We’ve been bullish on corporate bonds (especially corporate bond–focused closed-end funds yielding 8%+) for a long time now.

We remain so because we’ve got a nice “Goldilocks” setup for these funds right now:

- The US economy, while not booming at a rate that makes everyone happy, has steadily improved since the pandemic, prompting inflation to slow but remain elevated.

- The Federal Reserve, seeing this, is getting set to lower interest rates in late 2024, or possibly at some point next year.

These are both bullish signs for corporate bonds—and the closed-end funds that hold them. I’m sure I don’t have to tell you they were hit hard in 2022, resulting in an array of bargains. Then the corporate defaults investors expected as rates shot higher failed to materialize.

The result: a rally in corporate bonds throughout 2023 and 2024.

But don’t take that to mean we’ve missed out on the bond bull market. To be sure, some bond CEFs are looking a tad overbought. Others are just not built for the lower rates that are just starting to peek over the horizon.

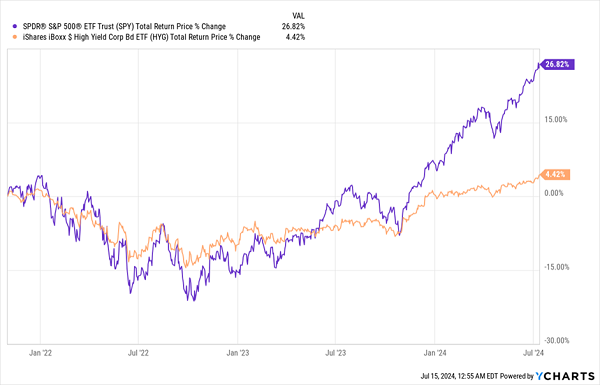

Nonetheless, corporate bonds on the whole, shown in orange below by the performance of the benchmark iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:), are still oversold.

That’s particularly true when you compare their meager performance to the (in purple), which has soared since early 2022, despite that year’s crash:

Corporate Bonds Still Lag Stocks

This is particularly weird since the average corporate bond went from paying about 3.2% in late 2021 to 5.8% today! Why would the market keep discounting bonds now that they’re yielding more?

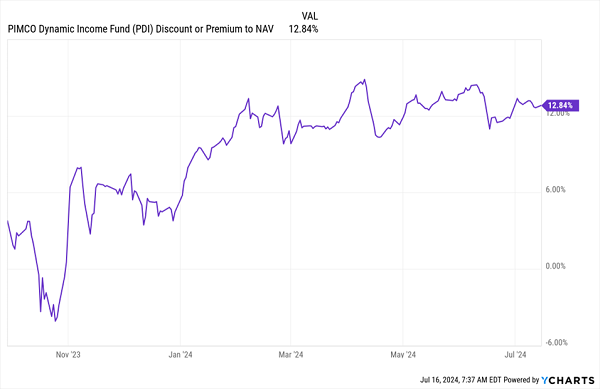

Of course, other investors have noticed this, which is why the largest corporate-bond CEF, the PIMCO Dynamic Income Fund (NYSE:), saw the discount to net asset value (NAV, or the value of its underlying portfolio) it carried late last year flip to a 12% premium as more investors looked to get into corporate bonds and tap PDI’s outsized 14% yield:

Investors Can’t Stop Buying This 14%-Paying Bond CEF

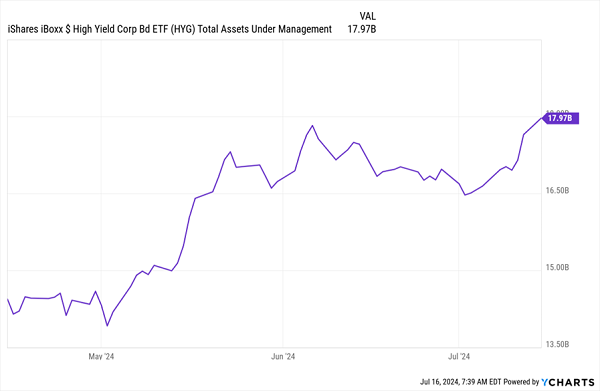

Reuters picked up this story, noting, “Investors queued up for US high-yield bond funds as rate-cut hopes grow.” That’s obvious when we look at the flow of cash into HYG in the last few months.

Bond Investors Pile Into HYG

To be sure, we may want to hold off on PDI for now, in light of its premium. But we also want to avoid HYG since its 5.8% payout is also low compared to yields available in CEFs—many of which are discounted—as we’ll see in a moment.

But how do we pick the right bond CEF?

While there are many that have beaten the broader corporate bond market over the long term, the future is likely to be different from the past. With that in mind, let me introduce you to three options.

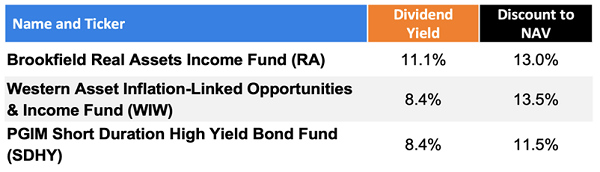

These are the three most heavily discounted corporate-bond CEFs currently. A novice investor who knows corporate bonds are undervalued relative to stocks and conditions are perfect for corporate bonds might simply go with the highest-yielding fund of our trio. That would be the Brookfield Real Assets Income Fund (NYSE:).

