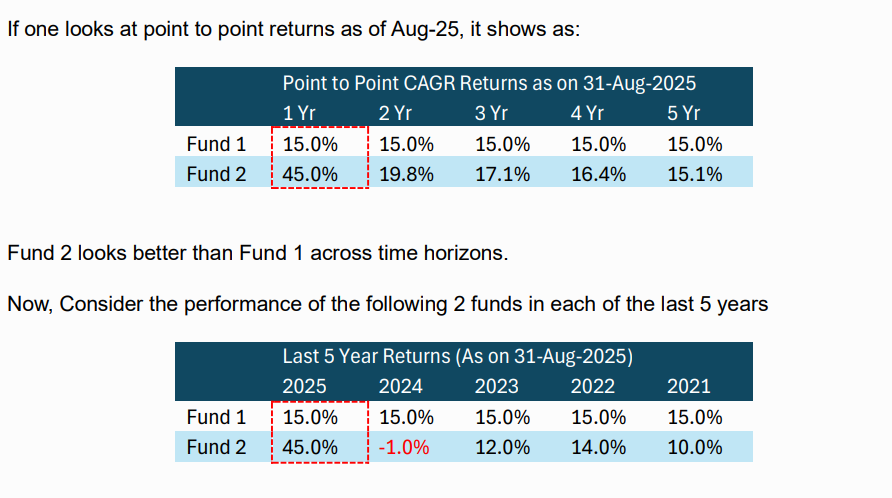

It has shown the idea with an illustration:

Though Fund 2 looks better than Fund 1 across time horizons. However, we know that fund 1 has been more consistent, HDFC Securities adds.

First Test For 1-Year Investing

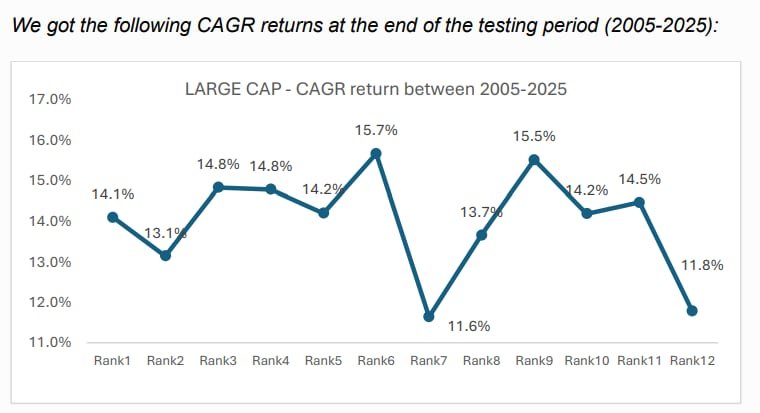

HDFC Securities did two tests to find the answer. In the first test, it had ranked 32 large-cap mutual funds each year based on their 1-year performance, starting from 2005, and had invested annually in the fund that was ranked 1st in the previous year. So basically, they redeemed the investment at the end of the each calendar year and reinvested the proceeds into the top-ranked fund based on the prior 12-month return.

In the findings, HDFC Securities concludes, next year’s performance has no relation with last year’s performance.

Selecting the #1 ranked fund each year resulted in a CAGR of 14%. Interestingly, consistently choosing the #6 ranked fund each year delivered a higher CAGR of 16%, it adds.

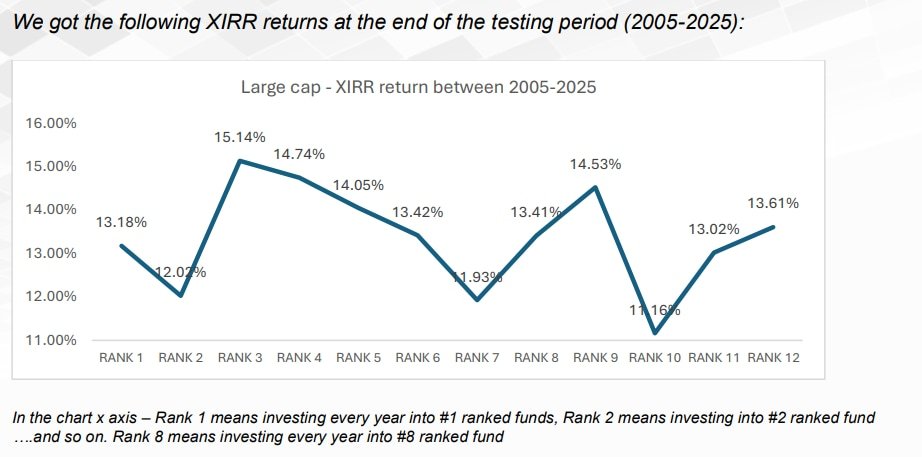

Second Test To Understand Long-Term Investing

In the second test, HDFC Securities extended the analysis to evaluate 3-year returns of the selected funds.

Each year, ₹100 was invested into the fund that ranked #1 based on the previous year’s 1- year performance, and this investment was held for next 3-year period.

To simplify, they are comparing 3-year performances of the funds based on last 1 year ranking.

In the findings, HDFC Securities concludes, that long term performance has no relation with last year’s performance.

Choosing #1 ranked fund each year gives a XIRR of 13%. Whereas, if one had invested in #3 ranked fund, it would have generated higher returns of 15% XIRR!,” it adds.

In conclusion, recent outperformance of any fund will fold into periodic returns (2yr, 3yr, and 5yr). Higher periodic returns do not imply consistency in fund’s performance, argues HDFC Securities in its study, adding that selecting funds on basis of recent outperformance does not ensure future outperformance.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

October 03, 2025, 15:50 IST

Read More