Mutual funds see 1.67 cr new SIPs in June qtr, led by Groww with 42 lakh additions. Retail participation strong despite market volatility.

This was significantly higher than the 1.41 crore registrations in the previous quarter, according to data from the Association of Mutual Funds in India (AMFI).

Groww emerged as the market leader, adding over 41.9 lakh new SIPs during the quarter, commanding a market share of 25 per cent.

In June alone, Groww registered 15.7 lakh new SIPs, making it the highest monthly addition by any distributor in the segment. In value terms, new SIPs registered on the Groww platform during the June quarter stood at Rs 1,116 crore, marking a sharp 32 per cent growth over the previous quarter.

Angel One, the second-largest contributor, added 15 lakh new SIPs during the quarter. Among traditional distributors, NJ IndiaInvest added 5.9 lakh, while SBI and HDFC Securities recorded 4.3 lakh and 3.8 lakh new SIPs, respectively. PhonePe, another digital-first platform, added approximately 5.9 lakh SIPs, largely concentrated in lower-ticket investments.

The surge in SIP additions came despite continued volatility in the equity markets, with the benchmark Nifty 50 delivering mid-single-digit returns year-to-date.

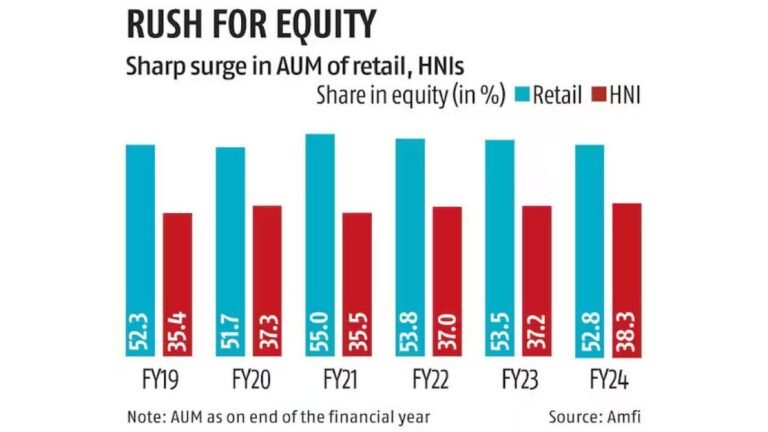

Nonetheless, retail investor interest in mutual funds remained strong. The industry saw total SIP inflows touch a record Rs 27,269 crore in June 2025, continuing a steady month-on-month rise. SIP assets under management (AUM) stood at Rs 15.3 lakh crore as of June 30, 2025, up from Rs 12.4 lakh crore a year earlier.

According to market experts, retail investors are increasingly viewing mutual funds as a tool for long-term wealth creation, indicating a shift from traditional savings to a more investment-oriented mindset.

Digital-first platforms have further improved accessibility and convenience for a broader base of investors. Additionally, investor education and awareness initiatives by AMFI and asset management companies (AMCs) have played a key role in promoting systematic investing and strengthening trust in the mutual fund ecosystem, they added.

The number of unique mutual fund investors in India grew to 5.4 crore in 2025, a 20 per cent rise from 4.5 crore in 2024 and a 42 per cent jump from 3.8 crore in 2023.

The industry’s total assets under management (AUM) reached a record Rs 74.4 lakh crore in June 2025, marking an 18 per cent increase from Rs 63.2 lakh crore in the previous quarter.