Balanced advantage funds (BAFs), which were running low on equities over the last several months owing to high valuations, had a good day on Monday even as the markets witnessed huge sell-off.

Most of them managed to offer downside protection despite markets correcting 3 per cent.

Data from the Association of Mutual Funds in India (Amfi) shows that net asset value (NAV) of every one in two BAFs declined 1.5 per cent or less on Monday compared to a 3.13 per cent decline in Nifty 500.

Given that most BAFs have opted for equity taxation, they have to maintain a minimum 65 per cent gross allocation in equities. However, they have the option to use equity derivatives to lower the net allocation. Exposure to equity and debt differs from fund to fund, depending on the model. ICICI Prudential BAF had only 37.4 per cent net equity allocation as of June end.

Experts said that for hybrid funds, especially in BAFs, the model differs based on the priority set in the mandate.

While some funds have a higher focus on returns, others have a tilt towards safety.

The difference in approach is evident in the returns chart.

In the one-year period, the returns range from 17 per cent to as high as 54 per cent, shows data from Value Research.

MF executives and investment experts say that BAFs and other hybrid funds may gain an edge over pure equity funds if the volatility continues in the equity market. The inflows into BAFs have been subdued in the last two years.

“The valuations are on the higher side right now, and hence, the equity returns may get normalised from here on. Also, in such scenarios, equities tend to see larger drawdowns if any adverse news comes in. The market condition along with the tax advantage that comes with hybrid funds makes a case for investment in BAFs and other asset allocation products,” said Niranjan Avasthi, senior vice-president and head – product, marketing & digital business, Edelweiss Mutual Fund.

Jiral Mehta, senior research analyst, FundsIndia, said investors can look at hybrid funds to take advantage of the expected volatility. He added that investors should make sure that the hybrid allocation does not “result in an unintended overweight or underweight position in any asset class.”

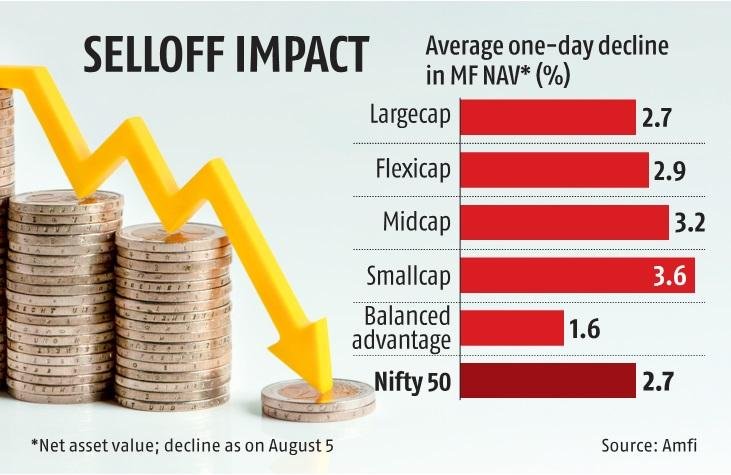

The sell-off in the equity market on Monday led to a sharp fall in NAVs of equity funds.

Smallcap funds declined 3.6 per cent on an average, followed by midcaps, which were down 3.2 per cent on an average.

First Published: Aug 06 2024 | 9:38 PM IST