Or they might pick the most discounted CEF. That would be the Western Asset Inflation-Linked Opportunities & Income Fund (NYSE:).

Or our beginner might go with the CEF with the best management team. That would be the PGIM Short Duration High Yield Bond Fund (SDHY). It’s run by PGIM, an arm of Prudential Investment Management, and has better connections and a better track record than the firms running our other two funds.

But none of these funds check all the boxes we want to see, so which really is the best?

Let’s start by noting the “short duration” in SDHY’s name; that’s because it holds bonds that will come to term soon. When that happens, SDHY will need to reinvest its cash into other, newer bonds.

That’s great when interest rates are rising, but it’s a problem when rates are falling, as we’re expecting them to do pretty soon. So no matter how good SDHY’s management is, the fund is simply not structured for the current moment.

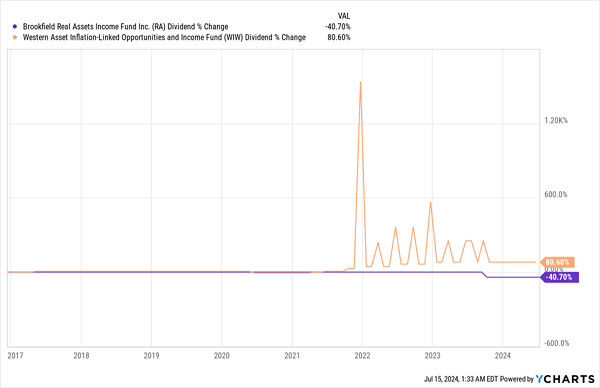

So with SDHY out, and since WIW and RA are close in terms of their discounts, should we just go with RA, since its yield is so much higher? Well, again, one should be cautious, not least because RA (in purple below) cut its payouts by 40% late last year.

WIW’s Payout Pops; RA’s Sags

So even though WIW’s yield is lower than that of RA, note that WIW (in orange above) has a history of dividend increases and has paid out some big special dividends in the past, so you need to look past the stated yield and focus on payout history. With that in mind, WIW is the clear winner, right?

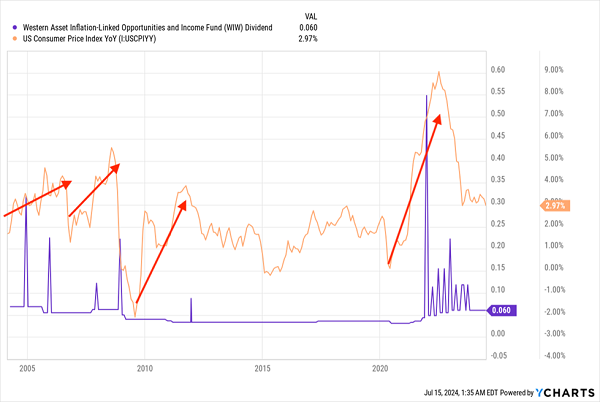

Except, remember, we’re talking about the past here. WIW had a bunch of special payouts in a very concentrated period of time: late 2021 to the end of 2023. That was a period of very high inflation, which has since eased.

WIW’s Special Payouts Were Based on Factors That No Longer Exist

If we look at all of WIW’s history, we see those big payouts happened when the growth in inflation (the orange line) was accelerating. However, since inflation is now decelerating, WIW’s special payouts aren’t likely to reappear anytime soon. Its regular dividend might even be threatened.

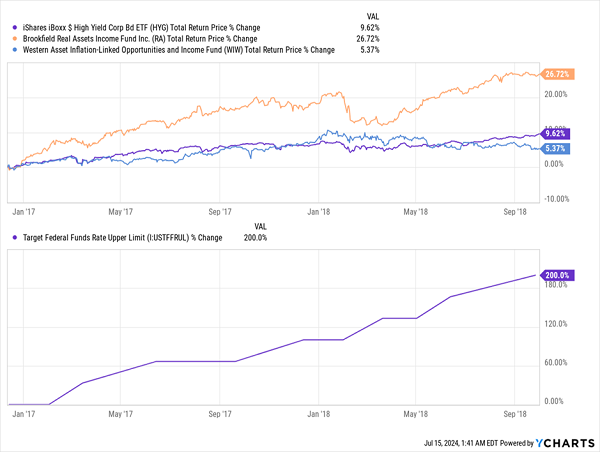

Thus, WIW is not the best option of these three, and RA would be the better choice, at least until the Fed starts cutting rates. And that shouldn’t surprise anyone, since RA was better than WIW during the last time rates were elevated:

RA Crushes WIW

So, RA is worth consideration right now and is likely to remain so until the Fed starts cutting interest rates in earnest, which could be later this year or earlier next year. Then it’ll be time to sell RA and go into something else.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”