Mumbai: A resilient economy in the face of global volatility, which lifted the equity markets to new highs in July, prompted retail investors to repose their faith in mutual funds and continue their investments through this asset class.

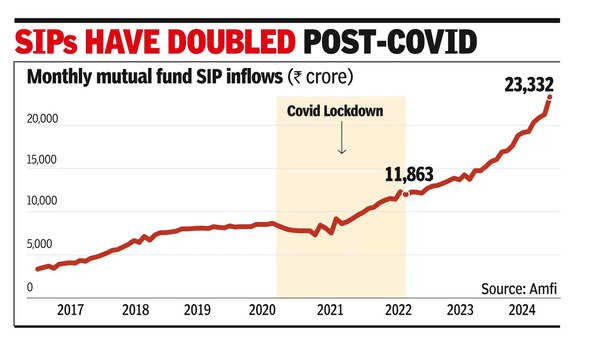

As a result, the monthly flows through the SIP route jumped to an all-time high of Rs 23,332 crore while the total assets under management of the MF industry was almost at Rs 65 lakh crore, also a new record high, data released by AMFI, the fund industry trade body showed.“SIP contributions reaching an all-time high…in July 2024 reflects the growing financial discipline among retail investors, helping them build wealth systematically over time,” said Venkat Chalasani, chief executive, Amfi.

Although equity funds recorded a slightly lower net inflow in July at Rs 37,113 crore compared to Rs 40,608 crore in June, it was the 41st consecutive month of net inflows for these schemes. Debt funds too recorded robust net inflows, at nearly Rs 1.2 lakh crore.

With the equity segment, sectoral and thematic funds showed the strongest growth with a net inflow figure of Rs 18,368 crore. However, this trend of shift away from broader equity schemes like large-cap, flexi-cap, mid-cap and small-cap could be a bit risky in the long term, industry players said.

We also published the following articles recently

Recent discussions have revolved around whether current investments in mid-cap and small-cap stocks are justified, considering their surge despite cautious expert commentary. The article explores the factors behind this rally, potential overvaluations, and historical causes of market crashes. It hints at the resilience of market trends amidst non-institutional inflows and robust macroeconomic conditions.

The 16-vent Ellis Saddle surplus water bridge at Stanley Reservoir in Mettur was closed after inflow decreased. The bridge, opened on July 30 to release surplus water into the Cauvery River, was shut due to reduced rainfall in Karnataka. Officials maintained the dam’s water level at 120 feet, discharging 500 cusecs for irrigation needs in Salem, Erode, and Namakkal districts.